I know that's a bold statement.

"The sure-fire way to financial freedom".

But give me a chance to explain why this is true, and will work for most people, especially those who have a stable income - and in a 9-to-5 job.

What is "Paying Yourself First"

I first learned this concept from reading the book, "Rich Dad Poor Dad" by Robert Kiyosaki.

The concept of paying yourself first.

And this concept could be summarised into one of Warren Buffet's quote:

Do not save what is left after spending, instead spend what is left after saving.

Let me explain what that means, and how you can actually practically use this concept.

(It's a concept I have been using since I started investing, and was what got me to a decent size investment portfolio today.)

This may be more applicable for the 9-to-5 who have a predictable and stable income.

What Would You Do First?

For those in a 9-to-5 job, like myself, we have a stream of predictable income that comes in a certain date of every single month.

(That's one of the main perks of a 9-to-5 job - stability)

Let's say you are paid on the 15th of every month.

What do you do with the money the moment the income comes in on the 15th?

Most people will gravitate towards spending the money first - it could be buying a new laptop, a new bag, or a decent meal at a restaurant.

And whatever that is left - will be saved in the savings account.

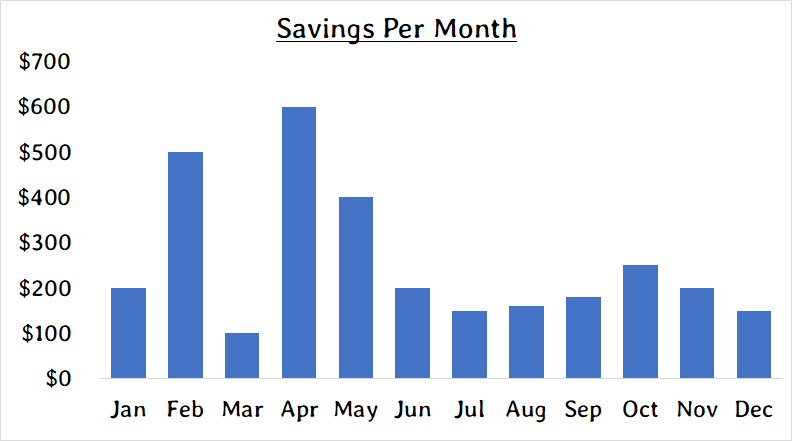

This will how your savings looks like every single month.

At one glance, you could probably tell that it is inconsistent.

And that's no surprise - if you decide to spend more in certain months, then of course, your savings will decrease for those months.

The opposite is true as well - if you spend lesser, you will end up saving more.

In this example, the total amount that you saved here was $3,090 for that year.

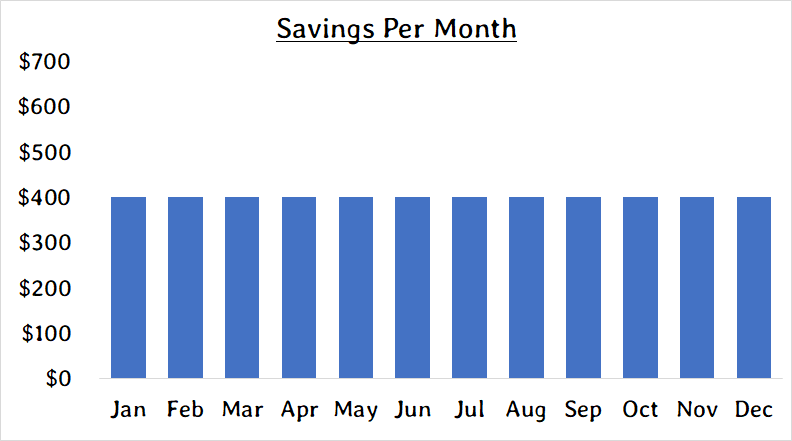

Let's take a look how the same chart will look like, if you decided to save first before spending.

Now, that's a pretty boring chart, isn't it?

But the beauty of it is that it is consistent.

Every single month, the moment you are paid - you put aside $400 into your savings.

(Btw, $400 is an arbirtary number - I will show you how I work on these numbers later)

You saved a total of $4,800 for that year.

How Much To Save Every Month?

The reason why this works so well - boils down to these two words - Delayed Gratification.

