For anyone who is just starting out in investing, $10,000 seems to first milestone that everyone struggle to hit.

In this blog post, I want to share the strategy of how we can hit our first $10,000 portfolio, starting with a capital of $1,000.

I am going to break down step-by-step, the exact way that I did it in my journey.

Step #1 - Find a strategy that works for small capital

When we are just starting out in investment journey, the one thing that most people struggle with?

A lack of capital.

I know it so well, because I have been there.

Because of which, I had to searched high and low for a strategy.

A strategy that works for people whom were starting out with a small capital like me.

Here's the big "a-ha-" moment.

When you are starting with a small capital, stay away from buying stocks.

"WHAT?! I want to make money from the stock market and you are telling me to stay away from stocks??"

You see, when buying stocks - you need to have a good foundation of how to examine the financials of the company. And even after you selected a fundamentally good stock to buy undervalued, it is going to take time for it to realise its intrinsic value before you take profit.

Here's the bummer.

If you were starting with just $1,000 - even if the stock appreciated 20% in a year, that only represents $1,200.

Note: I am not saying that it is bad to buy stocks - after all, I buy and collect undervalued companies myself too. What I am saying is - when we start off with a small capital, buying stocks alone do not yield meaningful returns.

So what is the strategy that best works for those starting with small capital?

The answer - use options, not stocks.

More specifically, I chose selling vertical option spreads - and this was also how I started as well.

I chose this strategy for three reasons:

- I only need $500 to start an option spread position (regardless of how expensive the stock is)

- I am able to define my expected win-rate before I even place the trade

- I don't need to consider the fundamentals of the companies, meaning there are more trading opportunities.

I cannot emphasize the benefit of having more trading opportunities. Here's why.

I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times. - Bruce Lee

The mastery of a single skill through countless repetitions.

Most people think that the stock market is a gambling den. I agree totally.

However, when selling vertical spreads - it is gambling with an edge. The odds are practically in your favor. And the more you trade, the more you discover pattern to shift the odds further in your favor.

So that's Step 1 - Selling vertical option spreads, an efficient strategy for those starting out with small capital.

Step 2 - Make Your Brokerage Account Your Bank Account

The beauty of gaining mastery over selling vertical spreads is this.

The unbreakable confidence that you will grow your money faster in your brokerage account than in your bank account.

You see, what differentiate those who choose to master the stock market and those who don't is this.

Those who choose not to learn anything about investing, will have to stick to measly returns by leaving money in the bank.

Once you master vertical spreads, you are freed from having to be stuck with the 1 - 2% returns of bank interest rates.

This is also the reason why a large amount of savings are in my brokerage account compared to my bank account.

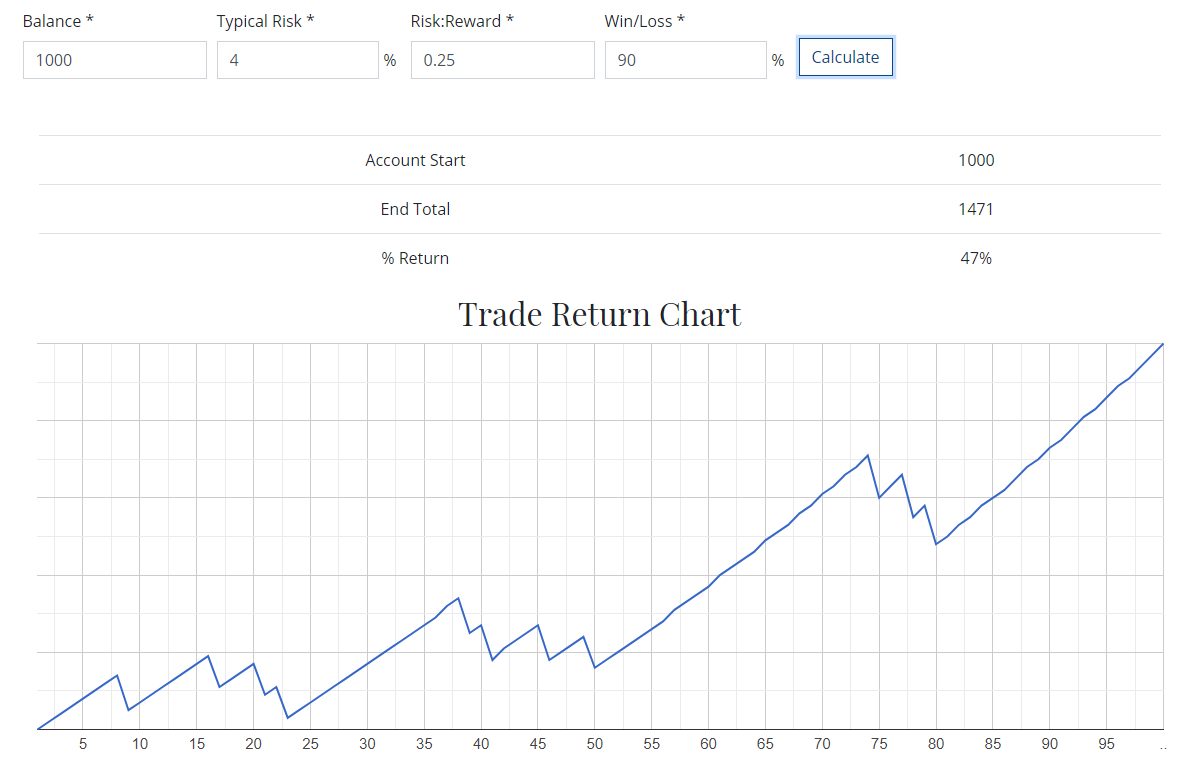

Let's talk about the rules of vertical spreads which I share in the Options Cash Flow Mastery Course:

- Probability of Profit (Mechanical + Statistical): Up to 90%

- Risk-Reward: 0.25

- Risk Per Trade: 2 to 4%

You can actually put the above parameters in a trading simulation website using this calculator:

You can go ahead and try out using the calculator - it is not uncommon to get double digit returns.

With that skill set, why would I settle for the low interest rates in the banks. The only reason why I leave money in the bank is for emergency use - any surplus will be in my brokerage account.

Step 3 - Rinse and Repeat

Imagine the kind of compounding effect we are going to get from these two accelerators:

- Selling vertical options with an edge

- Constant monthly deposit of savings into the brokerage account

It is only a matter of time to reach the first $10,000 in the brokerage account.

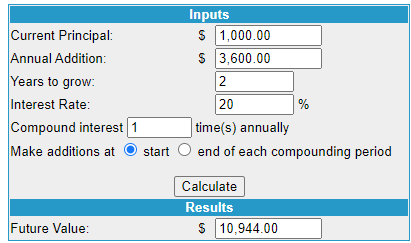

Imagine starting with $1,000, a conservative return of 20% a year and a monthly deposit of $300 into the brokerage account.

It will only take around two years to hit your first $10,000.

And once you reach $10,000 - you can even explore using long call options to compound your portfolio even further. (But that's a topic for another day).

The Bottom Line

I cannot stress further the importance of acquiring the skill set to generate a higher return that banks. This is really what separates those who compound their wealth and those who don't.

For me, when starting with a smaller capital - I started out with selling vertical option spreads and found it to be the most efficient strategy.

If you found this article, make sure to share it with those who might benefit from this sharing.

If You Like This Content, You Might Enjoy This

Become an option seller and discover how to extract cash flow from the stock market even if you are starting with limited capital