Building your personal financial freedom is kinda like walking up a flight of steps all the way to the 100th floor.

It is a simple process but more often than not, it is not easy.

Why is that so?

Well, to walk a flight of steps, all you really have to do is to put one foot over the other, over and over again, and eventually, you will reach the 100th floor.

But the process can be a very long one, especially, when you are not doing it strategically.

There are ways for you to climb the flight of steps much faster - but only we choose to work both hard and smart.

Break Down Your Goals

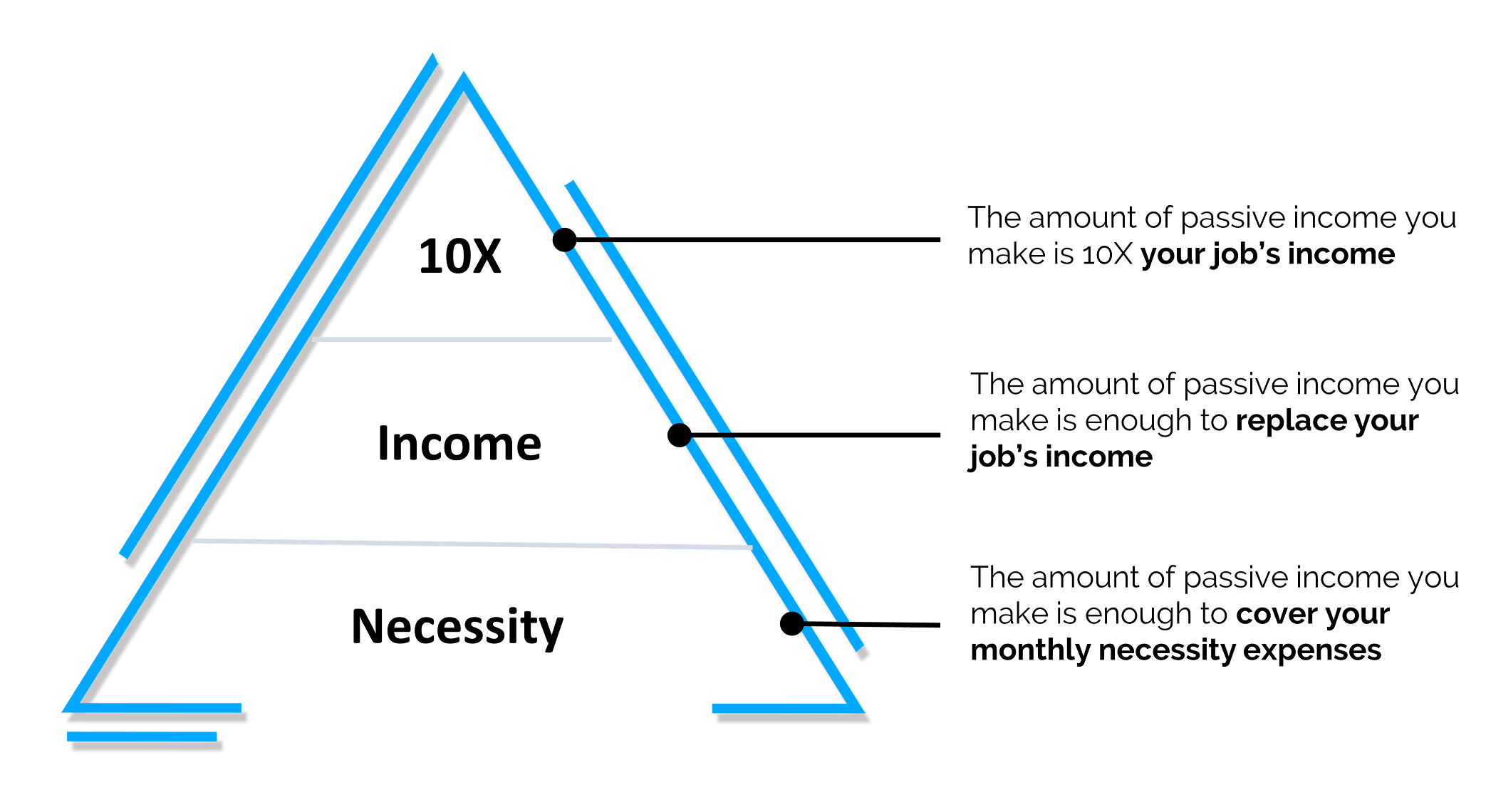

When it comes to financial freedom, I break it down into three distinct levels, which I call it the N-I-10 Framework.

Your first milestone should always be to achieve a necessity-based passive income.

This means that the amount of passive income that you have, would cover all your daily needs.

Take note that I am referring to needs such as your food, water, shelter, electricity - and not your wants like your luxurious meals, holiday trips, etc.

(But we will get to your wants later.)

And that is a significant milestone.

Why?

Because when you achieved a necessity based passive income, working for money becomes a choice and not a must.

You know you will still able to fulfill your daily needs even if you don't work for money.

When you reached that stage, getting to the next level of income-based and 10X-based financial freedom becomes much easier.

You see, most people are out there working for a job that they are not passionate about, and that they don't wake up feeling excited about what they are going to do. But they are forced to do it either way, because they need to pay the bills.

However, the entire story flips around when you already achieved your necessity-based income freedom. Because, you know that even if you stopped working for money, you will still survive. And that alone, would open up to many possibilities for you to like a much more enriched and purposeful life.

So, what you need to do is to take some time out of your schedule, and carefully calculate how much you need on a monthly basis to become financially free.

Should You Then Quit Your Job?

This begs the next question - should you then quit your job once you achieve your necessity-based financial freedom?

Well, it really depends on how much fulfillment you are getting from your job. Personally, my focus is on growth - if I am not in a place where I am growing, then I better move somewhere else, even if it means taking a lower salary. At this point, you probably realised that salary would not be a major deciding factor anymore, because our necessity-based freedom is already achieved.

