The Power Of Entering Tranches

Stock Investing Hub ⮞ Designing A Portfolio ⮞ The Power Of Entering Tranches

3 RESOURCES

⮞ Introduction

⮞ The Power Of Portfolio Diversification

⮞ The Power Of Entering Tranches

The Power Of Entering Tranches

Most investors, when they see a drop in share price - they tend to panic and thinking about selling.

Now, that does not make sense, especially when you already done your research and know that it has passed your investment checklist and that you are buying the stock at a reasonable valuation.

Let me give you a scenario.

Let's say, I went absolutely crazy, and I decided to start selling $100 notes for $50.

Will you buy my $100 notes?

The answer is probably "yes" - because you will make $50 every time you buy a $100 note from me.

And then one fine day - I decided to sell my $100 notes for $10 instead.

What would you say to me...

"Omg, GIN! It was selling at $50 previously! Now that it dropped to $10, it is not worth buying anymore!"

Do you think you will say that to me?

IT IS STILL WORTH $100!

When it dropped to $10, you would buy more, right?!

Its a simple concept, but when it comes to investing, most people throw logic out of the window.

Why Drop In Share Price Are Good?

This is the reason why whenever there is a drop in share price, or when I see a sea of red like this...

...it honestly gets me excited.

Even if I am already vested in these companies.

Why? Because it gives me a chance to accumulate more "$100 notes" at a much cheaper price.

However, the only way you are able to accumulate more shares when the prices drop - is when there are spare cash in your brokerage account.

This is why I always enter in tranches - so that I have surplus cash to invest in these businesses.

The Power Of Entering In Tranches

The main advantage of entering in tranches is to collect shares at a cheaper price.

In fact, this is one of the reasons why I was able to turn many of my "losing" stocks quickly into winners.

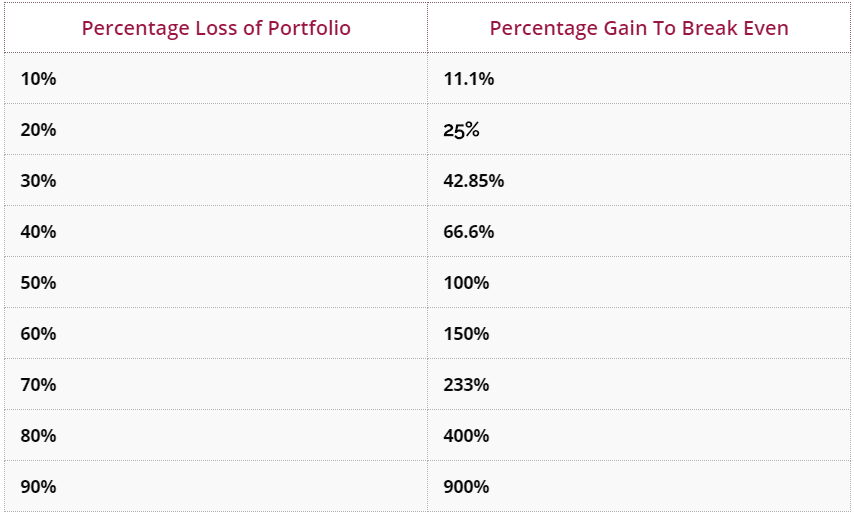

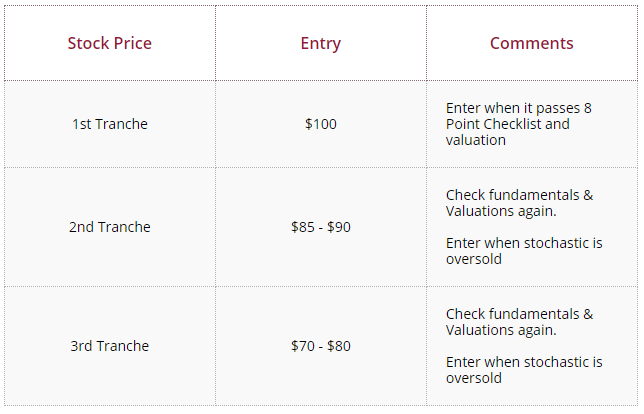

The biggest reason why entering in tranches is so important lies in this table.

