Over the course of selling options, I made it a practice to review both my winning and losing trades.

"Do more of what works, and do less of what doesn't work - eventually, you will just get better and better".

It becomes natural to realise patterns of what are the kind of option trades that have high probability of taking profits.

Tip #1: Sell Only At Favorable Stochastics

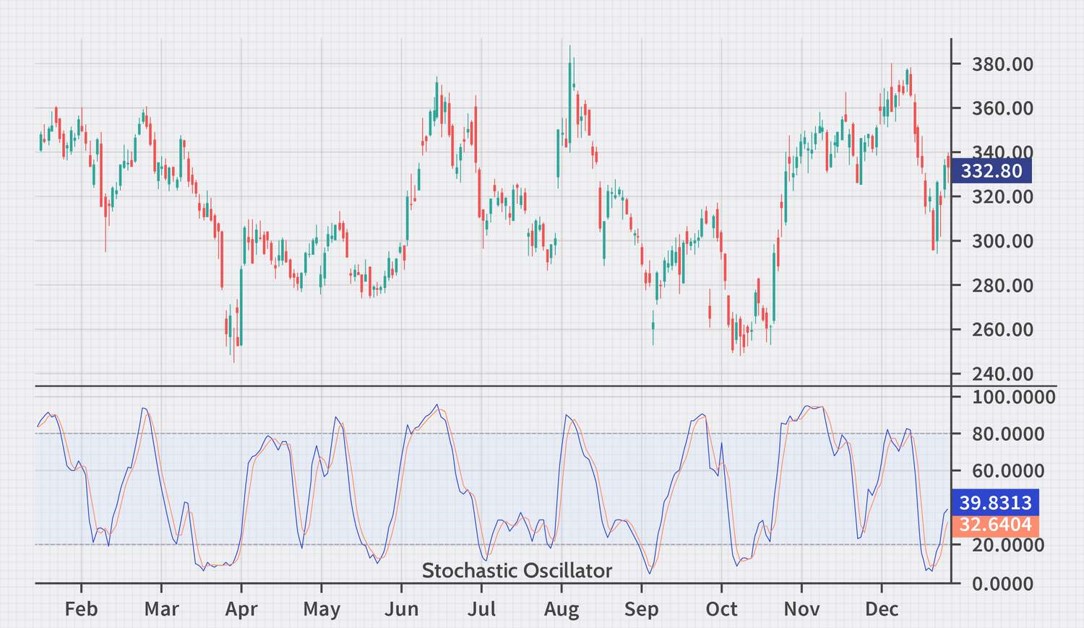

The Stochastics Oscillator is one of the most common indicators which I used to determine the probability of key turning points of stock prices. Let's take a look at the stock chart below.

Stock chart prices with Stochastics

Stochastics have a (1) overbought region and (2) oversold region.

When it hits the overbought region, the stock price tends to retrace. Similarly, for the oversold region, it sends to bounce back.

