“Learn from the mistakes of others. You can't live long enough to make them all yourself.” - Eleanor Roosevelt

Its okay to make mistakes - as long as you learn from them.

Or better still, learn from the mistakes of others.

In this blog post, I reveal 10 common mistakes beginner investors make - including myself when I just started investing.

1. Looking At Price and Not Value

Many people tend to make this mistake, where they are letting price stopping them from making a great investment.

Let's say I went absolutely crazy and wanted to sell you this $100 note for $30.

What would you say to me:

- $30? That's too expensive! You can go fly a kite!

- Oh wow, really?? (I can easily gain a $70 profit just by using $30!)

Now, in this example - the option is obvious since the value of the note is clearly $100.

And exchanging $30 for a $100 note is a no-brainer investment.

However, when it comes to investing in stocks - people tend to look only at the price of the stock - and not the value of the stock.

They tend to say things like,

"Microsoft costs $200! That's expensive!"

"A AMZN share cost $2000? You must be crazy to buy that!"

"Wow, GE only costs $8? That's dirt cheap! I am going to buy that!"

When they make such statements, clearly, there were only looking at the price of the stock and not the value.

Now, here's the analogy to what this really mean.

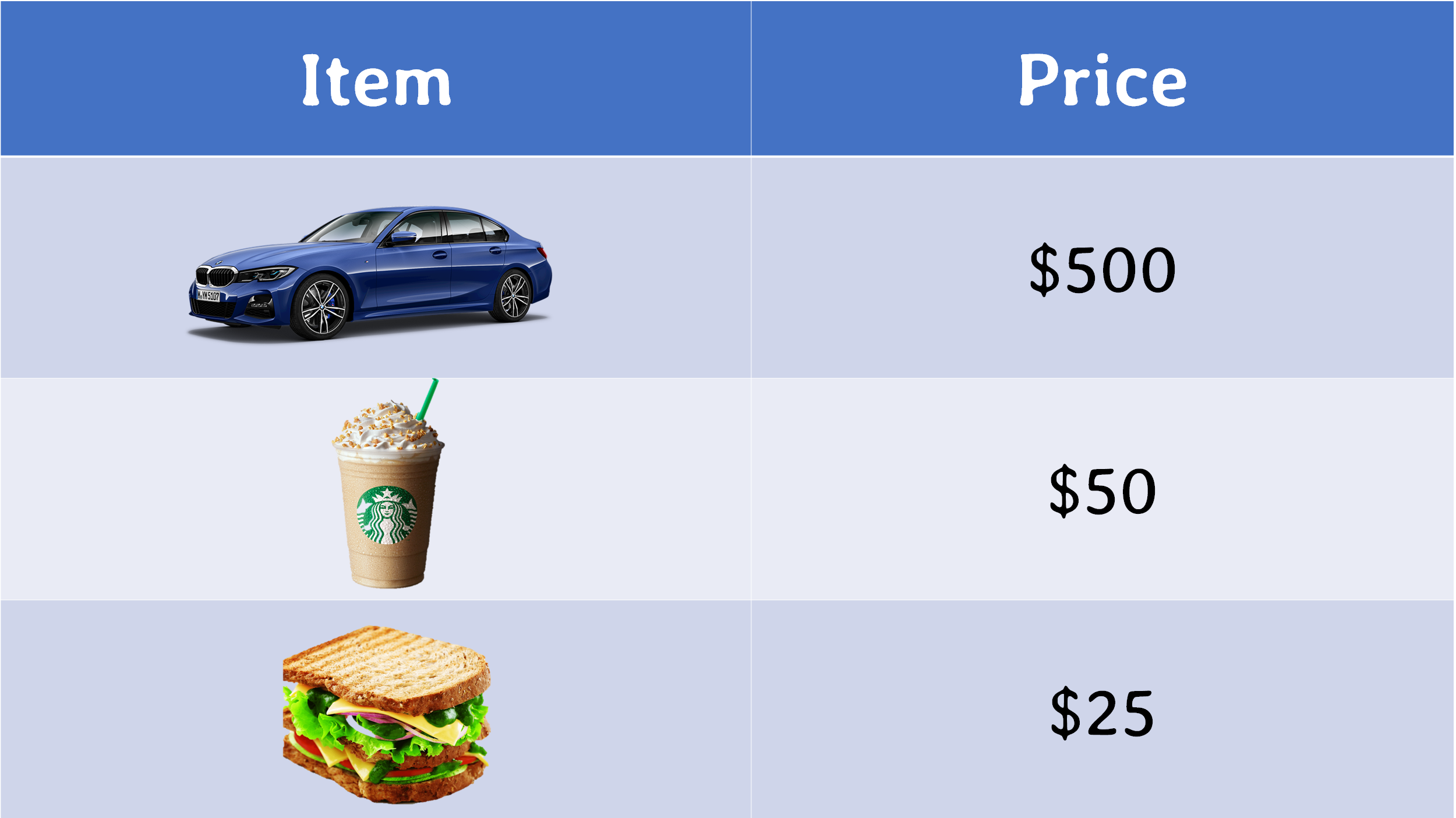

Let me ask you this, which one of the following would you buy?

Would you tell me that,

"Wow, this amazing sandwich is 20X cheaper than a BMW! This sandwich is dirt cheap!"

For obvious reasons, the BMW car is the best deal here (if you recognise the value of the car, that is)

However, when it comes to the stock market, people tend to throw this concept out of the window - simply because they were not taught how to calculate the value of businesses.

And that leads to mistake number two.

2. Blindly Following Gurus

Because some investors do not have the foundation of investing - they tend to go onto forums, YouTube and Facebook - trying to look out for the next hot stock that everybody is investing in.

Now, I am not suggesting that following the "guru" is necessarily a bad thing to do.

But don't be a blind mouse.

Before you follow the "guru", make sure that you understand the thought process of the investment - and that is by having the answers to these following questions:

- Why did he invest in the stock?

- What was the valuation that he calculated for the stock?

