When it comes to achieving our goals, it is always important to begin with an end in mind.

It is only when we clearly know our goals, then we can work towards it.

So when it comes to investing in the stock market, it is important to be extremely clear why you are investing in the first place?

For some people, it is just for the thrills and they see the stock market as a gambling platform.

But for others, it is for designing an investment portfolio that will eventually pay for our expenses.

In this blog post, I share the numbers and strategies that I personally used in designing a financial freedom portfolio.

Step 1: Protect Your Downside

You have probably heard of the saying,

"The best defense is a good offense"

When it comes to building your financial freedom, always make sure that you have sufficient medical coverage for yourself and your family.

You see, medical bills can often come as an unpleasant shock - especially when we are talking about severe illness/accidents that result in a loss of income.

As a general rule of thumb, I would want the insurance coverage to be able to cover at least 10 years of my annual income.

Most people have this idea that, "I am young and healthy - why would I need insurance?"

To me, that is thinking backwards.

It is precisely because you are healthy now, that you are able to buy insurance.

Think about it.

Will you buy a car insurance before an accident or after an accident?

That's right - it is before.

I know that there are people who insist that they don't need insurance coverage.

However, remember that the purpose of having an insurance coverage is not for ourselves, but rather for those who depend on us.

And for me, if anything severe happens, I know that I have 10 years of annual income to cover my family's expenses, and not to incur any financial burden.

While I am no insurance agent, do consider exploring and doing your due diligence in researching the suitable insurance medical/accident coverage for your circumstances.

Think of buying an insurance policy as buying a peace of mind.

Only then, you can charge towards your way to financial freedom. Now, let's go to Step 2.

Step 2 - Figure Out Expenses

If we want to design a portfolio that will pay off our expenses, it is common sense that we figure out our expenses in the first place right?

However, if I were to parachute into your life today, will you be able to accurately tell me what is the average annual expense that you are expected to have every year?

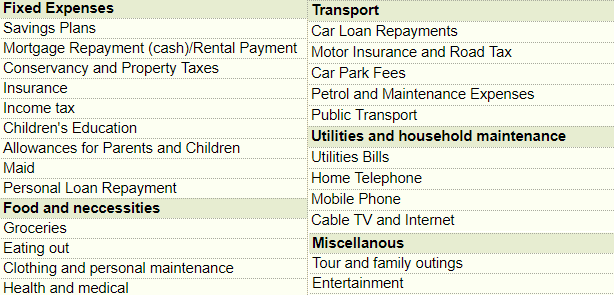

These expenses could include things like:

Remember that, "Clarity is power"

Only when you have clarity over these expenses, then you can proceed to design your financial freedom portfolio.

Following this list, should cover most type of expenses - of course, there is no stopping you from adding onto the list of categories that you might have.

You can do pretty simply using an Excel Template or Google Sheets Template.

However, if you want a copy of my template, you might want to read on and I will share with you how you can get access so that you don't have to recreate a Google Sheets Template on your own.

For the purpose of this example, let's say we have annual expense of $20,000.

(That's around $1666 every month.)

Step 3 - Estimate Your Cash Flow Returns

Now, most people misunderstand the concept of cash flow.

Cash flow does not refer to capital gains - but it is the actual cash that enters your account.

And needless to say, to pay for your expenses - you need to use cash.

Example:

If you bought 100 shares of Facebook at $150, and currently the share price is at $200. How much cash flow are you getting for this investment, if you have not sold the shares yet?

Ans: This investment give you a paper profit $5,000. However, it gives you zero cash flow - because there is no cash entering your pocket.

Its kinda like buying a property at $100,000 and it is now worth $200,000.

In order to profit that $100,000 of capital gain - you will need to sell the property.

However, instead of selling the property, one way is to rent out the property and collect rental income in cash.

These cash can then be used to pay for your expenses.

(Remember you cannot pay your expenses with paper gains)

So how do you create cash flow in a stock investment portfolio?

Well, there are mainly two ways for a stock investor:

When it comes to dividend investing, a reasonable cash flow rate of return in around 3% to 5% annually.

For me, I am always using the selling options strategy, simply because it is much more flexible and in terms of cash flow returns, you will get likely a better yield than investing in dividend stocks - which is around 5% to 10% annually.

So for the purpose of this Financial Freedom Portfolio example, let's say we target a 5% cash flow return every year.

This means that if you have $100,000 portfolio, you should expect to get $5,000 in cash from your investment every year.

Let's go through an example to make sure this make sense to you.

Example:

With a portfolio of $300,000 and a 5% cash flow returns, how much cash flow will you expect every year?

a. $5,000

b. $10,000

c. $15,000

Ans: Well, the answer will be "c" - $15,000. Because 5% of $300,000 is $15,000!