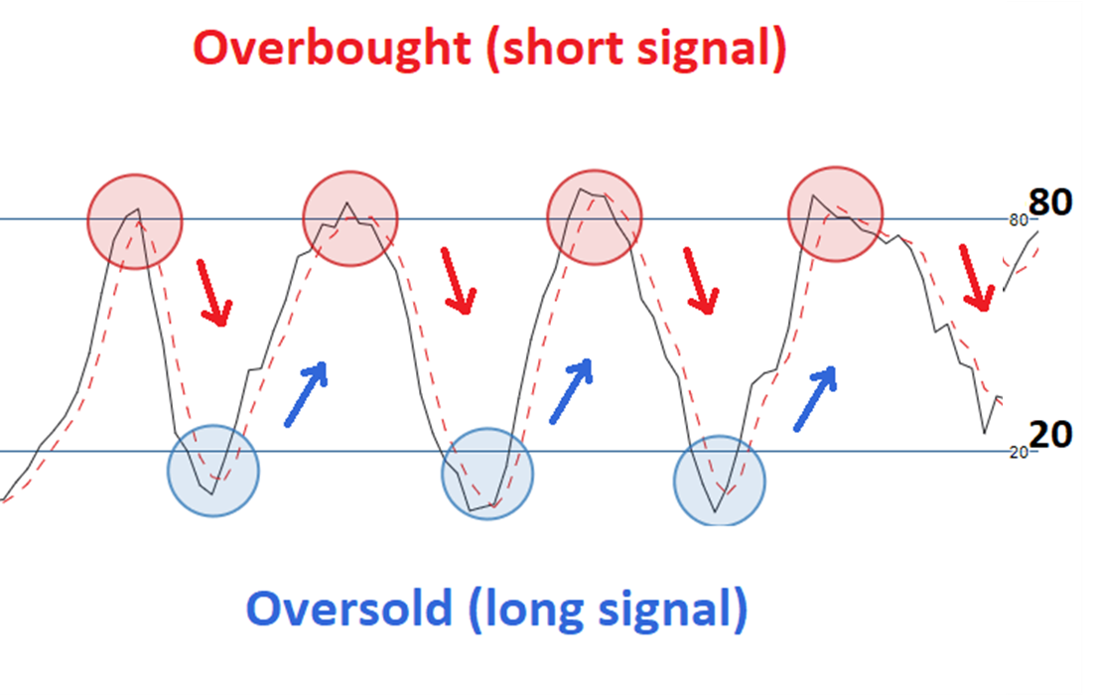

So when you mapped out the the stock prices to the overbought and oversold regions, you can see this correlation clearly.

Relationship between stock prices and Stochastics (click to enlarge)

As you can see, when the stochastics oscillator hit the oversold region, the price tend to bounce back up (and vice versa).

Note: I am not suggesting that this is a 100% foolproof and you should sell your house, your children and your dog to go bullish whenever the stochastics is oversold.

What I am trying to illustrate here is - it would be foolish not to have stochastics as part of your consideration when planning of high probability option trades.

Key Points:

- I only sell a Put or a Bull Put Spread when stochastics is oversold

- I only sell a Call or Bear Call Spread when stochastics is overbought.

Tip #2: Only Enter With Your Strike Price Protected By Support / Resistance.

The idea to only enter a position where your strike price will be "protected" by key pivotal points such as support and resistance is not uncommon. In fact, this is tip is so powerful, it is common sense to abide to it.

However, common sense is often not common practice. At times, we may be so anxious to enter a trade that we choose to enter a position even though it is not at pivotal points yet.

For example, when I choose to sell a Call Option - I will choose to a strike price where it is above resistance levels. This is so that the prices tend to get "blocked" before it even touches the strike price!

Remember, the key to selling options - is all about protecting the strike price.