If you bought a stock and it fell by 50% - you need the stock to gain 100% just for you to break even.

Not sure, what it means? Well, here's an example.

So let's say you bought 300 shares at $10 each.

If the stock fell to $5 - the stock has to increase by $5 to reach back the original $10 for you to break even on your investment.

This means the stock has to increase by 100%.

However, here is where the power of entering in tranches comes in.

When the stock fell to $5 - you buy another 600 shares, therefore committing another $3,000.

This changes your average purchase price - also known as your break even price.

Your break even price changes to ($6000 ÷ 900 shares) = $6.67 per share.

Now, let's take a look at how much the stock has to increase for you to break even?

In order for the stock to go up from $5 to $6.67, it will only need to increase by $1.67 - that's a mere increase of 33.4%.

A much more realistic increase in share price compared to the 100% previously.

The Common Problem

One of the most common problem that people face is that they don't have the courage to add more to a stock that have fallen in share price.

This is why I started this example with the $100 notes story.

When you have done your proper research with the 8-point checklist, and you have already determine the proper valuation of the stock - it gives you courage and conviction to add more to your positions.

Most importantly, when you have a long-term view, you will be rewarded in the stock market as long as you are holding quality businesses, and you bought them at a reasonable valuation.

Besides that - remember our previous section on "The Power Of Portfolio Diversification", even if you have some of your stock picks completely wrong - as long as you diversify your portfolio, you will still make money overall.

I hope that gives you some assurance in entering tranches, next, let's determine how do I actually enter in tranches.

How To Enter In Tranches

In the previous section, "The Power Of Portfolio Diversification", we talked briefly about entering in tranches.

However, we have yet to talked about how to enter in tranches.

Remember that when buying stocks, I will always enter in three tranches.

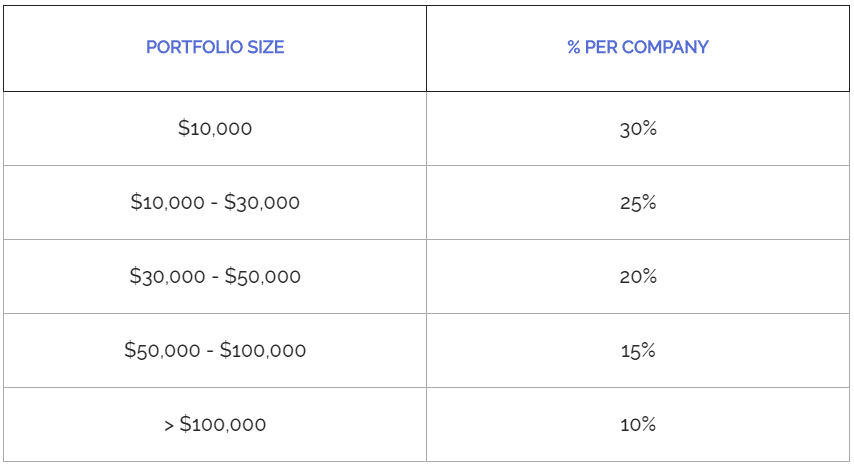

So let's say if I had a portfolio of $10,000 - I would only invest the maximum of 30% in a company, which is $3000.

(or if you want to be more precise to keep it at 33%, it would be $3,333.)

However, I do not invest the $3,000 straightaway when the stock hits my entry price.

I would invest only 1/3 of my allocated amount - which is $1,000.

Now, the question is when do I enter my subsequent tranches?

I would start to look for an entry point whenever the stocks fall between 10% to 15%.

Before you enter your subsequent tranches - you want to check the fundamentals of your stocks as well as the valuation again.

