As investors, we usually only take bullish positions. Bullish positions means that we enter the position with the expectation of the underlying share price to go up.

For bullish positions, there are two main strategies:

- Buying Stocks

- Buying Call Options

(For simplicity, I am not including other bullish option spreads such as synthetic, vertical spreads, etc.)

Now, what exactly is the difference between the two? Is one strategy really more superior than the other?

This is what we will be revealing in this blog post - let's start with expected returns.

Note: For the benefit of those who are unsure what buying call options means, here's a brief explanation.

When we buy a call option, we have the right to buy 100 shares of the underlying assets at a specified strike price before the expiry date. To buy this call option, we pay an option premium. Read the case studies below to understand this concept better.

Potential Returns

When we buy a call option, we are able to achieve leveraged returns. The reason is because of the lower cost of investment.

To illustrate this, let's compare the strategy between buying stocks and buying call options using an actual case study for Facebook.

On 29 Jun 2020, I wanted to invest around $5000 in Facebook. At that point of time, the share price of Facebook is $220.64.

I could choose between the two strategies:

- Buy ~ 23 shares of Facebook ($5000 / $220.64 = 22.7 shares)

- Buy 1 call option with 354 days of expiry at strike price of 190*

(*Don't worry, I will share with you how I select the expiry date and strike price at the end of this blog post)

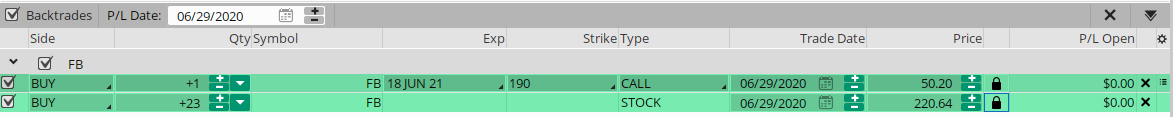

So here is the trade summary for the above two strategy executed.

Backtest Trades of FB at 29 Jun 2020 Using ThinkorSwim's Thinkback Feature (Click to enlarge)

(Note that the FB call option's trade price was $50.20, which is effectively $5,020 since one option is 100 shares.)

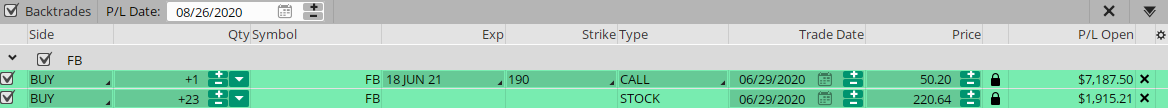

On 26 Aug 2020, the share price increased to $303.91. Now, let's see what happened to both of our positions.

Backtest Trades of FB at 26 Aug 2020 Using ThinkorSwim's Thinkback Feature (Click to enlarge)

Woah.

The call option made $7,187.50 while the stock only made $1,915.21.

Now, remember that we need to measure these profits in terms of return on investment, which is the amount of profits divided by our total capital outlay.

Here's the table to calculate our return on investment:

Strategy | Total Investment | R.O.I |

|---|---|---|

Buy Call Option | $5,020 | $7187.50 / $5020 = 143.18% |

Buy Stocks | 23 X $220.64 = $5074.72 | $1,915.21 / $5074.72 = 37.74% |

Wait...even while using around the same amount of capital, I am able to get 143.18% return??

Well, yes - that's the power of using call options. But there's a big problem.

Here's where people get greedy and tell themselves,

"I will never buy stocks ever again, I will only BUY CALL OPTIONS!"

This is the common mistake among beginner investors where they only look at returns, and throw the concept of risk out of the window.

I tell people this quote all the time, with hopes that they will truly internalize it in their investment journey.

Protect your downside, and your upsides will take care of itself

When I invest, I don't focus on the returns; instead I focus greatly on controlling the risk of my investments, which I will share with you how I personally do it.

The Risk

There are two aspect of risk that we have to consider:

- Probability of Risk

- Severity of Risk

Let me illustrate what each of these terms means.

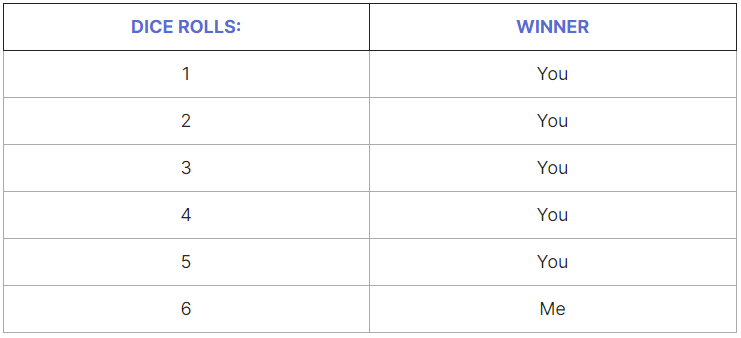

Imagine we are at a casino, and I proposed to you a dice game, and the dice has 6 sides.

- If the dice rolls anything other than 6, you win.

- If it rolls 6, I win.

So here's how it looks like:

This means that out of the six possible outcomes, you have 5 out of 6 chances of winning. That's a whopping 83.3% of winning!