- What is the portfolio percentage of the stock he invested in?

- What is his timeframe when he buy the stock?

- If the stock falls, will he be adding more positions?

- If he is adding more positions, do I have the same amount of capital as him to add more positions as well

- At what point, will he exit the investment?

These questions are aim to give you clarity on your investments.

Most people, when they blindly follow the guru, they tend to panic when the stock fell by a mere 10%.

And while they chickened out of their investments, the "guru" was busy buying more as the stock price fell - and making a huge profit in years to come.

This is why I never advocate the idea of blindly following the "guru" - you need to understand the thought process behind their investments.

Because this gives you clarity and conviction in your investments.

And even if the share price were to fall 10% or even 20% - you won't be worried, because you already have your own game plan.

In fact, one of the questions that I asked myself before I make an investment,

"If the stock were to fall by 50% - will I be worried or be excited to add more positions?"

And if the answer is that I will be worried, then chances are that I clearly do not have a game plan for my investments.

3. Focusing on Dividend Yield Only

Most dividend investors are going to get upset when I say this.

But here's my opinion anyways.

If you are starting with a small portfolio - it makes little sense to focus on dividend yield.

Here's why.

The whole purpose of investing is to build wealth and become financially free from your investments (at least, that's my opinion).

If you only have $10,000 - even a decent 5% dividend yield will only give you $500 per year.

That's barely enough to become financially free.

However, when you have $1,000,000 - that's where a 5% dividend yield gives you $50,000 a year - which is a pretty decent amount of passive income for most people.

And some dividend investors might say that,

"Gin, you don't understand - with the compounding effect, you can reinvest your dividends and eventually build up your portfolio."

Now, I completely agree - the compounding effect is powerful and does wonders for our wealth.

But the effect of compounding is not exclusive to reinvesting dividends - it can also be done by the business itself.

Look at Facebook for example.

Facebook does not gives any dividends to their shareholders, instead, they reinvest the money back into the business - this was how they are able to grow the business.