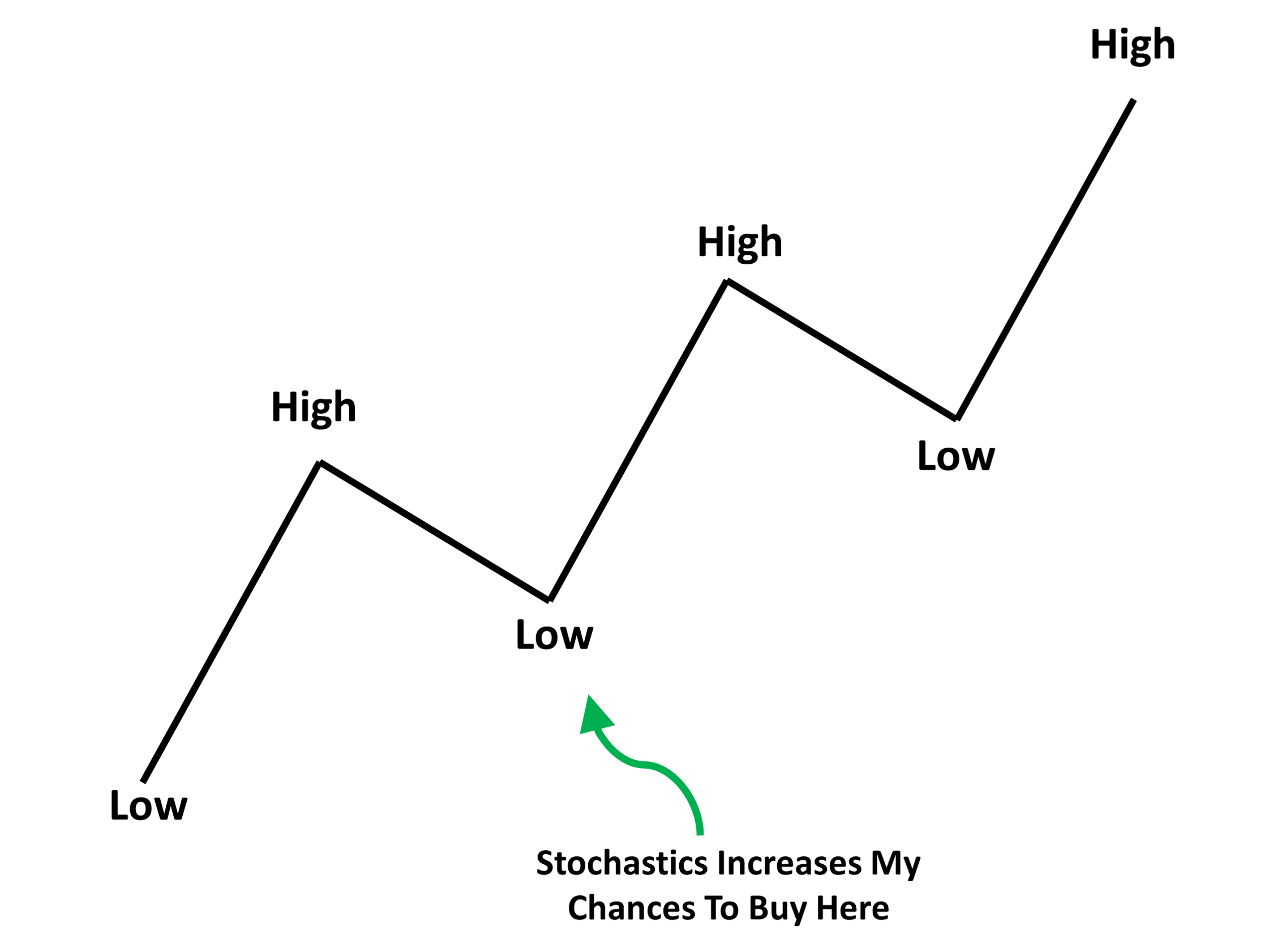

The next thing is to optimise your entry - which is to enter when the stochastic is oversold.

What does that mean?

The stochastic is a technical indicator that tells us whether the stock is overbought or oversold.

And as with all technical indicators, it only serves as a guideline to make our investing decisions.

When we buy the stocks when it is oversold, it increases the chance of us buying the dip of a trend.

Now that we have went through the power of having a portfolio, the next step is to understand when you should sell a stock.