Pros & Cons Of Selling Put Options

Options Investing Hub ⮞ Selling Put Options ⮞ Pros & Cons Of Selling Put Options

6 RESOURCES

⮞ Introduction

⮞ Pros & Cons Of Sell Put

⮞ What Stocks To Sell Put Options

⮞ Entry Rules Of Selling Put

⮞ Strike Price & Expiry Date Selection

⮞ What To Do If Sell Put is Exercised

Pros & Cons of Selling Put Options

After reading through the introduction and completing the quiz, you now have a better understanding of what selling a put option means.

I briefly explained that the advantage of selling put options is it allows us to collect option premium while waiting for the stock to reach our entry price.

However, let us dive a little further to truly understand what it means.

Pros of Selling Put

Remember that stocks can move in three directions:

- Up

- Sideways

- Down

Previously, when we buy a call option, the only way for us to profit from our position is for the stock to go up.

However, when we sell a put option - all three directions are actually favorable.

Yes - all three directions! (But only if you do it the right way)

Surprised? Well, here's a breakdown.

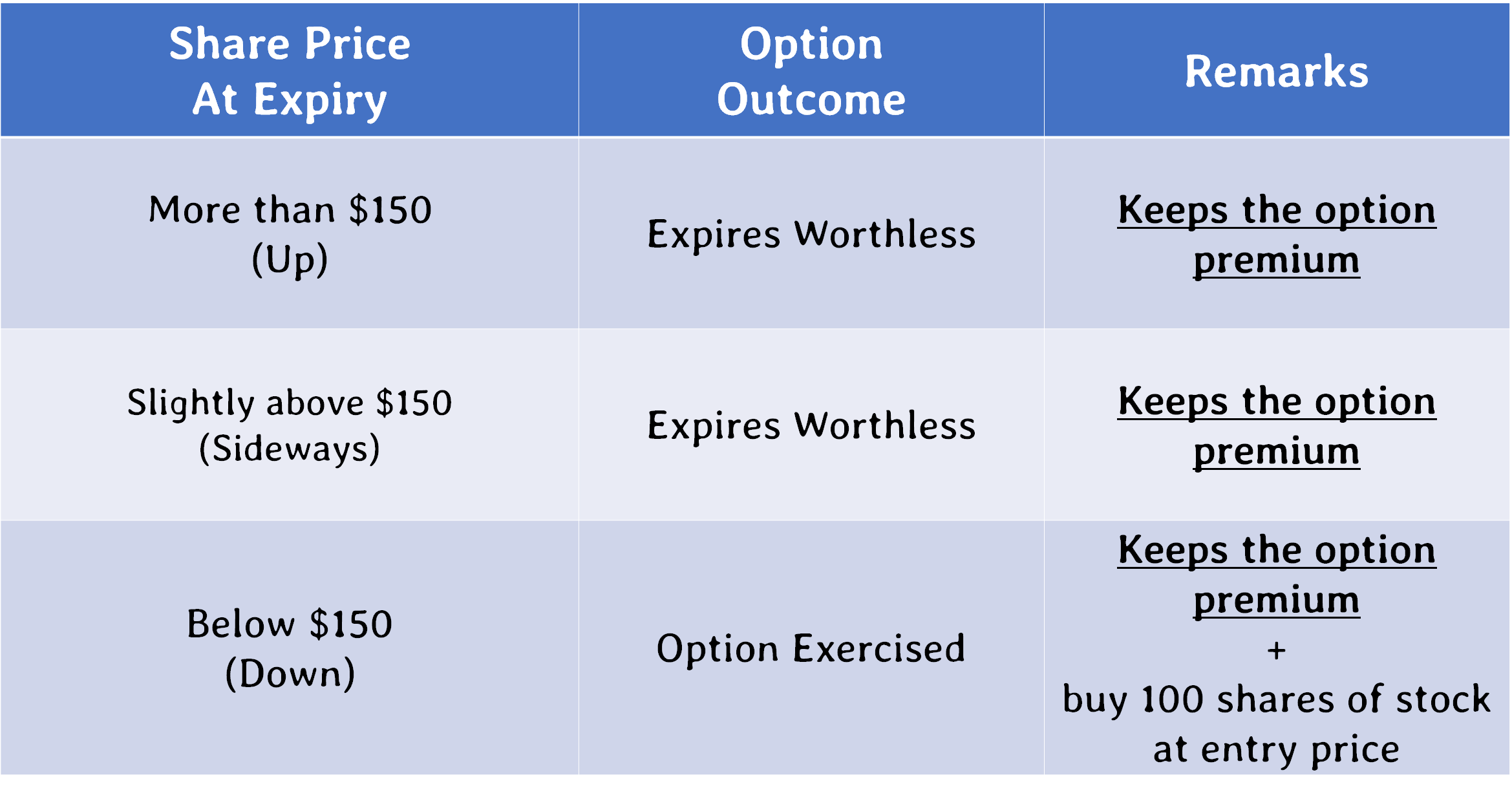

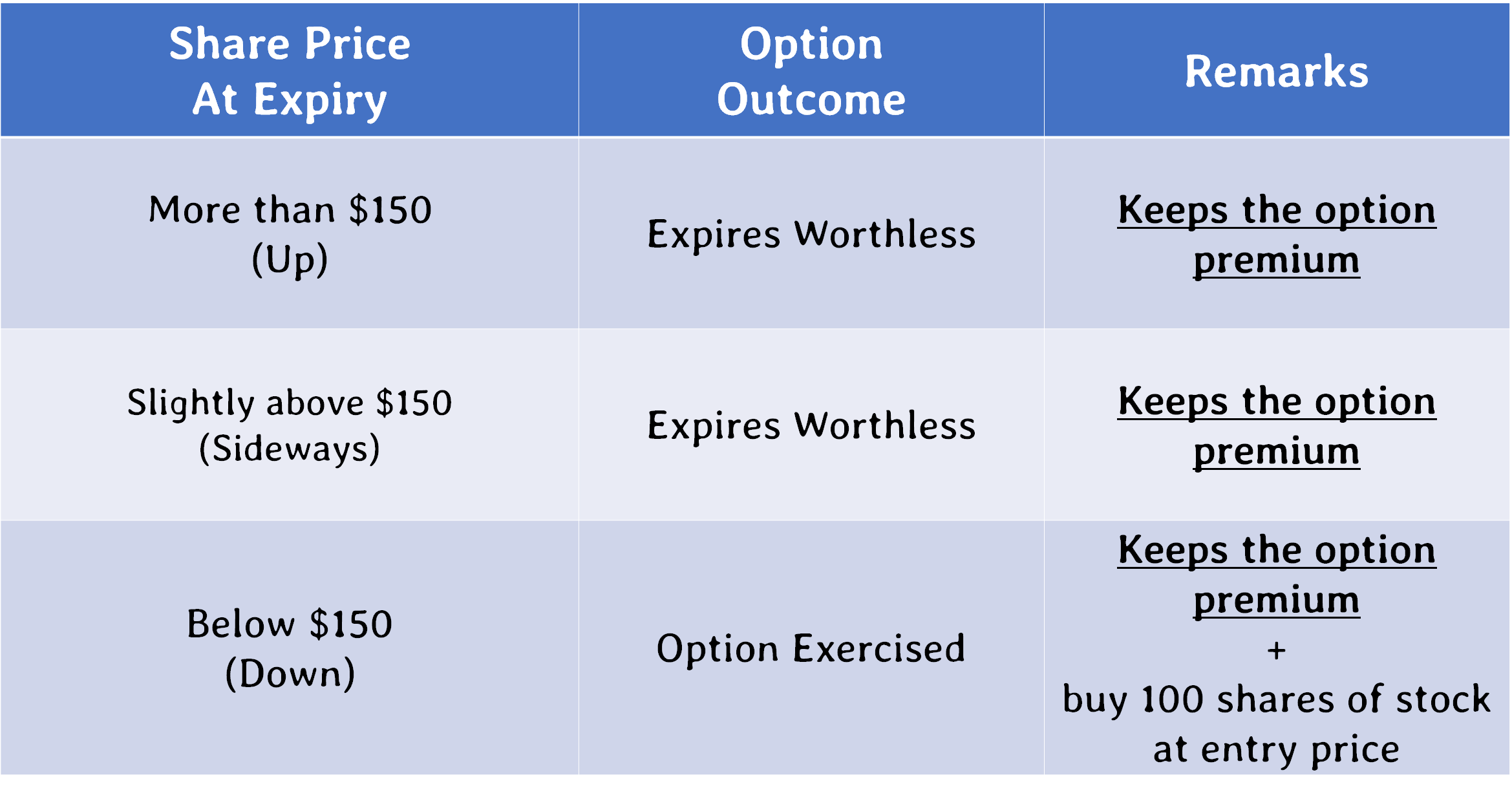

Let's say I sold a put option at 150, there are two possible scenarios.

- If the stock is above 150, the option expires worthless

- If the stock is below 150, the option get exercised

It is important to remember that you keep the option premium in all three scenarios.

It is just that when the option gets exercised, the option premium is used to offset your purchase of 100 shares. Here's an example.

