When I first started, I was close to broke - and $1,000 was a lot of money to me. But still, I wanted to break free from the rat race and I knew that investing in assets were one of the ways to do it.

However, as simple as it sounds, investing takes money to make money. If I only had $1,000 to my name - how can I get started in the most strategic manner?

In this blog post, I want to share with you how I will actually get started in my investing journey with just $1,000 and if I had zero knowledge in investing.

But first, let's answer the big question.

Can I Invest With Only $1,000?

Yes, you technically can. There are many online investing webinars that will tell you that you can as well. After all, if you look at Facebook stock which costs around $350 at the point of writing, nothing is stopping you from buying just 3 shares.

So yes - you can definitely start with $1,000 - but the question is why would you only start with that amount? Why not $5,000? Why not $10,000?

The answer is because if you are just starting to invest, you always have that fear of losing money. That's the real reason why people ask this question, "Can I start investing with just $1,000?"

You need to read this up close.

While it is possible to start with just $1,000 in your investment journey, if you truly want to be financially free from your investments, you need to constantly add more capital into your investments.

Imagine if you need $50,000 a year to become financially free.

Assuming a 5% return a year, a $1,000 investment will only give you $50 annually.

If you want to be financially free on $50 a year - you have to be living on la-la land.

Even if Mr. Market was absolutely generous and gave you a 100% return - that will still only be a $1,000 profit a year - and still not enough to be financially free anyways.

So while most people will tell you, "Of course you can get started with $1,000 - join our investing course to get started!".

Here's the untold truth - if you are not prepared to add more capital in your investments, you will not get any significant life-changing results from investing.

How To Add More Capital Into Investing

Now, the technical aspect of adding more capital is as easy as transferring money from your bank to your brokerage account. That's the easy part.

It is the investing that capital that makes it hard.

Like I said, the reason why most people are afraid to put in most of their net worth into the stock market is because they do not know what they are doing. They are constantly on social media, Reddit, Facebook groups, looking for the next hot stock to invest in, and ended up with a lost sense of direction in the stock market.

If you truly want to get significant results from your investments, you need to be able to fearlessly invest your capital in the stock market. In fact, most of my capital are in my brokerage account, and consistently compounding money for me. I keep very little cash in the bank - simply because it is a ludicrous idea to keep a surplus of cash in the bank and earning puny interest.

Now, let me show you this statistic and you will realise why I can fearlessly pour money into the stock market.

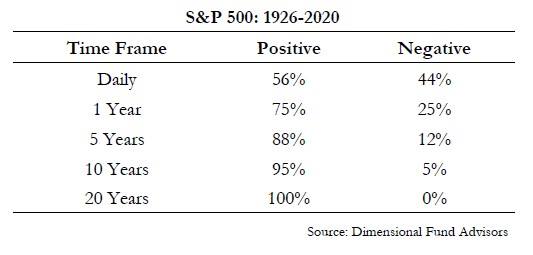

The table above shows the likelihood of your investments being positive depending on how long you hold your investments for.

You can see that just by willing to hold your investments for at least 10 years, you are already statistically have a winning odds of 95%.

I know, I know, the pessimistic amongst you will still say that "there's still at 5% chance of losing money!"

Let do this logically.

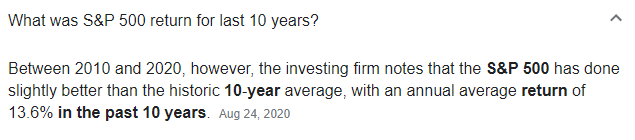

The stock market 10 years average return is around 13.6% - meanwhile the bank's savings returns are 0.50% (and I am being very generous with this assumption).

This means that you have two options:

- Invest in the stock market and hold for 10 years, and you have an 95% chance of making 13.6% annually.

- Leave your money in the bank and hold for 10 years, and you have a 100% chance of making 0.50% annually.

The mathematics is blindingly obvious - it was a no brainer for me to invest most of my net worth in the markets, rather than leaving them as cash in the bank.

So What's The Best Way To Invest Your First $1,000

Don't even bother investing a single cent in the stock market - until you first invest in yourself.

You have probably know this before, "Investing in yourself is the greatest investment."

But knowing it and DOING it are two very different things.

Just like how I know that if I ate right and exercise right - I would get six pack abs.

But as I look at my belly while typing this - I only see one big pack.

Can you see? Knowing and Doing are two different things.

In fact, let me give you a litmus test by asking you a few questions:

- When was the last time you paid money to learn something for your own personal development. This could be a book, an online course, a workshop, etc.

- If you did attend a course for knowledge, was this investment made because you wanted to improve yourself - or did your company forced you to do it?

- Did you spend more money/time on your own self-education or university education?

I'm sure some of you see the point that I am trying to make - most people stop their education after graduating from university - and they wonder why they stopped improving. And when life get stuck, they point fingers at the company and complain why the company did not organise any courses for them to upgrade their skills.

Never point fingers at others - you will be giving up the control of your own life. You have to remember that you will take charge of your own life and your own success.

You need to always keep learning and growing. If you are willing to spend that tens of thousands of dollars to attend universities to become a better employee for 50 years - why will you not spend the same amount of money to take control of your own finances to retire in 10 years?

And trust me - these self-education does not even need to be expensive. Nobody is asking you to attend a course that will set you back $3,997 or $5,997. If it costs more than your monthly salary - you might have to think hard whether this is a suitable investment for you. But I can vouch that there are some that are truly worth the investment, as I have made more than 10x of my initial investments for those courses.

There are great books out there that cost less than $30 - and to be honest, reading these books is going to change your life more than any university education. I am not trying to belittle university education but we all know for a fact that university education is mostly geared towards being a better employee, and there are plentiful of other aspects that will never be covered in a university education.

The Bottom Line

The best way to invest your first $1,000 is in yourself - and you have to do it, because it is going to save you so much more money and pain in the future. I have seen too many people who are just trapped in their daily lives, simply because they didn't get the self-education they need to break free.

Always remember that success leave clues - don't try to reinvest the wheel - just model the habits and systems adopted by those who are successful, it will dramatically increase your odds of success.

The 6-Figures Roadmap

What an engineer did to grow his portfolio from $7,137.68 to $185,352.15 in just 4 years using qualified stocks...so that WORKING AT A JOB was A CHOICE AND NOT A necessity...