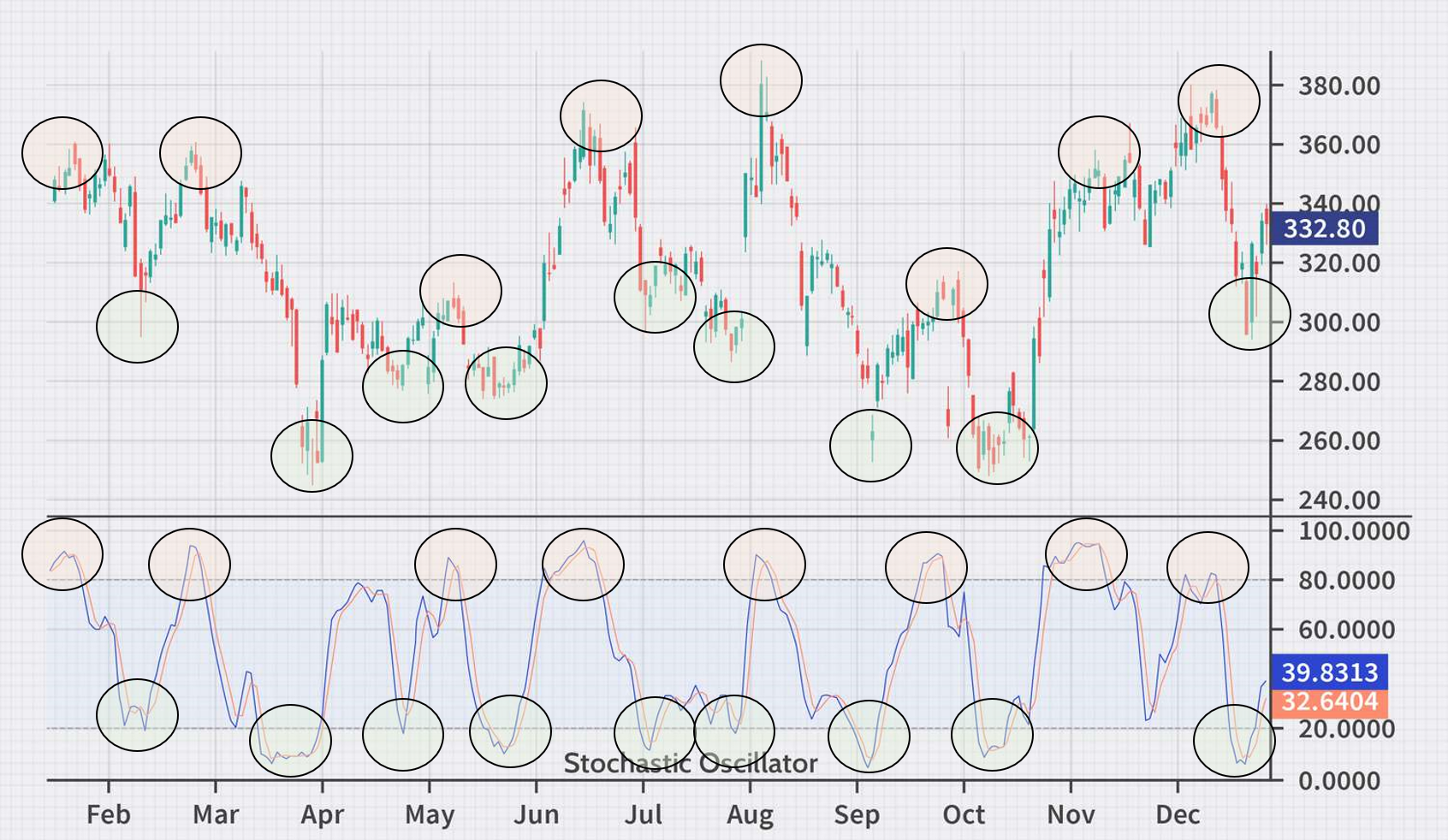

Example of Resistance Levels of Stock Prices

Always make a habit to plot out your support and resistance levels before entering any trade!

Example of Plotting of Support and Resistance Levels

Key Points:

- I only sell a Put Option with strike price below support levels

- I only sell a Call Option with strike price above resistance levels

Tip #3: Optimize Your Probability of Profit To > 75%

Did you know that when selling options, we are able to define our statistical win rate even before we enter the position?

Well, this is called Delta (which is used to estimate your "Probability Out-of-The-Money" or "POTM" for short).

A Delta of 0.25, represents a POTM of 75%.

When we are options sellers, it is beneficial to us if the options expires worthless. POTM represents the probability the underlying expires above a put’s strike price or below a call’s strike price (i.e. making a profit).

Before, we even start selling at options, we can already choose the Delta that we determine.

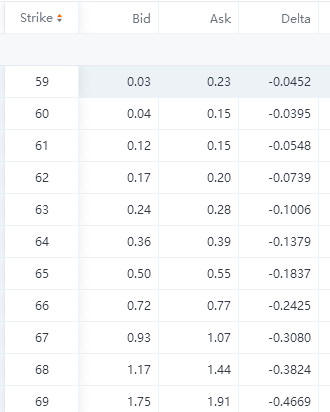

Example of Delta in Option Chain (Ignore the negative sign)

From the above image, you can see the Delta column which can be used to estimate the POTM. <you can ignore the negative sign of the Delta>

Typically, I will look at a Delta of <0.25 (i.e. 75% POTM) for vertical spreads.

Some of you might ask, "Gin, why don't I just go for the lower Delta like 0.10 (i.e. 90% POTM)?"

Well, the answer is because, the higher the POTM, the lesser the profit. We need to strike a balance between probability of profit and amount of profit - hence I decided to go with 75%.

Key Points:

- I only sell options with a Delta 0.25 or lower.

Tip #4: Take Profits at 50% Levels

Whenever we sell an option, we collect cash upfront.

The idea of selling an options is to - sell high and buy low.

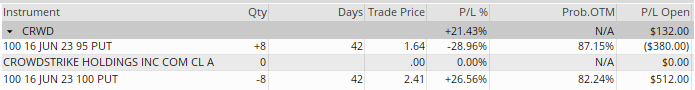

Take the example below where I sold a BPS on CRWD strike:

- Sold a put option and collected $241

- Buy a put option and paid $164

So net net, I am collecting $77 per option.

Note that if the option expires worthless, I am collecting a total of $77 per option contract.

However, I usually do not wait till option expiry - this is because, the longer you wait, there is always a chance the stock price can reverse on you and you end up returning your profits.

I take my profits at 50% levels, then take these profits to reinvest into the next high probability trade. Rinse and repeat.

Therefore, in this example, I will close the trade - once I have collected $33.50 per trade.

Key Points:

- I take profits when the options P/L is at 50% levels.

- Rinse and repeat. Pour these profits into the next high probability trades.

