Whenever the market is at another all time high, people tend to get worried and thoughts like these start to fill their head:

"Should I take profits?"

"What if the market goes higher right after I take profits?"

And they start to make investing such a complicated process.

My approach is a pretty simple one - treat your stocks like how you treat a property.

The Beauty Of Properties

When we buy a property, we rarely have a short term view - a 10 year horizon would be a reasonable estimate.

But why is it that, when it comes to stocks - people tend to have shorter term views, and end up making decisions that hurt their returns?

Well, it is simply because it is so easy to sell their stocks.

A click of the button, and poof. There goes your shares.

And because of that, sometimes they do not think rationally when it comes to making investing decisions.

Unlike a property - before you sell the property, you need to do a valuation, have an option to purchase, sign the agreement, think about your next purchase, etc.

With that many considerations just to sell your property, it make sense that you would think twice before actually signing any documents.

So what am I trying to say here.

Well, when you invest in stocks - it is always important to have a long term mindset.

After all, when we invest in stocks, we are investing in actual businesses. Businesses that will help you compound your wealth.

"But Gin, if I don't sell now - It might have a correction and I am going to regret not selling!"

My reply?

"Time in the market is more important than timing the market."

I have had so many conversations with people who constantly tell me, "What if the stock market goes down".

Let's be clear about one thing - nobody can accurately predict the short-term share price of stocks.

The key word here is "short-term".

But when we stretch out our investment horizon - things all of a sudden becomes clearer. Because I know that companies that I hold (which passes that 8-point checklist) are likely to continue to do well and compound my money in the long run.

So if I know I am going to make much more money by holding the stocks long term - then why would I sell it and take short term profits?

Note: When I say hold the stocks long term - I am only referring to good quality companies - not "Reddit" stocks.

But Its Only Paper Profits

"Gin, you don't understand - if you hold the stocks and don't sell, those profits are only paper profits."

As a cash flow investor, I completely agree. By holding the stocks, we are just gaining paper profits - which is why I am going to share with you how I generate cash flow from my investments.

But let me address this "you need to sell your stocks to take profits" concept.

We must always remember that as investors, it is our responsibility to make our money work hard for us. And to do that, we have to invest the money into assets such as stocks. The WORST thing we can ever do is to keep our money in the bank, earning a puny interest of less than 1%.

So back to the "you need to sell your stocks to take profits" concept.

Let's say that you choose to sell your shares instead of holding onto your investments.

After you sell your shares, you get your capital back in cash.

What are you going to do with that cash?

Put in the bank? And earn an interest of less than 1%?

No no, you are a smart person. Of course, you are not going to leave your money in the bank. You would put it back into assets like stocks that give you a greater return.

If that's the case, then why would you sell the stocks in the first place?

And their answers always amuses me - which is I tend to interpret along these lines:

"Gin, you don't understand. I have this unique ability to predict share prices. I will sell my stocks at a high now, and then after that, I will buy back the shares when it is lower!"

If you have been reading my blog, you know my usual reply.

"If you are so good at predicting share prices, then why not you sell away your house, take a personal loan from the bank, and probably loan sharks, and invest all in stocks? After all, you know where the share prices will go right?"

Then they tend to get stunned, and reply,

"How can you say that - the stock market can do anything. Are you trying to ruin my life?"

And all of a sudden, they lost that unique ability to predict share prices.

The point I am trying to make is this.

Nobody can predict the short term share prices. It is much easier to just buy and hold quality companies.

So We Will Never Sell Our Shares?

Not quite.

There are mainly three scenarios why I would sell a stock.

- A better investment opportunity

- A change in stock fundamentals

- The stock became overvalued

In other words, I don't sell a stock just because it seems "high", instead, I hold the stocks until one of the above three scenarios happen.

Some of you who have watched my free course, Financial Freedom Fundamentals - would have realised that it is important for us to create cash flow from our investments.

And if we are just holding our stocks, where would we get the cash flow to pay for our expenses and eventually become financially free?

What does "cash flow" means?

Well, cash flow refers to the cash that enters your pocket - and can be used to pay for your expenses such as your food, groceries, utility bills, etc.

And cash flow is important because you cannot pay for your expenses using paper profits right?

But where do you get cash flow?

I Know, Dividends!