From the first two steps, here are the numbers:

- Annual Expense = $20,000

- Cash Flow Returns = 5%

We will use these two numbers in Step 3.

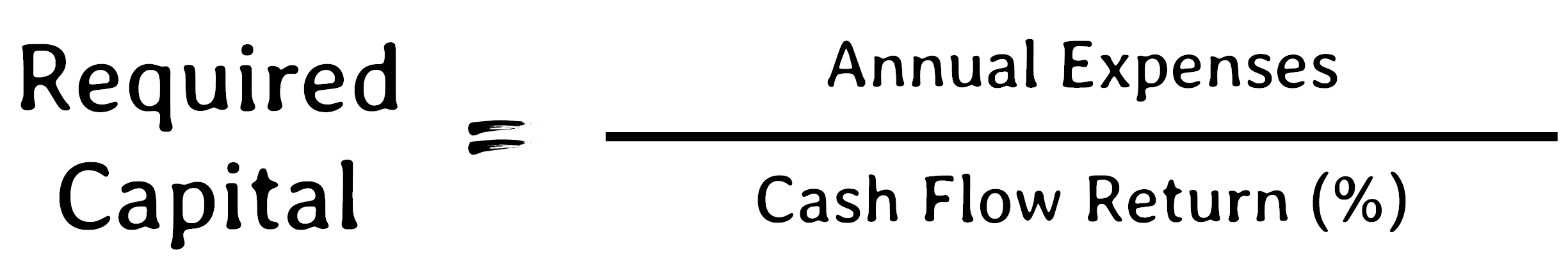

Step 3 - Determine Capital Required

So what is this capital required?

Basically, once you hit this amount of capital, you will declare yourself financially free.

Yup, this is probably what excites people the most.

So here's the magical formula to determine your capital required for your financial freedom portfolio.

So let's use the numbers that.

Our required capital will be - $20,000 / 5% = $400,000.

Woah. You mean I need to have $400,000 to become financially free?

Well, yes - using these numbers.

And if you are overwhelmed by these - let's take a look at the next step.

Step 4 - Capital Reduction Strategies

Now that we know we need $400,000 to become financially free, let's see how we can achieve this much earlier.

Well, first thing is we can try to reduce the amount of capital required.

From the above equation, we know that it can be done by two ways:

- Reduce Expense

- Increase Cash Flow Returns

Remember that currently, we are using an annual expense of $20,000 and a cash flow return of 5% as an example.

Let's see what happens when we tweak these values.

Example:

Let's change the expenses to $12,000 and the cash flow return maintained at 5%. What will happen to the required capital?

Ans: Well, the required capital will become $12,000 / 5% = $240,000. That's a whopping $160,000 lesser than before!

While the numbers look nice, do bear in mind that this means that you should be able to live with $1000 every month.

Everyone's circumstances may be different, so remember to work out what will suit your lifestyle.

The idea is that you have to work out these numbers based on your individual circumstances.

Now, let's explore the other approach with is increasing cash flow returns.

Example :

Let's maintain the expenses to $20,000 and the cash flow return increased to 10%. What will happen to the required capital?

Ans: Well, the required capital will become $20,000 / 10% = $200,000. That's a whopping $200,000 lesser than before!

So you can see that by tweaking the cash flow return to 10% - we are able to reduce our required capital to $200,000.

However, to achieve a 10% cash flow return is probably quite hard using dividend investing - you might want to explore into selling options in this case.

Of course, these are just mere ideas for you to be able to reduce the capital required for you to become financially free.

The bottom line is - choose one that suits your lifestyle or investing strategy.

In case you are wondering, we are not done yet - I have yet to talk about capital acquisition.

That's the next step.

Step 5 - Capital Acquisition Strategy (Part I)

From Step 1 to 4 - we would have worked out the capital required for us to be financially free.

Now in this step, we are going to explore ways to acquire this amount of capital.

For most of us who are in the 9-to-5, the most effective capital acquisition strategy is the compounding effect of investing.

I know, I know - this is probably not new to some of us.

After all, compounding is known as the 7th wonder of the world.

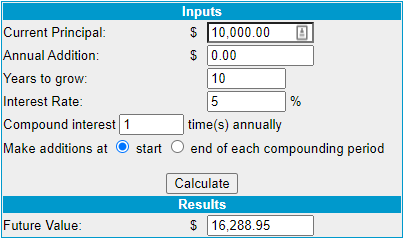

So let's take a look at what will happen if we had $10,000 at compound at a conservative 10% every year for 10 years.

Well, your $10,000 would have grown to $16,288.95!

Hmm, that's a little far away from our $400,000 goal right?

So much for the "7th wonder of the world".