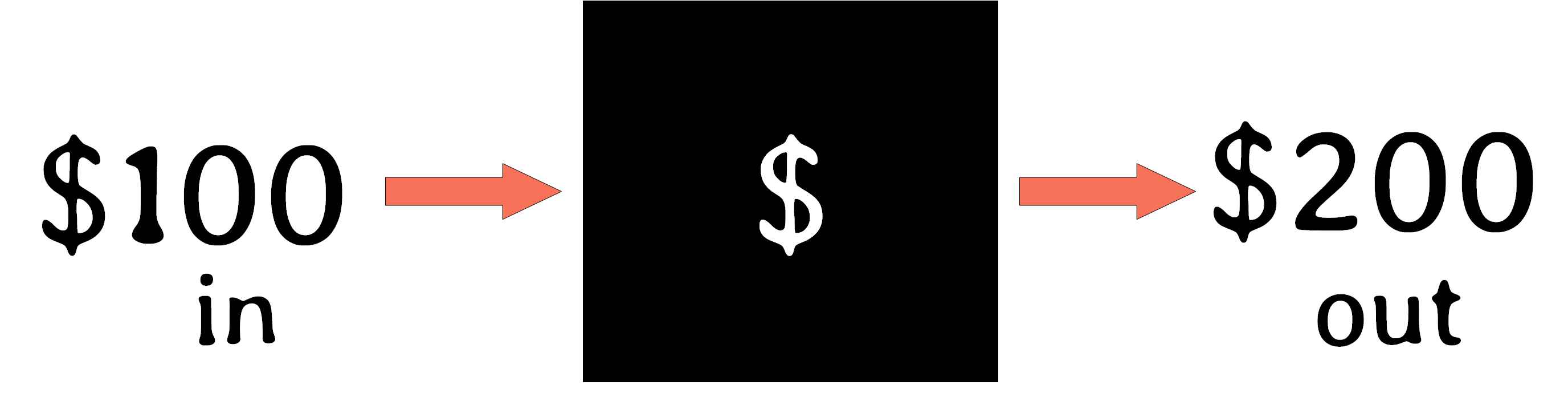

You see, businesses, in financial terms, are like a money-making machine.

Imagine if you have this money machine where you put $100 in and get $200 out.

What will you do with your $200?

Will you choose:

- Wow, $200 - let's give this money away to our shareholders and reward them.

- Wow, $200 - let's reinvest this $200 back into our business and make $400. This way, we can reward our shareholder even more.

What do you think?

If you chose option A - then clearly you are a irresponsible CEO - because you are denying your shareholders, the growth of the company!

The earnings growth of the company will lead the the growth in share price - and this is what will build your shareholder's wealth.

Now, before I go on - I want to emphasize that, I am not saying the companies that pay dividends are bad companies.

What I am saying is that, we should not base our investment decisions simply because the company pay dividends.

If they are paying dividends, ask yourself this - are they doing that at the expense of the growth of the company?

Because the growth of the company is what will compound your wealth - and not the dividends.

In fact, if you take a look at Jeff Bezos - the amount of salary that he pays himself is only $81,840 - which is a humble amount compared to his billionaire status.

Why is this so?

Because he wants to keep reinvesting the earnings of the company!

Guess what - Amazon doesn't pay dividends to its shareholders as well - and rightfully so. Otherwise, they won't experience growth like this.

4. Panic Selling After A Drop

This is another common mistake among beginner investors - where they would panic sell away their stocks simply because of a drop in share price.

If we have done our homework, and understand the quality of the business - a drop in share price is an amazing opportunity to add more positions into our stocks!

In fact, look at the S&P 500 index for the past 10 years.

If you could turn back time, and buy stocks at the time period circled in red - would you have done so?

Your answer might be,

"Of course Gin! I would have made a lot of money!"

And this is a logical decision - but most people wouldn't have the courage to buy simply because of their emotions and lack of ability to think long term in their investments.

What would cross their minds would be,

"Oh no, what if the share price falls even further! I cannot take the red in my portfolio anymore, I am going to sell all my shares!"

And somehow, once they sell their shares - the stock market starts to recover and they get frustrated, thinking that the market is against them.

