In my recent correspondence, an insightful question surfaced regarding options trading:

"I learned about selling call and put options, which is not ideal because it has a possibility of unlimited losses."

This sentiment resonated with my past beliefs, echoing the cautionary notion surrounding the word "possibility." While, in theory, selling call and put options introduces the potential for unlimited risk, this article is to help dissect and demystify these concepts.

First of All, What Are Naked Options

Naked put and call options is a bold (yet simple) strategy within the arsenal of options trading.

When an investor engages in selling a naked put, they essentially commit to acquiring the underlying asset at a predetermined strike price if the option is exercised. On the flip side, selling a naked call entails agreeing to sell the underlying asset at a specified strike price if the option is exercised. The "naked" designation arises from the absence of an offsetting position or ownership of the underlying asset at the initiation of the trade.

Consider this: when you sell a put option with a strike price of $100, you are essentially pledging to purchase 100 shares at $100 each, totaling a substantial $10,000. If you lack the funds to cover this amount, you find yourself selling a naked put. Similarly, when selling a call option, you commit to selling 100 shares at $100 each. If you don't own these 100 shares from the outset, you are venturing into the realm of a naked call option.

Now, one might rightfully exclaim, "Wait, Gin, this sounds extraordinarily risky!"

Indeed, there is an inherent risk in naked options trading. However, amidst the perceived risk lies a unique benefit. Seasoned option sellers often leverage naked options to seize opportunities for premium income and capitalize on market expectations without necessitating a hefty capital outlay. It's a strategy that demands careful consideration and risk management, offering a distinctive approach for those seeking bold maneuvers in the dynamic world of options.

Risk Profile of Naked Options

In the context of naked put options, the theoretical loss hinges on the underlying asset's value plummeting to zero. If the option is exercised, compelling the trader to purchase the asset at the agreed-upon strike price, the theoretical loss materializes. To illustrate, consider the scenario of selling a put option at a strike price of 105 with a premium collection of $145. If the asset's value were to collapse to zero, the trader would be obligated to buy a worthless asset at $105, incurring a theoretical loss of $105 per share minus the $145 premium collected, resulting in a potential loss of $10,355 for 100 shares.

Risk profile of Sell Put - Max loss when share price goes to zero

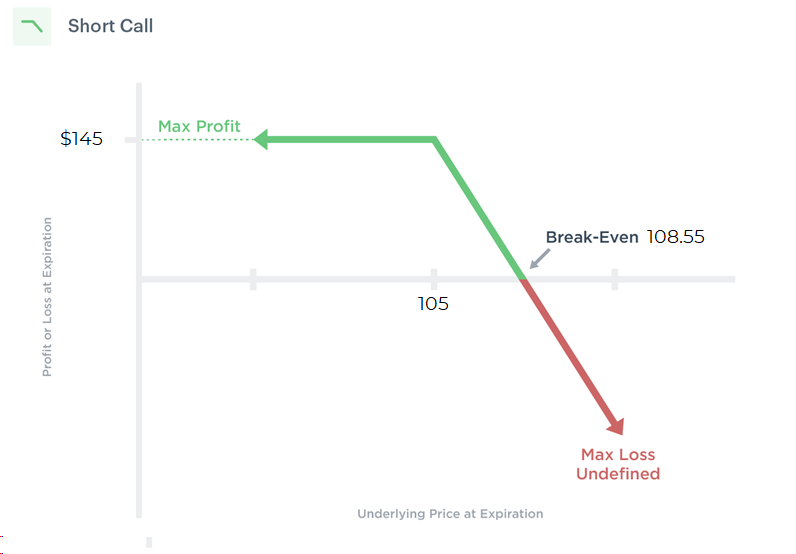

Naked call options, on the other hand, harbor a distinct risk profile characterized by theoretically unlimited losses. When an investor sells a naked call option, they commit to selling an underlying asset at a predetermined strike price if the option is exercised. To exemplify, envision selling a call option at a strike price of 105, collecting a premium of $145. If the asset's value were to skyrocket, say, to $200, the trader would be obligated to sell the asset at the agreed-upon strike price of $105 - representing a loss of $9,355 (after deducting premium collected) . Unlike put options, call options lack a maximum capped value, allowing the underlying asset's price to surge indefinitely - incurring a theoretically unlimited loss.