This is a no-brainer game. But here's the problem.

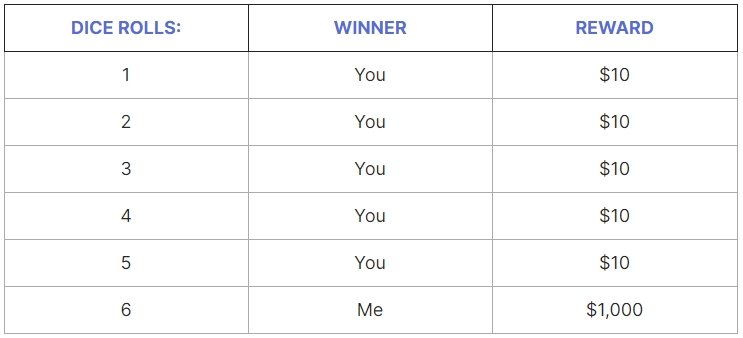

We have yet to look at the next aspect of risk - severity of risk.

What if I added the condition that if it rolls anything other than 6, I will pay you $10. But when it rolls a 6, you will have to pay me $1,000.

Now, all of a sudden, the tables have changed. At any one point of time, if the dice rolls a 6, you immediately lose $1,000. While the probability of this happening is only 1/6, it is a HUGE severity risk that you have to consider.

Now, let us go back to the risk of call options and stocks.

In the above example, we spent around $5,000 in both call options and stocks.

If we only invested $5,000, what is the maximum we can ever lose (assuming no leverage)?

That's right - $5,000! You cannot lose more than that! That's refers to the severity of risk.

However, what about the probability of risk?

Let's say we spent $5,000 and buy Facebook shares at $220.64 each. The only way for us to lose the entire $5,000 is for Facebook share price to drop to $0! Do you really think that is likely for a fundamentally sound company like Facebook?

However, what about call options? Well, let's look at Visa during the Covid-March Crash as a case study.

On 24 Feb 2020, I wanted to invest around $3,300 in Visa. At that point of time, the share price of Visa is $198.79.

I could choose between the two strategies:

- Buy ~ 17 shares of Visa ($3300 / $198.79 = 16.6 shares)

- Buy 1 call option with 326 days of expiry at strike price of 175*

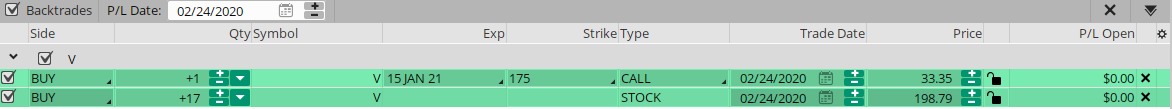

Here is the trade summary for the above two strategy executed.

Backtest Trades of V at 24 Feb 2020 Using ThinkorSwim's Thinkback Feature (Click to enlarge)

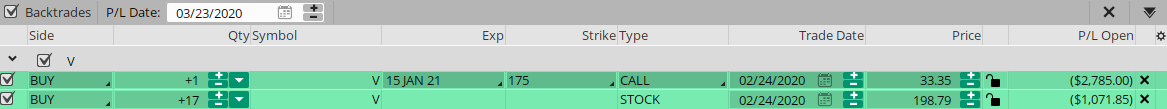

On 23 March 2020, the share price fell to $135.74. Now, let's see what happened to both of our positions.

Backtest Trades of V at 24 Feb 2020 Using ThinkorSwim's Thinkback Feature (Click to enlarge)

Now, remember that we need to measure these losses in terms of ROI, which is the amount of losses divided by our total capital outlay.

Here's the table to calculate our return on investment:

Strategy | Total Investment | R.O.I |

|---|---|---|

Buy Call Option | $3,335 | ($2,785)/ $3,335= 83.5% |

Buy Stocks | 17 X $198.79 = $3,379.43 | ($1,071.85) / $3,379.43 = 31.71% |

Can we see that with call options, the probability of losing our invested capital is very real? During the crash, our Visa call options would have lost 83.5% of our invested capital, while stocks only lose 31.71%.

I have not even considered the emotional turmoil that beginner investors would be going through looking at a paper loss of 83.5%.

Imagine if this was a greedy investor who invested his/her entire net worth of $100,000 in call options, this would be looking at $83,500 paper loss. Close your eyes and imagine if you have the emotional discipline to handle this.

I am not trying to scare you that call options are risky. Every instrument has its risk, what matters more is how we control this risk. To be able to control this risk, we first need to gain knowledge on the financial instruments that we will be using.

What's Next

Successful investing is all about compressing our downside, so that the upside eventually follows.

I also shared about the probability of risk and severity of risk, and how we have to look at BOTH of these aspects.

It is my goal to help beginner investors build a solid foundation around investing using stocks and options, and to do that, I have built two free resource hubs, known as the Stock Investing Hub and Options Investing Hub.

These two resource hub were built painstakingly through my personal experience and you will discover the various criteria that I personally used for stocks and options. If you found the resource hub useful, do share it on your social media platforms so that I can serve more beginner investors in their investment journey.

The Knowledge Hub

Be it stocks or options, never get lost in your investments again.