The only thing that we should recognise is to focus on the fundamentals of the business and not the share price.

In fact, let's go back to the $100 note example.

On day 1, I decided to sell this $100 note for $50.

You saw that it was a no-brainer deal - and decided to exchange your $50 for $100.

But on day 2, I decided to reduce my price to $25.

What will you do?

Will you tell me that,

"Shit! It was at $50 previously! If only I waited till today, I could have gotten a better deal at $25!"

Probably not right?

You will take out your wallet and exchange your $25 for $100 again!

Its common sense - but again, people tend to throw logic out of the window when investing in the stock market.

Remember to recognise the value of the business, and not the price.

Does the stock price falling had anything to do with the fundamentals of the business?

Or in this case, did my reduction in price changed the value of a $100 note?

If it doesn't - then it shouldn't stop you from buying more shares at even more undervalued prices.

However, some of us will not have the capital to buy more shares as the share price falls, and that leads us to the next mistake.

5. The "All-In Or Nothing" Mentality

This is otherwise known as the gambler's mindset.

I remember that once someone told me that Apple was about to launch their new iPhone and the price will surely go up!

I jokingly replied,

"Surely go up?? Then why don't you sell your house and kids and buy the Apple shares? Once you profit from your Apple shares, you can always buy your house and kids back."

(I am just kidding, please don't do that to your house. I mean, your kids.)

He was stunned and said,

"You must be crazy - there is a possibility that it would go down as well."

So its not so "surely" anymore?

You see, there are many people who are investing based on hear-say, and they didn't want to miss the boat - and they enter with an "all-in" mentality.

If you want to invest consistently, portfolio management is key.

And if you have an "all-in" mentality, it is only sooner or later that your portfolio will be wiped.

For example, during the market recovery in Mar 2020 which is the "post-covid" crash, many of the stocks went up.

Because of that, many people happened to catch that wave, and they end up being overly confident in their trades - and wound up overleveraging and wiping their portfolio eventually when the market correction came.

The key here is to recognise that, "anything that can go wrong, will go wrong."

Don't operate with the mindset, that you will never be wrong and you somehow have the God-given ability to pick out the market tops and bottoms. With this mindset, your portfolio is just waiting for trouble.

6. Actively Monitoring The Stock Market

I remember when I just started in investing, I will tend to take out my phone and open the Yahoo Finance app to just look at share price movements.

Thinking that if I looked at it long enough - I can control share price movements with eye power.

You probably think that that is crazy.

And looking back - I admit it is foolish too.

But many beginner investors tend to actively monitor the stock market prices for absolutely no reason at all.

What we should realise is that:

The stock market in the short term in a betting machine; but in the long term - it is a weighing machine.

If you have the ability to think long term, short term market fluctuations should never bother you.

In fact, if the market does fall - it should actually get you excited because that means that opportunities to buy quality companies at reasonable prices are actually coming.

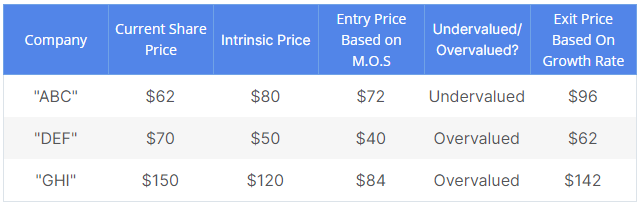

So instead of constantly monitoring the stock market, why not focus on building up a watchlist of quality companies where you know when to enter and when to exit?

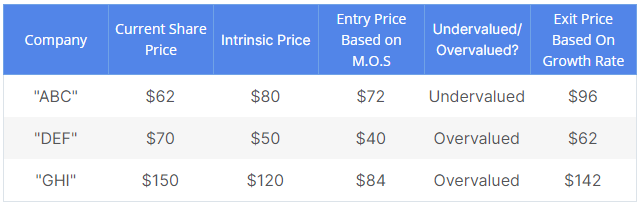

Something like this.

This way, you don't have to monitor the stock market every now and then.

All you have to do is design your game plan and execute on your game plan.

