Yes, yes - I admit, I don't have much money in the bank. In fact, I hate it when I have too much money in the bank.

Why?

You see, the way I perceive money is that they are my employees.

Would you like it if your employees are slacking, and working at a rate of return of less than 1%?

As an investor, it is our responsibility to make sure that our money works hard for you.

P.S Before you read on, this is just my personal view about how I manage my money, it is entirely up to you to decide what suits you best.

Money in the bank is Not SECURITY

Sometimes, when people see that their bank account having a lot of money - strangely, they feel that that is secure.

Would you really feel secure if your employees were slacking around?

To make things worse...they are in fact losing money every single year due to inflation.

If the money in the bank is staying stagnant, while the cost of living is always increasing - effectively, leaving money in the bank is as good as losing money.

So where else should you put your money?

"Well, in assets of course."

That's exactly why I invest in the stock market and properties - to make my money work harder for me.

"But Gin, the stock market is risky! You could lose your money!"

"What if you need money for an emergency?"

Well, let's address the first point.

Risk Comes From Ignorance

First of all, risk does not come from the stock market.

It comes from not knowing how to invest in the stock market.

Its kinda like driving a car. A car is only risky if the driver does not have a clue on how to operate the vehicle.

Also, if you are constantly worried about a market crash, chances are that you are still not an investor.

Because a real investor will know that market crashes are the best time to create a huge amount of wealth - but only if you have the knowledge.

But if you don't have the knowledge - then don't do what I am doing until you close that knowledge gap.

This was an important lesson for me when I just started out investing in properties, where I got an advice from property veteran.

"Don't invest in your next property until you truly understand what you are doing."

And it was true, I had a knowledge gap that I had to close, and I spent well over $5,000 going to veterans with over a decade of experience, and learn from their war wounds that they received in their investing journey.

As much as people may not like him, the famous quote from Donald Trump makes a lot of sense,

Always try to learn from other people's mistakes, not your own - it is much cheaper that way.

Now, what about the second point.

"What if you need the money for an emergency?"

Planning For Emergency

This is why insurance coverage is a necessity.

If you do not have insurance policies that covers you and your dependents for medical expenses, you might want to consider doing it as soon as possible.

Please don't be one of those who have the mindset of scarcity and think to yourself, "Oh I don't want to buy insurance, it only makes insurance companies and their agents money."

Insurance policies are meant to transfer our financial risks to the insurance companies. So that, if anything unfortunate happens to us or our dependents, we know that we don't have to touch our personal investments.

To me, that's a no brainer.

I want to invest without having the fear of any uncertain medical expenses that would force me to touch my personal investments.

But here's the thing.

I will not buy any investment products (i.e. endowment, unit trusts, etc.) from insurance companies - because...their returns are not amazing. I could easily invest in the S&P 500, do nothing, and still beat their returns easily.

Now, for the next point.

"Okay, what if I lost my job?"

Firstly, if your job is your only sole of income - you better start to learn the necessary skill sets to create additional streams of income.

For example, in the past as a student, I used to buy broken iPhones, repair them and sell them for a profit.

Here's a Picture of Me Doing A Phone Surgery

Yes, I bought the repair kit, and watched tutorial videos on how to repair them - and then resold the phones online.

And to be honest, this is something that anyone can learn to do.

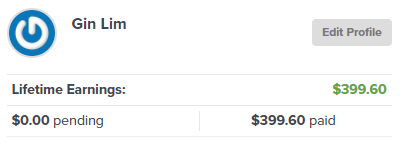

I then did affiliate marketing for a short while and made some money through there as well.

The point that I am trying to make is - the money is out there.

You just to need to be willing to work on building a new skill set that helps you acquire another stream of income.

If you are saying you don't know how to do it, that's just a convenient excuse for you to do nothing.

You see, if I did not bother to learn all these skill sets, then of course I wouldn't know how to do it!

Did you think that I magically knew out how to repair phones? No, I went to YouTube to learn it.

Did you think I magically knew how to do affiliate marketing? No, I went to paid for a course to learn it.

Did you think I magically knew how to invest? No, I paid for a mentor to learn it.

If you are afraid of failing and choose to stay in the comfort zone, then guess what, you life will forever be the same.

But if you want to break out of the pattern, then you need to start thinking how you can create your extra streams of income. Stop complaining and start doing.

What's Next?

Today, a major part of income comes from my investments, but that's a blog post for another day. But it wouldn't be possible, had I not used the capital raising strategies that I shared in my free course, "Financial Freedom Fundamentals".

You can get access to it right here.

It also contains some of the courses that I attended that you might want to check it out.