In the past, when I invest, I used to always look out for the stocks that fell sharply in share price - particularly those that have 52-weeks low.

Why? Because IF it could recover back to its original price, that would mean huge profits - right?

Not only that, I only looked for stocks that are "cheap" - below $10.

Looking back, it was the foolish thing to do.

Today, I don't care whether it is 52-weeks-low, or recently hit a 52-weeks high, I will still collect the stocks as long it is fundamentally good and at reasonable valuation.

Similarly, I don't care if a stock is $10 or $500 - I will still collect the stocks as long it is fundamentally good and at reasonable valuation.

The First Step To Building Your Portfolio

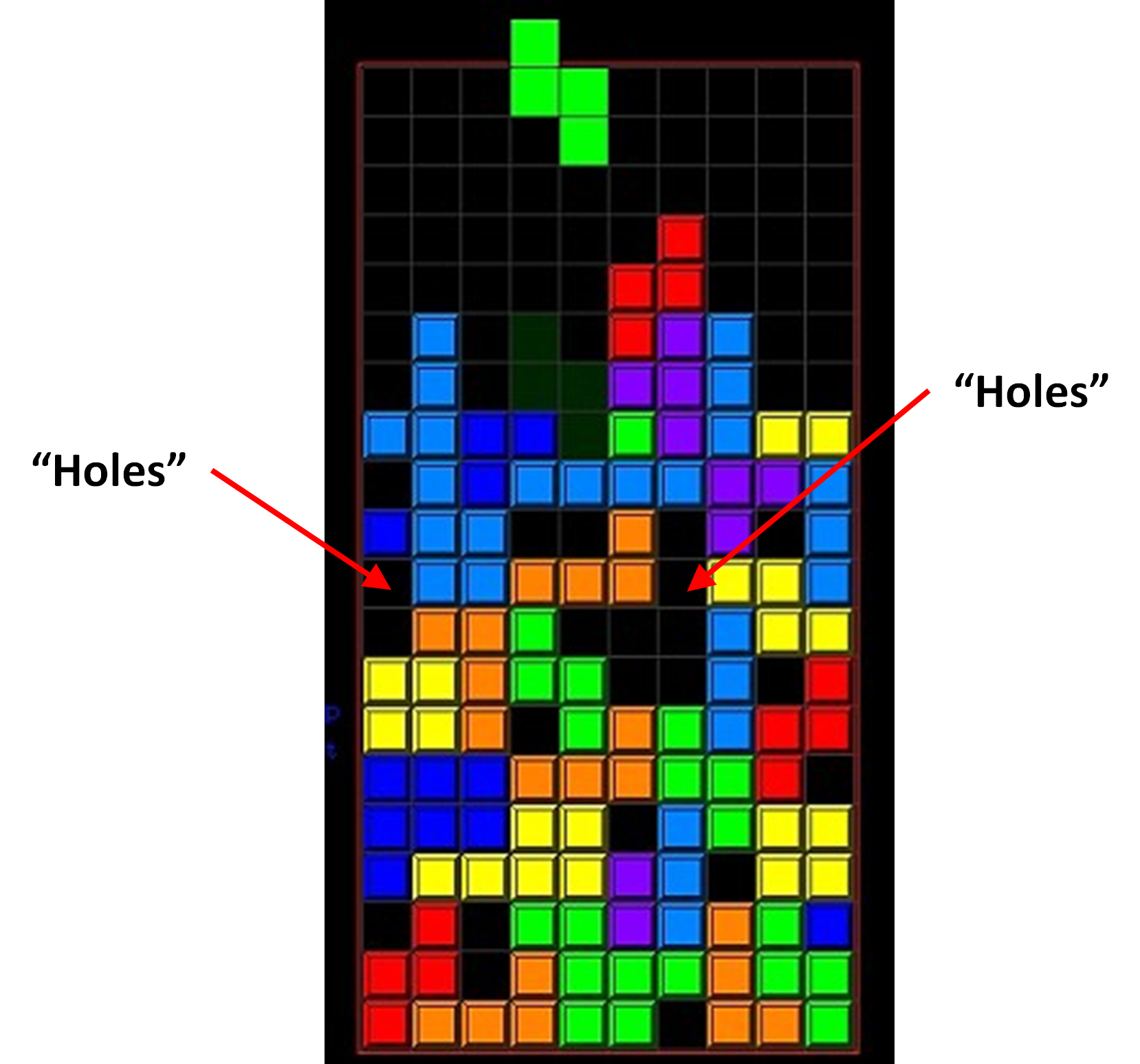

I'm sure that many of you are familiar with the game, Tetris.

(Or at least, seen it before)

A good Tetris player, would have gotten rid of the holes.

These holes are what you need to get rid of in your investment portfolio as well.