A salary from an unfulfilling job is just the drug they give you when they want you to give up on your dreams.

Can you see that once you achieved at least a necessity-based money freedom, you begin to think in abundance. In fact, take a moment and think about who you rather be:

- Earning $20,000 of salary working at a job you hate for 12 hours a day.

- Earning $3,000 passively, and having all the time in the world to do what you love.

I probably don't have to tell you who will be the happier person among the two. Waking up in the morning and feeling genuinely excited about the day is one of the highest form of success - and everyone should work towards it.

But what I want to emphasize is this. The worst reason that you could possibly think of to quit your job is to lie on a beach.

Personally, I am not a believer that financial freedom means lying on the beach, doing absolutely nothing or just watching dramas and movies. That is not what financial freedom means. And if that is your perspective of financial freedom, I can assure you that your financial freedom will be a very shallow and meaningless one.

We all have to find work to do and contribute to others. And ideally, we have to put ourselves in the position where money is the not focus, but a by-product of our contributions.

Build A Healthy Relationship With Money

Many people have a negative mindset towards money, thinking that money is evil. The reality is that money should be treated as resource to fuel your contribution. For example, let's say that you own a organic food business that you believe is the healthiest food in the world, and it is your dream to get everyone to get into the healthy diet. But can you do it for free?

Well, possibly not. If you done it for free, sooner or later, your organic food business is going to close down, and it is going to crush your dreams of getting everyone into a health diet. Money is a resource that helps fuel your contribution.

Some would argue - "Okay, then don't do it for free, but do it at cost price, so that you don't make a loss but neither do you make a profit - so that it is affordable for everyone."

That's a reasonable suggestion. But let's go back to the bigger picture here - you want to be able to get everyone in a healthy diet with your organic food. If you are not making a profit, then where would you get the money to build your next factory to impact even more people? Again, money is a resource that helps fuel your contribution.

