In the past, I had this belief that having more money in the bank, means more security.

But through my interactions with many other investors and entrepreneurs, that belief completely changed - and today, I make it almost a sin for myself if I left too much money idling in the bank.

Before I go on and share my perspectives, I need to emphasize that these are just my perspective. Each and everyone of us have our circumstances and financial objectives. So take this blog post, more of a leisure read.

Your "Savings Account" Is A Lending Account

In most upbringing, we were taught that having debt is bad.

After all, I'm sure we all heard horror stories about how people suffered with the huge amount of debt on their shoulders.

But think about it, if having debt was so bad, then why do banks borrow our money?

In case you haven't noticed, when we put money in the bank - effectively we are lending banks our money. And in return, we are paid an interest rate ranging from 0.05% to 1%.

Now, let's flip things the other way round.

When we borrow money from the bank, how much interest rate are we paying?

- For mortgage loans, this could be 2% to 5% - depending on where you are from.

- For credit card loans, this could an exorbitant amount of above 17%+.

In this scenario, do you think that debt is considered "bad" for the bank?

They borrow money from our deposits at 0.05% and loan them out at a much higher interest rates. Sounds like a pretty good deal for the banks.

(Of course, banks have to manage their risk in case of loan defaults, etc.)

I'm not sure about you, but I am certainly uncomfortable with idea of loaning the bank money at 0.05%, and having them loan that same amount of money to someone else at 5%.

Now, before I go on, I am not asking you to be a loan shark/illegal money lender, and start lending people money - which is why I emphasize earlier to take this as a joy read. I would much rather do things the right way - so that I can sleep better at night.

So what's the alternative?

Well, its pretty straightforward. Get a higher interest rate on your savings by investing it into assets.

Where To Invest?

This is what led me to start investing in the first place, and most importantly consistent profitable investing - you will see why this is important later on.

Investing in the stock market is one of the lowest barrier of entry for savings to grow.

Unlike properties which require a higher down payment, you can start buying as little as one stock.

For example, If FB costs $260 - then you only need $260 to start buying Facebook shares.

This means that if you were starting out with a small capital, and want to grow your savings, the stock market is probably the best place for growth, in my opinion.

However, there are so many stock exchanges all around the world.

Where should you invest in?

Most people tend to stick with what they are comfortable with, which is the local stock market. I started there as well, but in 2020 - I have since liquidated all my local stocks and redeploy that capital into the US stock markets.

A simple glance at the average return of the various stock market index will probably tell you why I made this move. The images below are the ETFs of the various country index.

The above images shows the share price of the overall stock market of these individual countries.

What I want you to notice is not the share price, but the trend of the share price over the years.

Some may say that, "Gin, the past performance of an index, does not guarantee future performance."

Sure, that is definitely true.

But which would you rather put your money on:

- A country whose index has been consistently going up over the years

- Or one that has been moving sideways.

It became an obvious decision for me to shift my capital to a place where it can actually grow. A decision that I probably should have made long time ago, but procrastinated over and over again.

And if you think about it, it all makes sense, after all most huge international companies all tend to come from the United States.

When I encourage others to invest in the US stock market, another common objection is, "but US stocks are so expensive!"

My answer would be, "Expensive in terms of what?" We need to look at things in context.

If you were to spend $500 on a cup of coffee - now, that's expensive.

But what if you could use the same $500 to buy a Ferrari with no conditions attached? All of a sudden, that Ferrari is dirt cheap.

Of course, this is merely an example. The point that I am trying to make is this. Most people who only learned how to see the price and not the value of things are bound to always short-changed themselves.

As long as the value of what I am getting is higher than the price that I am paying for - it becomes a no-brainer decision.

Price is what you pay. Value is what you get.

This is why my capital are only in the US stock markets, simply because historical data tells me so.

Bonus: For those who want to invest in the US stock markets, you need to open a US brokerage account. Avoid using local brokerage to buy foreign shares as they will likely charge a custodian fee, which isn't worth it. A US brokerage account will also offer better commissions.

Personally, I am using both ThinkorSwim and InteractiveBrokers. You can check a comparison between them on this page.

What To Invest?

At this stage, we know that leaving money in the bank earning us an interest rate of 0.05% to 1% is probably not a good idea and the US is a great place to deploy our savings instead.

However, the US stock market is so big, what are the stocks that we should invest in?

Well, you could invest in the entire US stock market itself, by investing the S&P 500.

The S&P 500, or simply the S&P, is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States.

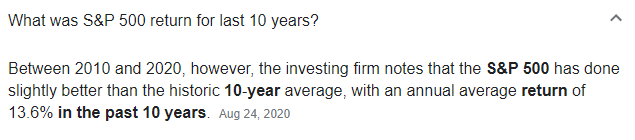

In fact, here's the average annual return of the S&P 500.

This means that if you invest in the US stock market index alone, you will have received an average return of 13.6% annually, which is much better than bank returns.

This is known as ETF investing, and it is one of the most straightforward ways to invest in the US stock markets.

Of course, you can potentially increase your returns by picking good companies to invest.

For example, if you invested in Facebook from 2012 to 2021 - your returns would have been 865.26% or around 72.1% annually - even much better than bank returns.

Conclusion

Ever since I learned investing and getting pretty decent results for myself, most of my savings go into my brokerage account rather than leaving them in the bank.

Learning to invest is ever so important, especially if you want to grow your savings beyond the interest rates that are given by the banks. It is my mission to help equip beginner investors who are just starting out in the stock market to get their foundation steady from the get-go. I summarized the basics of stock market investing all in one single resource page, which I fondly call it the Stock Investing Hub.

The Stock Investing Hub

Never get lost in your investments again.

Do check out the Stock Investing Hub from time to time, as I constantly upgrade it as I upgrade myself.

If you found this article helpful, do share it with your friends and family by clicking on the social share buttons below - it brings me great joy to be able to serve more readers.