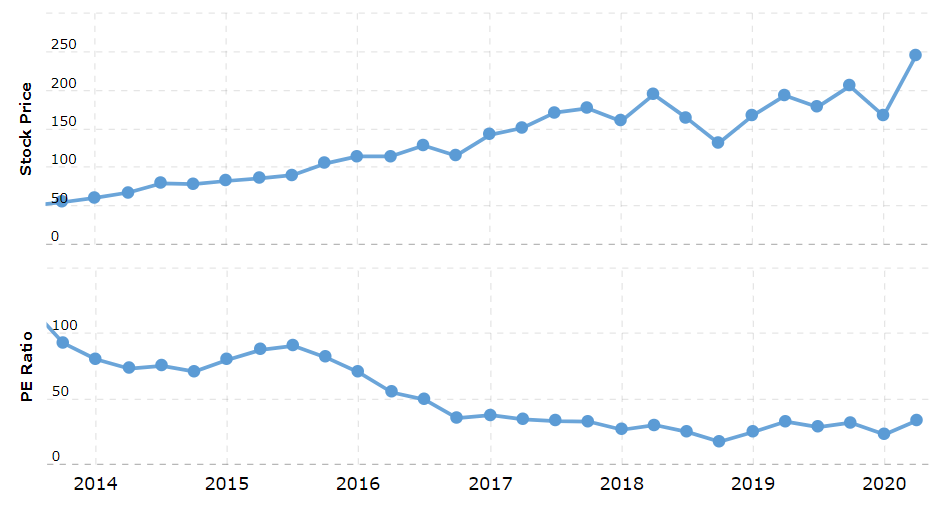

7. Thinking that a Low PE Ratio < 12 is Cheap

When it comes to valuating the stocks, it is surprising to me when people still say things like:

"This company has a PE ratio of 25? That's 25 times of their earnings! It is so expensive!"

What they don't realised is that higher quality companies will also enjoy a higher PE ratio.

And if we only stick to buying companies with lower PE ratio, because we thought it is cheap - then we end up buying a lot of poor quality companies.

Look at companies like Facebook, for example.

The PE ratio of FB was never below 12.

But yet, the share price keep increasing over time - because their earnings keep increasing.

And those who still stubbornly believe that, "I will not buy a company unless a PE ratio is below 12," will simply likely only end up investing poor quality companies in their portfolio.

Well then, how would I valuate companies?

I will cover that at the end of this post, for now - let's go to mistake number 8.

8. Selling A Stock Too Early

Remember the watchlist that I was talking about earlier?

When we built this watchlist, or what I call a profitable watchlist - we would have determined the price we want to exit the stock.

However, many people make the mistake of taking early profits instead of enjoying the full ride of the stock.

The reason why they want to take early profits is because they are constantly worried about the stock prices falling.

And this is a mistake that I am guilty of in the past.

I always took my profits early and ended up leaving thousands of dollars on the table.

The lesson learned here?

Have a defined game plan, and be willing to ride it out on quality companies.

Some may not be comfortable waiting on their stocks, which is why they end up selling their shares early.

Instead, what they could do is to execute option strategies to collect decent option premium while waiting for the stock to reach its exit price.

Option strategies are beyond the scope of this blog post, but I will share more at the end of this blog post how you can get discover more about options.

For now, let's go to mistake number 9.

9. Confused Being A Trader and Investor

Some investors think that they are investing, when in reality they were actually trading.

Here are some tell-tale signs that you are actually trading and not investing:

- 1You see your stocks as nothing more than share prices, rather than underlying business that is actually making money

- 2You have no clue how the businesses in your portfolio are actually making its revenue

- 3You have a short term view of your stocks, typically less than a year - sometimes even a month.

- 4You cut your losses, the moment the stock moves against you

- 5You use leveraged as part your strategy to increase your returns (or losses)

Well, here are just some symptoms that you are actually trading rather than investing.

Now, let's be clear about one thing.

I am not suggesting the trading is bad.

Trading and investing are simply two different vehicle to make money from the stock market.

In fact, I had both a investing mentor and trading mentor - and both of them are still multi-millionaires, who made their wealth through the stock market.