"Delayed gratrification means the act of resisting an impulse to take an immediately available reward in the hope of obtaining a more-valued reward in the future."

Most people will reward themself immediately the moment they have available cash.

Imagine someone who struck the lottery - in most cases, they would just squander the money away.

By paying yourself first, it forces you to save a portion of your income, instead of spending that money rightaway.

So how much do you save every single month?

A general guideline that I learned from Grant Cardone - the 40% rule.

Save 40% of your income, and put it aside.

So if you are making $3,000 in disposable income, then you want to be setting aside $1,200 - and survive on the remaining $1,800

In fact, this is exacly I have been doing every single month.

When I started my financial freedom journey, my disposable income was only $2000, so I saved $800 every month.

And when my income increased to $2500, I started to save $1000 every month.

And after getting my degree, my income increased to $4500, I started to save $1,800 every month.

If you are struggling to survive on the remaining 60% of your income - that's cool.

Start with saving 10% first, and start increasing your personal income.

So here's the action plan for you:

Every single month, once your pay check comes in - commit a portion of that income to savings.

Now, once you have started saving your income, its about how to use those savings to fuel your financial freedom.

How To Use Your Savings?

Now, this is where the rubber meets the road.

You will be surprised about what I will telling you next.

Don't leave your money in the bank.

That's right - don't leave your money in the bank.

The interest rates on your savings is miserable - downright miserable.

Once you have a substantial amount saved - you want to make your money work hard for you.

I always treat my money like soldiers - and leaving them in the bank, it like letting my soldier rest in their barracks and do absolutely nothing.

I want to send them to wars (strategically), so that I can actually grow my wealth.

What are these wars?

It is basically investing - be it in the stock market, real estate, trading, or in your own business.

You want your money to work hard for you.

For myself, I started my "war" in the stock market, and afterwards in the property market, and subsequently in businesss.

But here's the bummer - winning these wars are not easy.

It takes knowledge, skills and execution.

Putting Your Money To Work

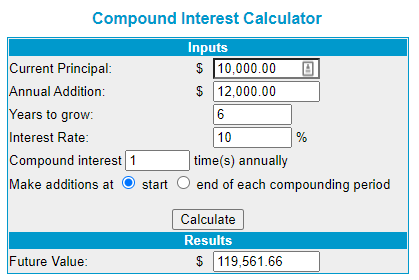

Building your wealth takes constant contribution to your investment portfolio.

The image below shows an example of how someone can start with a $10,000 portfolio and compound it to $100,000 in just 6 years - with constant contribution of $1,000 every month and a return of 10%.

In fact, with the right strategies, you can probably achieved your first $100,000 much earlier than 6 years.

These calculations are done using the Compound Interest Calculator from Moneychimp.

They have very kindly offered a link below to get quick access to this calculator.

Besides the constant contribution from your 9-to-5 job, you can also look for other sources of income as well.

It could be building an online business, or any sort of side hustle.

Many times I meet people who feel stuck - when all they had to do was to look for a side hustle that could supplement their income.

If we are not willing to change our habits - then we will never change our lives.

Everyone of us have our own journey to financial freedom, these are only some ideas to get you started.

The Goal Of Passive Seeds

And when I started Passive Seeds - this was my goal.

To inspire and help others achieve their financial freedom - because I know that there are many people who feel like they can are stuck in the 9-to-5s because of their financial commitments.

A mentor of mine once told me this, "If you can get money out of the way, you are able to live to your fullest".

This why I got obsessed with building wealth - and aim to help others to achieve the same as well.

I decided to build a free resource hub - designed solely to help beginners invest in the stock market.

I call it the Stock Investing Hub.

In this free resource hub, you will find tons of useful information to help you invest profitably in the stock market.

I hope you enjoy this blog post and looking forward to serve you with more quality content in the future.

Bonus: I will discuss more about using building wealth through the stock market, so if you want to be kept updated when my blog posts are out, the best way is to join my newsletter.

P.S It even includes a wealth building guide for 9-to-5s as a welcome gift.

Here at Passive Seeds, we hate spam, so we will never share your info. An email will be sent with the link to the wealth building guide, but you can unsubscribe at anytime.

Here at Passive Seeds, we hate spam, so we will never share your info. An email will be sent with the link to the wealth building guide, but you can unsubscribe at anytime.