However, have you heard of the 8th wonder of the wonder?

Its the contribution compounding strategy.

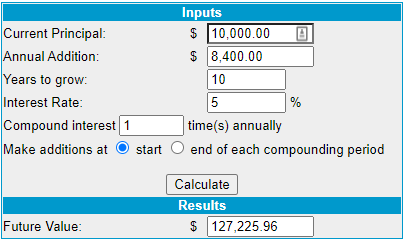

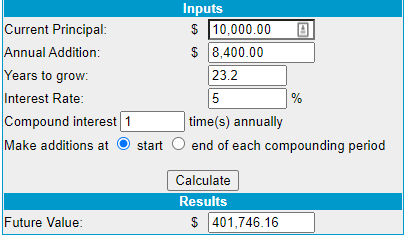

What if we contributed $700 every month into this investment portfolio - that's an addition of $8,400 every year!

Wow, now we are looking at $127,225.96!

You might be thinking, "But Gin - I have to contribute $700 every month..."

And my response would be,

"Where else would you put that $700? In the bank with a return of 0.05%?"

My approach is to always create an investment portfolio that serves as a high-interest bank account.

And if you do not have a surplus $700 every month - that's fine.

You can always start small with $300 and slowly increase the contribution amount.

The point is - get started.

As what Zig Ziglar would say,

You don't have to be great to start, but you have to start to be great.

So if you truly want to build a financial freedom portfolio - then you have to get started.

The next question that I get is, how sure can we achieve that 5% every year?

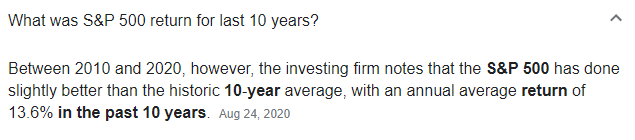

Well, let's take a look at historic returns of the S&P 500.

This historical annual average return for the S&P 500 was 13.6%.

And I was actually being conservative and putting an interest return of 5%.

So if you want to start to acquire your required capital, start to contribute to your brokerage account, and start investing.

Now, with a required capital of $400,000 - let's see how long we need to become financially free using this capital acquisition strategy.

Well, it will take around 23.2 years.

For those of you who think that 23.2 years is too long - remember step 4 on capital reduction strategies.

You should be able to shave off quite a number of years to financial freedom.

Here's the compounding calculator, courtesy of moneychimp. Try it out for yourself and figure out how long it takes to become financially free.

For those who are still hungry and wanting to achieve financial freedom earlier, you need to check out the next step - where we discuss a more advanced way for acquiring capital.

Step 6 - Capital Acquisition Strategies (Part II)

One of my business mentors told me this quote, which I will always fondly remember.

If you want to get out of your 9-to-5, it all depends on what you do after your 5.

For many people, after their day job - they would Netflix and Chill.

Now, there's nothing wrong with that.

However, if you truly want to achieve financial freedom much earlier, then accept the fact that you have to put in more work than the rest.

I am referring to having a business on the side.

You see, having a business is still one of the fastest ways to raise capital.

Remember our goal of $400,000?

Let's say if we had a product that sells for a profit of $100, how many products do you have to sell to raise $400,000?

Well, it would be 4000.

And if we wanted to raise this capital in 10 years - this means selling 400 products per year, which is around 33 product a month.

In fact, here's a breakdown, depending on the profit you make on a product.

However, I have to re-emphasize this - this step is not for everyone. Building your own business can be tough and a painful process of failing and learning. But at the same time, it is one of the most fulfilling journey as well.

In short, if you are not willing to fail in order to succeed - then you might want to skip this step.

For example, in your first year - it could be that you sold nothing at all. And your friends and family may even start to discourage you and thinking you are wasting your time.

But as you learn from your mistakes, you then start to figure out how you can run the business better, and make more sales.

And you continue to monitor and improve the process and start to compound your growth.

For example, I know people who failed utterly in their e-commerce business in their early years but eventually building enough income to become financially free.

To others, it may seem like an "overnight" success, but in reality, they worked every single day after their 9-to-5 to achieve what they have achieved today.

Reminder: Again, this step is not for everyone - after all, we all have our different journeys and ambitions. However, for those who are interested in building an online business, there is a great training on this recommended by my mentors.

What's Next?

Remember that I told you that I have a google sheets expenses calculator.

Well, you have access to it in your Downloads section right here.

In this calculator, there is also a link to a video training that gives a quick summary of what is covered in this blog post.

Remember that clarity is power - so make sure to take the time out to figure out what is the required capital that you need to become financially free.

That's the end of this blog post, I hope this serves you and give you more clarity on the numbers behind financial freedom.

And if you enjoyed this post, why not share it with a friend who may benefit from this 🙂