Yes, dividends is one of the ways to get cash flow.

But I hate using this approach.

High dividend yield companies, tend to be more mature companies that do not grow as much. That's why, they choose to pay out more dividends to attract people to buy their shares.

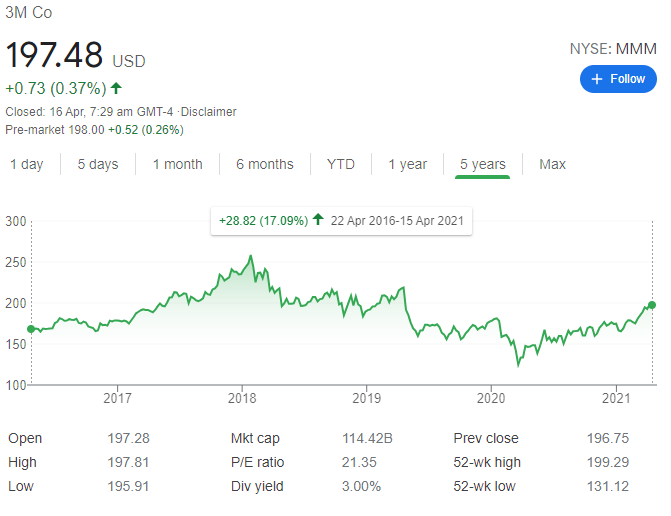

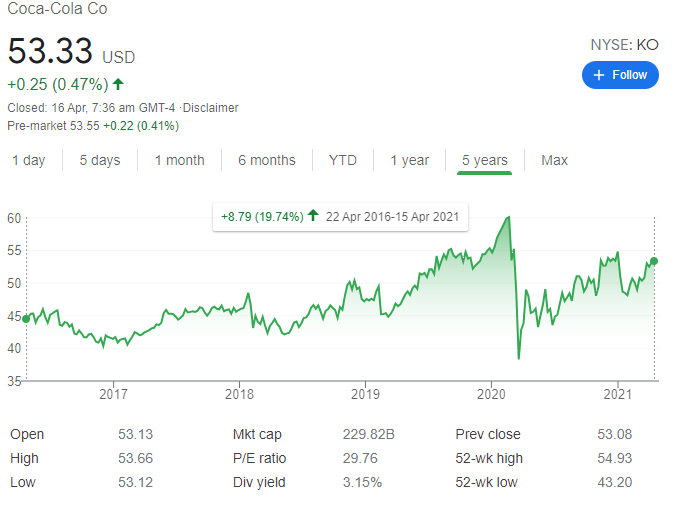

Take a look at these well known dividend companies and check out their returns on a 5 years time frame.

Yes, their capital appreciation are very little, and the amount of dividends they pay is somewhat like a consolation prize...

(Needless to say, all of these companies failed the 8-Point Checklist)

So instead, what do I do to create cash flow from my investments?

Selling Call Options

Remember in the beginning, I mentioned to treat buying stocks like buying properties.

Well, selling call option is like renting out your stocks - just like how you would rent out a property.

One example is a stock that I have invested called USNA.

I have bought 100 shares of USNA at around $70 and have been selling call options to collect option premium.

From 23 Sep 2020 to 12 Apr 21, I have collected a total of $1,271 in option premium.

This is done in just 7 months.

My investment in USNA is around $7000 and I collected $1,271 in option premium. That's already a 18.16% return in just 7 months. No dividend stock will give you that kind of cash flow.

And that's not all, unlike the high dividend yield stocks, this stock actually have a decent capital appreciation - thanks to the 8-point checklist.

And I continued to collect the option premium while waiting for the share price to increase.

Sounds too good to be true?

Well, yes - selling options have its risks, especially when you are unclear about how options work.

But risks is not something that you avoid, but something that you managed by learning about options. This is how I am able to collect a decent amount of cash flow every single month from my portfolio. Cash that actually be used for my expenses.

How You Can Get Started?

Options can be a complex beast.

And if you are interested in discovering how options can help you in your portfolio, you have to check out our free resource, the Options Investing Hub.

These resource outlined the main option strategies that I used in my personal investment portfolio. Even if you have already read it, do read it over and over again, until you successfully implement the strategy.

If you have any questions, I am always just an email away.

The Options Investing Hub

The free resource to navigate options