Warren Buffett once famously revealed his rules for investing success:

Rule No.1 - Never lose money. Rule No.2 - Never forget rule No.1

If you are not sure what the term "Assassin" is...

...it is from a book called the "The Art of Execution" by Lee Freeman-Shor.

Till date, I find that this has been the best book on the stock market, as it deals with a lot of practical mindset you can adopt to be successful in the stock market.

Here's a reflection on one of my favorite chapters in the book.

Never Lose Money

The "Assassins" are my people that I have the utmost respect for.

And they are the kind of people I desire to be.

When it comes to selling losing positions to preserve capital they were ruthless, like cold hearted hitmen, pulling the trigger without emotion. Then they carried on with their lives like nothing has happened.

This is no simple feat.

I reflect on this - and I realised why.

By selling and cutting your losses, most people see it as admitting that they were wrong.

And trust me - most people are egoistic and never want to say that they are in the wrong. They hold onto the positions, and use the hope-and-pray method that they are right.

However, let's change that mindset and akin it to muscle building.

In order for us to build muscle, the muscle first has to break down and we will start to feel our muscle sore. Eventually, when the muscle recovers - it becomes stronger than it was before.

The same applies to our portfolio.

In order for our portfolio to grow, you know fully well that there will be inevitable losses. These are natural retracements on our portfolios.

Why Losses Must Be Taken

It is human psychology that whenever we take a loss, we find it very hard to switch off. Many times, we will tend to check how a stock is performing after we have cut our losses.

However, all these psychology is very well understood by the Assassins.

They have reframe it.

They know that all drawdowns left to their own devices are ultimately what destroys wealth.

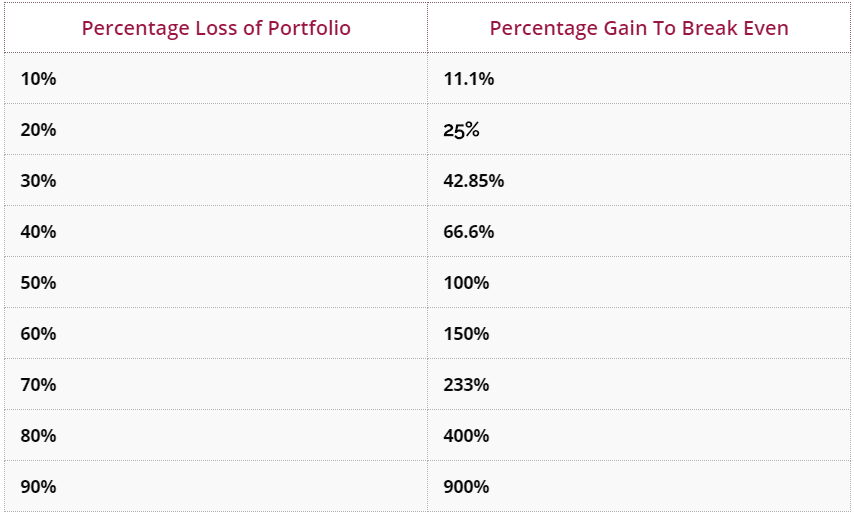

The mathematics behind it makes perfect sense. Take a look at the table below.

There was a story about the hedge fund legend, George Soros:

"He is the best loss taker I have seen. He doesn't care whether he wins or loses on a trade. If a trade doesn't work, he is confident enough about his ability to win on other trades that he can easily walk away from the position"

Despite what you might imagine, in reality we can all be as cold and ruthless as the Assassins.

What I liked about the Assassins was that they lived by a pair of sacred rules. The rules were derived from their own experience and beliefs, and the key to their success was that when they were losing they would always let the rules, not their emotions or feelings, drive their decisions.

They knew that when faced with the uncertainty that naturally follows when the market has turned against them, they could not rely on themselves to do the right thing.

They therefore committed to becoming slaves to the rules. When a loss occurred they would follow their commandments to the letter.

They planned well in advance; before they invested, they knew what they would do afterwards. They did this because they knew that when push came to shove they were likely to make poor decisions in a ‘hot’ (or emotionally charged) state of mind.

As the old saying from Sun Tzu goes, “battles are won [or lost] before they are fought.”

The Bottom Line

Be like a Assassin.

Formulate your trade management rules. Stick to them, and review them periodically based on a collective analysis of your trades.

Capital preservation is the key to ensuring that your wealth does not get robbed away from you.

If You Like This Content, You Might Enjoy This

Become an option seller and discover how to extract cash flow from the stock market even if you are starting with limited capital