The key idea is, when you put on a trade - understand whether you are behaving like a trader or investor.

Because each of them have a different entry and exit plan.

So you need to be very clear, which one are you.

10. The Lack of An Investment Checklist

This is absolutely crucial in your investment journey.

Even if you are a trader - it is crucial that you need to have a checklist to make sure you are doing the right trades.

You can think of having an investment checklist - like having a gatekeeper in your portfolio.

A gatekeeper that is preventing all the poor quality investments from entering your investment portfolio.

For myself, I used a checklist that helps to filter our companies based on their financial numbers.

And for me, that has served me very well in my investment journey.

(If you read to the end of this blog post, you can get a copy of this checklist as well).

When we have our own personal checklist, we are able to make more objective decisions when it comes to investing.

This means that when people tell you things like,

"Buy stock XYZ! They are going to go big!"

You can easily go through your personal checklist and decide whether this is an investment you want in your portfolio.

What's Next For You

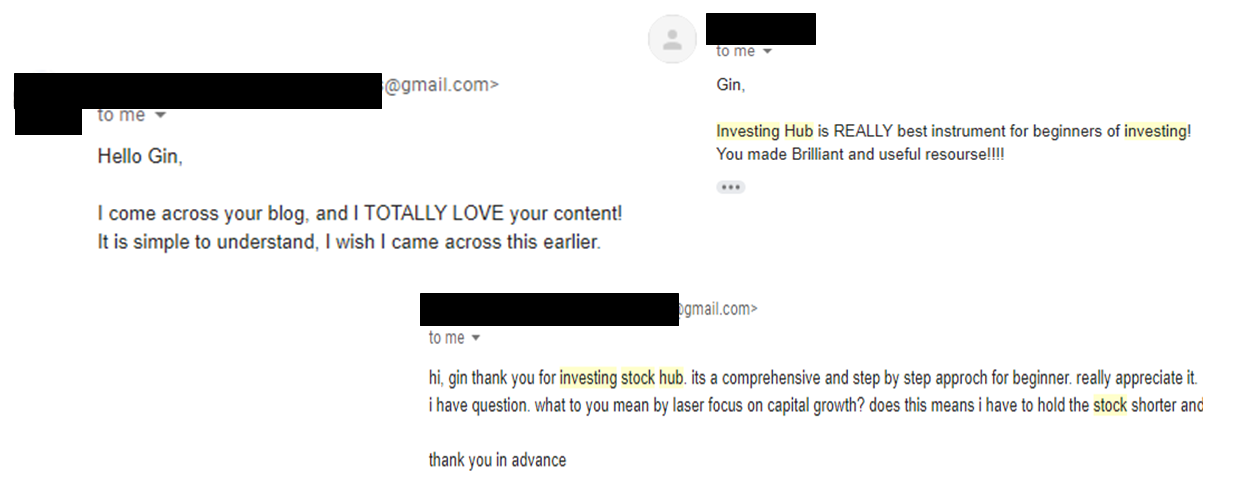

When I write a blog post, I try to think hard on how I can serve my readers to become better investors.

This is why I created this free resource hub, called the Stock Investing Hub.

The Stock Investing Hub

Never get lost in your investments again.

This resource hub was something that I built for my readers because of the lack of organised information out there to help those who are keen in learning investing.

And I decided to spend a few months to build up this resource page and will continue to improve on it as I upgrade myself by learning from other investment experts.

And it warms my heart when my content is able to serve my readers out there.

Also, remember the last mistake - was the lack of having an investment checklist.

So as promised, if you want a copy of my personal investment checklist, you can get it right here:

Get Your 8-Point Checklist!

So that you know what stocks

to avoid investing in.

By getting this checklist, you will automatically be subscribed to our newsletter.

Of course, if you feel that you are not getting value from the weekly newsletter - you are free to unsubscribed at any point of time 🙂

Lastly, if you benefited from this blog post, it will do me great joy if you could share this article with a friend who might need to see this.

Till then, I will see you in our next blog post - or in the newsletter, if you decide to join us.