We need to get into a positive mindset about money, and how it can be used to fuel our contributions. For example, if I didn't that extra money every month, I wouldn't be able to sustain my blog and my newsletter to be sharing this with my readers as well.

Find Something That You Can Contribute To

When I achieved my necessity-based financial freedom number, I had to start to think about what would I do to contribute to others. The reality is that all of us, have a wealth of knowledge within us, from our personal knowledge and experience. And if these knowledge and experience can be used to help others to be more confident, happy, wealthier - then we have that moral obligation to uplift others who may not have figured out this journey.

For example, there are still people who are still fearful of the stock market, and I felt that it is important to teach them the idea of thinking long term, and the reality is that leaving money in the bank is much more scary than leaving them in a stock market index. Why? Because in the bank, you are GUARANTEED to lose money due to inflation. Meanwhile, in the stock market, as long as I am investing in quality companies, I will definitely do well in the long run.

However, to be able to serve others in their journey, it forced me to constantly upgrade myself - because if I did not do so, then how else would I be able to add more value and serve more people. This was what started the Stock Investing Hub and Options Investing Hub in the first place. Some people might take this information lightly because after all it is free information - when in reality, it contains the knowledge that I am using in my personal portfolio.

(And this is where someone enlightened me and said that, "People only pay attention to things they pay for - If there is no vested interest, there is no attention.")

Get Rid Of Poverty Mindset

Very often, what is stopping us from achieving our goals, is due to a poverty mindset. I used to have that as well, but books and mentors have set me free. One simple way to get rid of your mindset to identify and network with people who have an abundance mindset. After all, you are the average of the people around you. If you are constantly interacting with people who are already successful, then that alone increases the chances of you achieving success.

There is no better explanation that what Jack Ma shared:

“The worst people to serve are the Poor people. Give them free, they think it’s a trap. Tell them it’s a small investment, they’ll say can’t earn much. Tell them to come in big, they’ll say no money. Tell them try new things, they’ll say no experience. Tell them it’s traditional business, they’ll say hard to do. Tell them it’s a new business model, they’ll say it’s MLM.“

“Tell them to run a shop, they’ll say no freedom. Tell them run new business, they’ll say no expertise. They do have somethings in common: They love to ask Google, listen to friends who are as hopeless as them, they think more than a university professor and do less than a blind man.”

“Just ask them, what can they do. They won’t be able to answer you. My conclusion – Instead of your heart beats faster, why not you just act faster a bit; instead of just thinking about it, why not do something about it. Poor people fail because on one common behavior: Their Whole Life is About Waiting.”

Something that I have to emphasize is this. When Jack Ma used the term "poor people", he is not referring to those who are broke, but rather those with a mindset of scarcity and limiting beliefs.

The biggest poverty that we have is not the poverty of money - but the poverty of dreams and actions. Instead of constantly thinking about what you cannot do, why not just have the courage to do it anyways, fail and keep trying. That alone will put you ahead of those who never had the courage to take any action.

And if you ever need a reminder - its this.

Life is short. At your deathbed, would you want to tell yourself:

"I am glad I played it so safe in life, took no risks at all"

or would you rather be the one saying:

"I am glad that I had the courage to take action and made the most out of my life".

What's Next

It is my hope that everyone could at least aim for their necessity-based financial freedom as soon as possible, so that they can get money out the way and live a more fulfilled life.

To achieve your necessity-based financial freedom, we have to first calculate our expenses and figure out how much capital we need to be financially free. Please don't think that you need a lot of money to achieve your necessity-based financial freedom, because the reality is that you don't need alot.

I have recorded a training previously - and it happens to be free. I am honestly considering to charge money for this since from experience people only pay attention for things that pay for. But I know that amongst you that there are people who are action takers. So I am still keeping it free for now.

Here's the link to the training:

P.S You will be prompted to create a Passive Seeds Account to access the course.