This is going to be a time-sensitive blog post which I am writing as of 16 Oct 22.

If you read this blog post too late, then perhaps you have missed the boat.

The best part is that you only need $428 to start this trade.

I will break down the trade as follows:

- What is the stock

- What is the option strategy

- How much option premium you are expected to collect

- Probability of winning

- Risk involved

- Why I Am Doing it

P.S. I have a vested interest in this trade and have already put my order in. Kindly do your own due diligence.

The Trade Execution

The stock that I am executing this trade is NVDA, which passes my 8-Point Checklist. This means that this is a fundamentally good company.

The stochastics of the stock is currently low, which means that it is likely due for a rebound. The volatility of the stock is also very high, which means being an option seller is much more beneficial than being an option buyer.

The Option Strategy

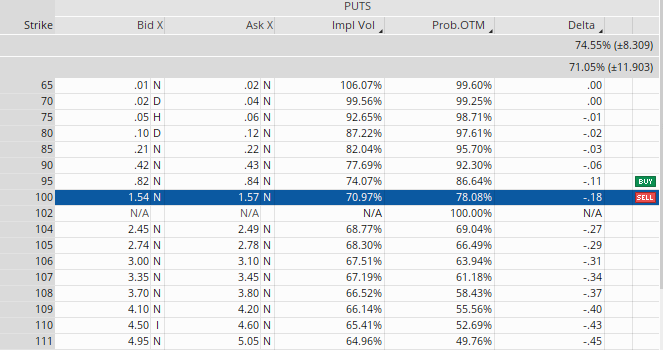

Initially, I wanted to simply sell a put option @ 100 with an expiry date of 28 Oct 22 (12 days from now) and collect a premium of $1.54. The probability OTM is at 78.08% - this also means that there is a 78.08% chance that the option will expire worthless.

However, most of my readers has emailed me that they are not comfortable with the selling just put options.

This is because if the put option is exercised, you will be required to by 100 x $100 = $10,000 worth of NVDA shares.

So how do I solve that?

Well, that is to sell a bull put spread, which is as follows:

- Sell 100 Put @ 28 Oct 22. Collect $154.

- Use a portion of the $154 and buy a put option 95 @ 28 Oct 22. Paid $82.

This means that by executing this trade, I collect a total of $154 - $82 = $72.

The odds of me collecting this $72 is still 78.08%. However, what is my risk?

The Risk of Bull Put Spread

Unlike a naked put option, where most people are concerned with getting their sell put options exercised...you don't have to worry about this which a Bull Put Spread.

Why?

Because even if the stock were to fall all the way down to $0...

...the maximum you will ever lose is $428. Yes, pretty crazy right?

Let me explain why. The answer lies in that you buy a put option at $95, which give you the right to sell 100 shares at $95.

So for example, let's say the share price fell all the way down to $50.

- Your sell put will exercised and you wind up having to buy 100 shares @ $100 - this means you suffered a loss of $5000.

- However, you have your buy put option which allows you to sell the shares at $95. This means that even though the share price is at $50, you can exercise your buy put to sell your shares at $95. This gives you a profit of $4500.

Therefore, putting this both statements together - you would only lose $500. However, remember that you collected $72 at the start of the trade? This means your maximum loss is only $428.

Some will wonder...why do I want to risk $428 to make $72?

Well, the answer is the probability of success is extremely high. Based on statistics, it is at 78.08%. To be frank, when you sell the put option at stochastics low and the company is one which passes the 8-point checklist, the odds are a lot higher.

Why Am I Doing This

This is typical example of playing the odds to your favor and I am taking this trade.

Such trade set up come more often in volatile periods where everyone is wary of the stock market as many companies are falling.

I then use all the profits I collected from these trade set up to buy even more stocks of quality companies. This means that once the stock market recovers, all of my companies will break even faster.