The Margin Of Safety

Stock Investing Hub ⮞ Stock Valuation ⮞ The Margin Of Safety

5 RESOURCES

⮞ Introduction

⮞ Share Price Don’t Matter. Look At This Instead.

⮞ Why Valuations Are Important

⮞ How To Valuate Companies?

⮞ The Margin of Safety

The Margin Of Safety

After you find the intrinsic value, it does not mean that you invest in the company right away.

Why?

Because Warren Buffett, once said, the three most important words in investing - "Margin of Safety".

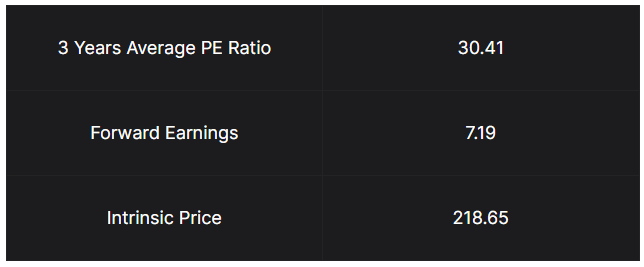

You can see that from our previous example - we found Facebook's intrinsic price to be $218.65.

After finding the intrinsic value - we need to find the entry price, in other words, the price we want to pay for the stock.

That is by adding the margin of safety.

"But Gin, how much of a margin of safety should we add?"

Well, it depends on the 8 Point Checklist.

We went through previously in detail in the "8 Financial Numbers To Look Out For When Investing" on how to find each of the financial ratio and to calculate the checklist score.

Remember the following table?

Financial Ratios | Criteria | Score |

|---|---|---|

Earnings Trend* |

Increasing | 1 |

Net Margin | > 15% | 1 |

Debt To Equity* & Interest Coverage* | Refer to "8 Financial Ratios" | 1 |

Return on Equity | > 15% | 1 |

Quality of Earnings | > 0.8 | 1 |

CAPEX/OCF | < 0.5 | 1 |

Free Cash Flow | Must be Positive | 1 |

Total Score | 7 |

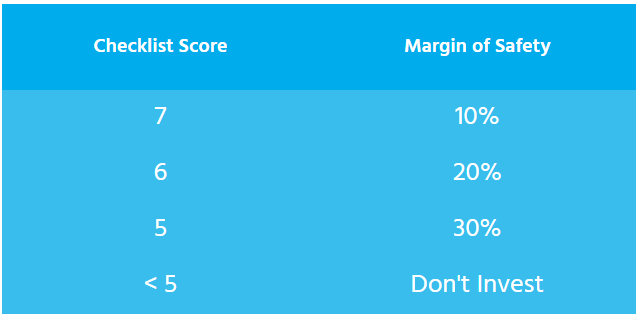

The checklist gives a maximum score of 7, and we will not invest in a company with a score of less than 5.

The 8 Point Checklist serves another purpose - which helps determine the margin of safety based on the score.

Remember to check out "8 Financial Numbers To Look Out For When Investing" to determine the margin of safety.

So in this case, because FB has a checklist score of 7 - the margin of safety is 10%.

This means the entry price is $218.65 X 90% = $196.79.

This means that when Facebook reaches $196.79 or lower, I will start buying the shares.

And this completes the chapter on valuating companies.

You should now know how to quality companies and also to valuate them and understanding what is a reasonable price to pay for a company.

However, we have yet to answer one more question.

After finding an undervalued quality company, how many stocks should we actually buy? Well, this brings us to the next topic, "Designing A Portfolio".