That's right - these "holes" are stocks that have poor fundamentals.

If you have a bad stock in your portfolio, don't hesitate to kill it off.

Now, when I say bad stock, I am NOT referring to the stocks in your portfolio that is currently having a negative P/L.

I am referring to the stocks that have poor fundamentals.

Particularly, stocks that didn't pass your investment checklist, but still invested anyway - because of the fear of missing out.

I did this exercise years ago - where I went through every single company in my portfolio, and I mercilessly cut off the stocks that failed my checklist.

This is why having a checklist is so important - if you have not had your own yet, feel free to use mine, and modify it according to your own personal criteria.

Get Your 8-Point Checklist!

So that you know what stocks

to avoid investing in.

Once you have gotten rid of the "holes", then only you can focus on actually building up your portfolio.

The name of the game is simple - collect the stocks as long it is fundamentally good and at reasonable valuation.

Be A Business Collector

Many people buy a stock, with the idea of selling it for a quick profit.

In short, they are impatient to make money.

And a common characteristic is that they always constantly worried about the stock market.

Charlie Munger once said this:

The big money is not in the buying and selling...but in the waiting.

That's where the big money actually lies - just holding the stock.

Which is why I emphasize to approach the stock market as a business collector.

More importantly, be a collector of fundamentally good companies.

Now, being a collector does not mean that you will never sell the stock.

A stamp collector will eventually sell his precious stamp collections as well - but only at an attractive valuation.

This is why the concept of valuation is so crucial - to understand the value of the company to determine your entry price and exit price.

Be A Smart Business Collector

Being a business collector is one thing - being a smart business collector is another.

There are two aspects of being a smart business collector:

- Don't overpay for your stocks

- Don't bet your entire net worth into a few stocks.

Valuation is one of the key concepts when it comes to investing.

If you have not watched the TV show series, Shark Tank - you definitely should check it out.

This is where a panel of multi-millionaires and billionaire investors - dissect a entrepreneur's business and they decide if they should invest.

There are many lessons that you can learn from this show, and I highly recommend that you check it out and learn from these high net worth investors.

One key lesson? They never invest in a business that have a ridiculous valuation.

(And no, I am not affiliated to them in any way, I just think it is a great show that my readers should check it out.)

Secondly, these high net worth investors have multiple businesses - they don't just put their entire millions and billions into a single business.

This is otherwise known as portfolio diversification.

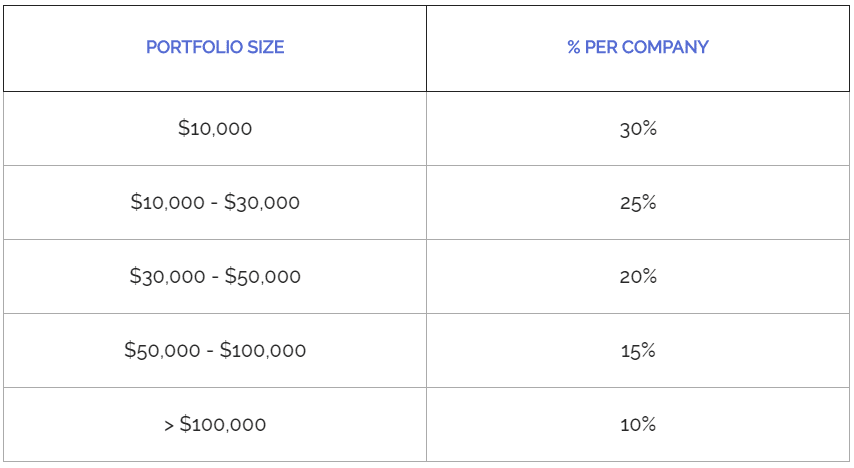

I will not dwell too much on this - but here's a guideline.

Be concentrated when you are small, be diversified when you are big.

When you are starting out with a small portfolio, it is probably worth being a little more concentrated - as your focus for a small portfolio is growth.

But as your portfolio gets bigger, you want to start to diversify to protect your portfolio.

As a general guidelines, here's the portfolio sizing that I use:

What's Next

So here's a quick summary.

If you truly want to invest for the long term, I will encourage you to patch up your "holes" in your Tetris and get rid of the stocks that does not pass your checklist.

After you have patch up these holes, then only can you focus on being a smart business collector.

For obvious reasons, I cannot cover the A-Z of investing in a single blog post - but here's what I have done for you.

I have put together a free investing resource (yes, completely free) on my webpage, that I have spent months to build in order to help investors who are just starting out.

You can click the button below to check this resource out.

The Stock Investing Hub

Never get lost in your investments again.

If you found this blog post useful, do me a favor and click on the share button below so that I can serve more audience 🙂