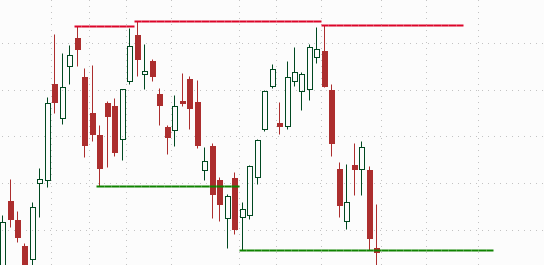

Tip #5: Don't Take Your Trades Through Earnings

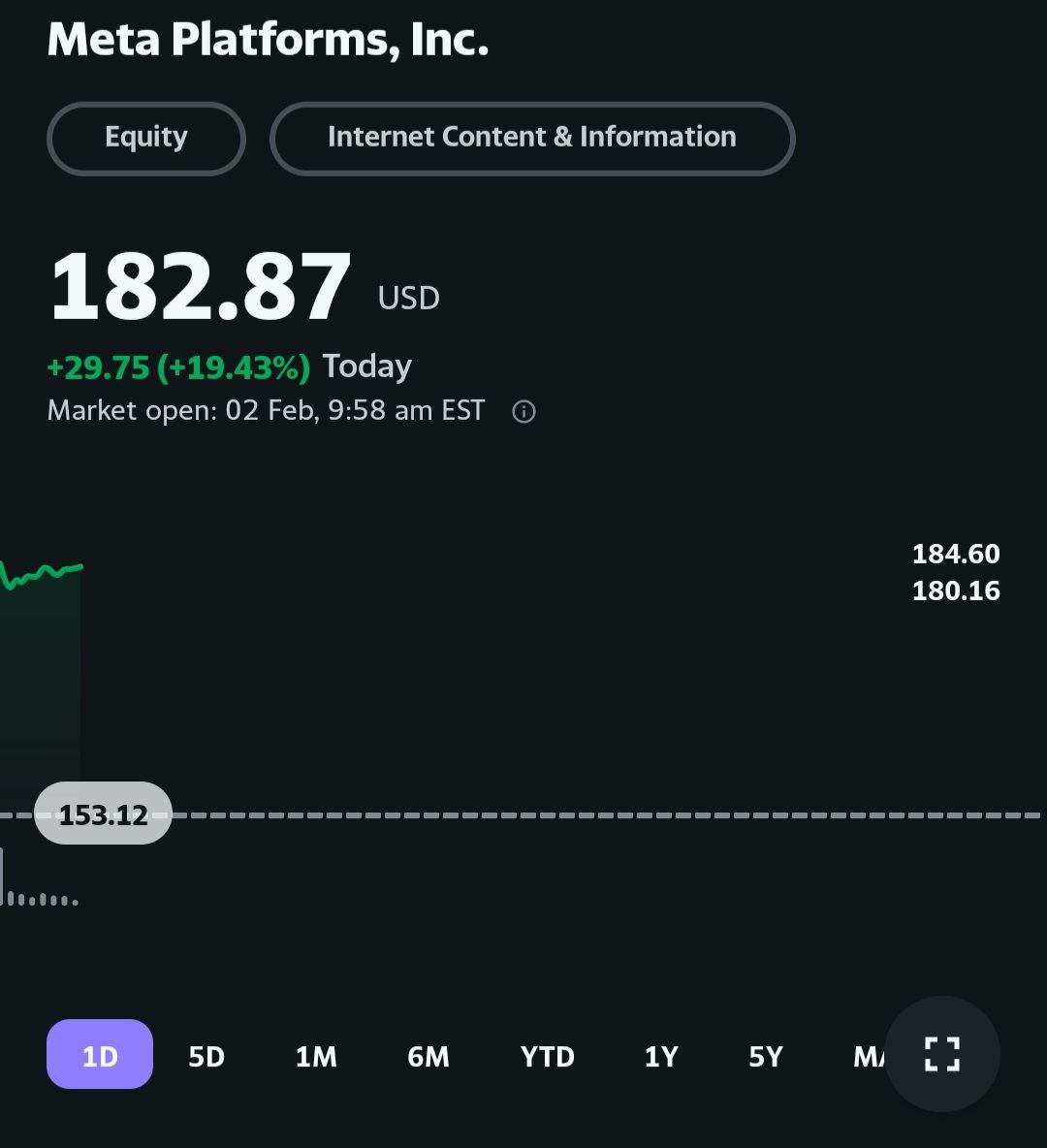

When selling options, the worst thing that can happen its a sudden change in stock price.

For example, imagine if you sold a call option and the price suddenly shoots up. Ouch.

Spike in META share price

This is why I never want to hold my vertical spreads through earnings - the risk is simply far too high compared to the rewards.

This is also the reason why I tend to sell lesser vertical spreads when nearing earnings seasons as well.

If You Like This Content, You Might Enjoy This

Become an option seller and discover how to extract cash flow from the stock market even if you are starting with limited capital