Risk profile of Sell Call - Max loss when share price goes to infinity

The inherent risk of naked options underscores the paramount importance of implementing rigorous risk management strategies when venturing into the intricate landscape of naked options trading.

However, let's dive a bit deeper.

Are Naked Options Actually Risky?

Absolutely, "theoretically," engaging in the sale of naked options carries inherent risks and the potential for substantial losses.

However, it's crucial to recognize that in our daily lives, we encounter various risks, from the mundane, like the possibility of choking on a fishball during a meal, to the extraordinary, such as the prospect of a plane crash while flying or an accident while crossing the road.

Despite these perceived risks, we continue with our daily activities. Why?

Because, fundamentally, risks can be managed and mitigated through careful consideration and strategic planning. The key lies in understanding, assessing, and implementing effective risk control measures to navigate the uncertainties associated with various aspects of life, including financial endeavors like options trading.

Let's look into three ways we can mitigate our risks when it comes to selling naked options.

#1 Examine The Possibility

Huge losses on naked call and put options tend to materialize during significant price movements in the underlying stocks, often coinciding with earnings seasons.

During earnings seasons, share prices often experience heightened volatility due to the release of companies' quarterly financial results. The discrepancy between market expectations and actual results, coupled with forward guidance, triggers rapid adjustments in stock prices. Increased trading activity, speculative behavior, and options activity further contribute to the amplified volatility.

Hence, one of my steadfast rules is to avoid holding a sell option trade through earnings unless one buys a "term insurance" to protect oneself. By making the decision not to hold your option trades through earnings, the potential for incurring substantial losses is significantly reduced.

The term insurance strategy is simply a buy option position to protect the downside from the potential whipsaw of share price during earnings.

#2 Protected By Strike Price

An essential concept in mitigating risk is the "sell strike price."

For a call option, if the share price does not increase beyond the sell strike price - I am still very likely to make money. For example, when I sell a call option at a strike price of 80, as long as the share price does not go above $80, I still have a good chance of making money.

For a put option, if the share price does not decrease below the sell strike price, the same as well. For example, if I sell a put option at a strike price of 50, I have a good chance of making money as long as the share price does not fall below $50.

For those who have access to the Options Cheatsheet, you would know that I exploit three golden rules to ensure that the sell strike price that I have selected provides a high win rate of more than 80%. This is what helps me to remain sane when I sell naked options.

#3 Protected By Portfolio Sizing

The additional layer of protection in selling naked put and call options lies in portfolio sizing. Before initiating a new option trade, ensuring a minimum of 50% option buying power remains available allows for fluctuations in option buying power for naked options. Note that option buying power remains stable for vertical spreads. This strategic approach significantly reduces the risk of encountering a margin call, thereby demystifying the concept of "unlimited risk."

By adhering to these three layers of risk management, the seemingly daunting notion of "unlimited risk" gradually loses its intimidating aura, providing a structured and informed approach to navigating the complex landscape of selling naked options.

The Bottom Line

The crux of the matter is this — each of us must discover the strategies that align with our preferences. While some may lean towards vertical spreads for their lower option buying power and limited risk, others might be inclined towards naked puts and calls, enticed by their higher probability of winning. If you have further queries about selling options, feel free to email me. I'm more than willing to address your questions through blog posts like these, sharing my perspective and insights.

If You Like This Content, You Might Like This

"The Options Cash Flow Cheat sheet" to help options traders achieve high win rate and consistent cash flow

(and more other instant bonuses inside)