When using the wheel strategy, this is a chance where put options are assigned.

For most people, they will start to panic, "Oh no, my put options get exercised - I don't want to hold the stock!"

However, for those who have a keen understanding of the wheel strategy, we know that being exercised is where the wheel strategy will churn out the most amount of cash.

That's right - because after you get the 100 shares, you will be able to sell call options.

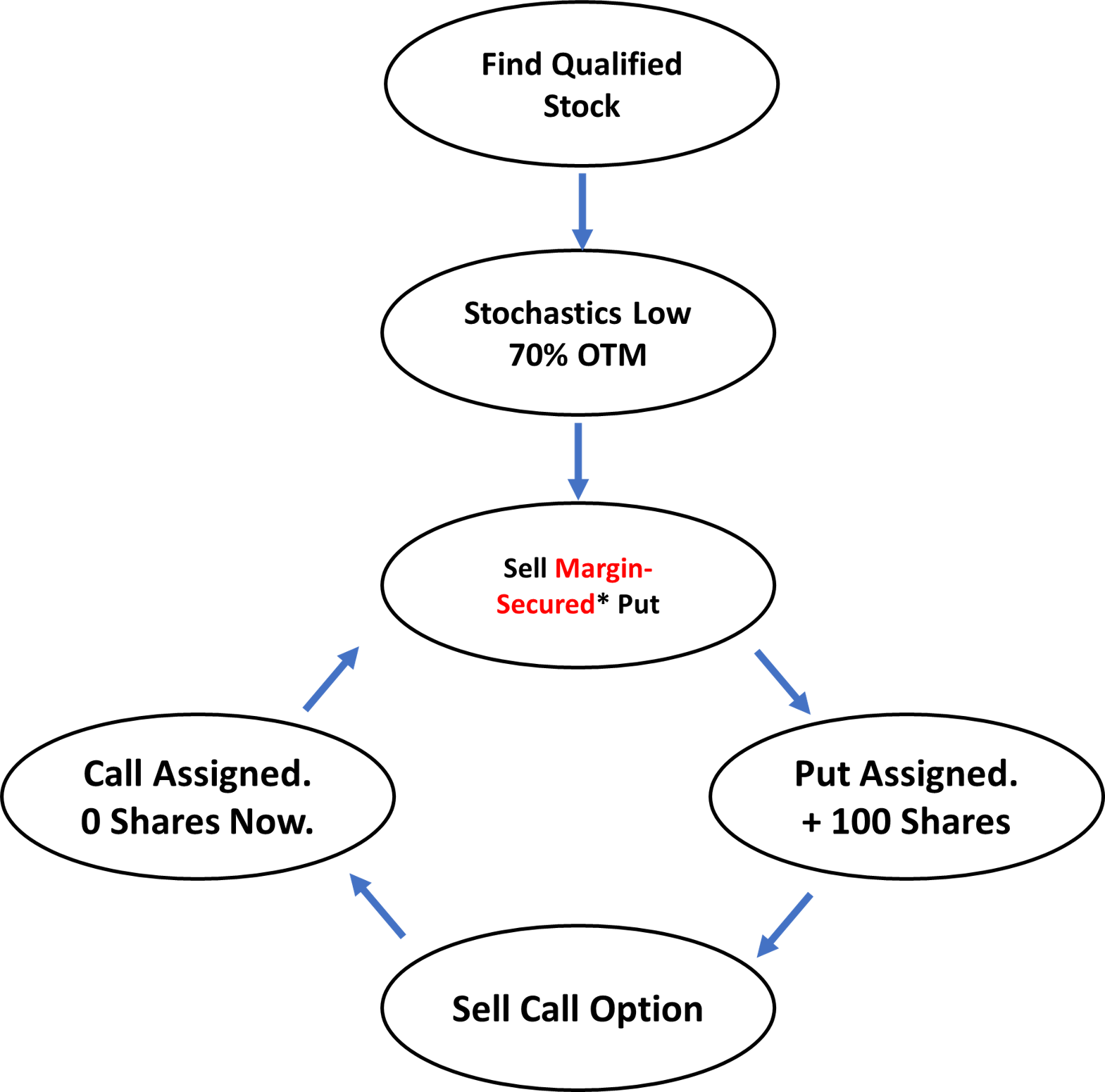

As a recap, here's the wheel strategy again.

Why You Get More Money Selling Call Options

The answer lies in the second step - selling the put option at 70% OTM and at stochastics low.

Remember that put options only get exercised when the share price is below the strike price at the end of the expiry date.

For example, if I sold a put option META at a strike price of 147 at the expiry of 16 Sep 22. At the end of expiry, the share price was $146.29. This means that my put option will be exercised.

By selling the put option at 70% OTM and at stochastics low, the share price has to fall considerably in order for the put option to be exercised. And by the time it falls down, it is more than likely that it is already due for a rebound.

Before it rebounds, I will immediately sell a call option at the same strike price (sometimes lower) and collect a ton of option premium.

The reason why the premium is much is higher is because:

- I am selling the call option at near at-the-money

- When the share price falls considerably to get the previous put option exercised, there is a spike of volatility, therefore - the option premium increases considerably as well.

This is the reason why I don't mind my put options being exercised on a wheel strategy.

How Much Margin Do You Need If Your Put Options Are Assigned

This is a great question especially if you are using the margin-secured put option strategy.

Well, when a put option gets assigned, you are essentially buying 100 shares. If you do not have enough cash to buy the 100 shares, you will be buying that 100 shares on margin.

In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin.

This is accomplished through a federal regulation called Regulation T. Reg T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions.

Initial Margin Requirement

Initial Margin is the percentage of the purchase price of securities that you must pay for with your own cash and/or marginable securities.

Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. So on stock purchases, Reg. T requires an initial margin deposit of 50% of the purchase value, which in turn allows the broker to extend credit or finance the remaining 50%.

For example, if you are purchasing $1,000 worth of securities, under Reg T, you are required to deposit $500 and allowed to borrow $500 to hold those securities.

Maintenance Margin Requirement

Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position.

During active market hours, IB clients can take advantage of reduced intraday margin for securities – generally 25% of the long stock value. In order to hold a position overnight, margin requirement reverts to the Reg T requirement of 50% of stock value.

What does this means?

Well, imagine that I have a 147 put option on META which was exercised - this means that I have bought $14,700 worth of META shares.

At a 50% margin requirement, my portfolio equity should not be less than $7,350. The moment my portfolio equity falls below $7,350 - I will get a margin call and be forced to liquidate.

This means that if my portfolio equity is $10,000 - I will still be able to hold the 100 shares of META using margin comfortable, and continue to milk cash flow by selling call options.

Only Use The Wheel Strategy On Qualified Stocks

For those who are keen to use the wheel strategy, please only do it on quality stocks which we know is bound to recover over time.

You can watch this recorded webinar on what qualified stocks are about.

The "Qualified Stocks" Training

What an engineer did to grow his portfolio from $7,137.68 to $194,383.30 in just 4 years using qualified stocks...so that WORKING AT A JOB was A CHOICE AND NOT A necessity...