Example 1:

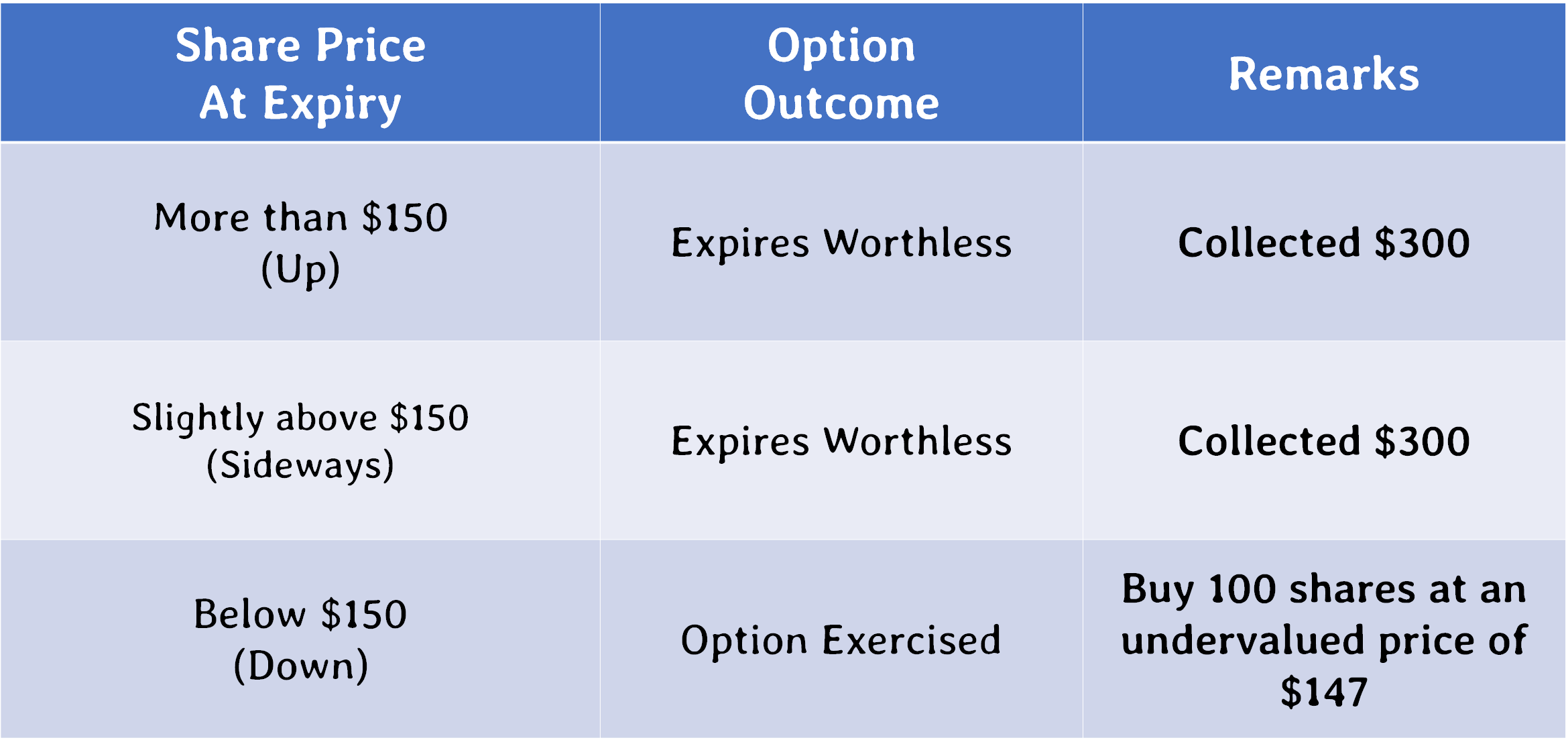

Stock XYZ was at $170. Gin decides to sell a 150 put option on stock XYZ, and collected $300 in option premium. The put option later got exercised, and he had to buy 100 shares at $150 each. What is his average purchase price of the stock?

a) $150

b) $147

c) $153

Ans: The answer is b. When the put option gets exercised, he had to pay $15,000 to buy 100 shares at $150 each. However, because he collected $300 in option premium previously, he only had to top up the remaining $14,700 for the 100 shares.

This means that his average cost per share is $14,700 / 100 = $147.

Now you might be thinking, "Okay, but why is it favorable for the option to get exercised and you end up buying 100 shares...?"

The answer lies in choosing the right stock and strike price.

You see, if we know that stock XYZ is a quality stock, and we calculated our exit price for the stock to be $246 - then we wouldn't mind buying the shares at $147, right?

So here's how the table look like:

The whole idea is to sell put options on only quality stocks and at prices we don't mind owning at.

If my exit price for stock XYZ was at $246 - would I mind buying the stock at a cost price of $147?

Well, of course I wouldn't!

The trouble is that most investors are actually afraid to have their put options exercised, because it means that they have to commit cash to buy the stock.

Usually, the reason they are afraid is because they are selling put options on stocks that they are NOT even intending to own, which is why they always panicked when their option are going to be exercised.

This is why going through the Stock Investing Hub is so important - so that you know what is considered a quality stock and to know how to valuate a stock.

Fun Fact: In fact, I LOVE it when my put option gets exercised!

Because when a put option gets exercised, I get to own undervalued shares and will make a bigger profit when the stock appreciates to my exit price.

Cons of Selling Put

Now, let's discuss the limitations of selling put options.

Let's say stock ABC was at a share price of $160 on 15 Jun 2020.

I decide to sell a put option at $150 that expires on 15 Jul 2020. In return, I collected a premium of $300.

On the date of expiry, the share price was at $170.

This means the share price is above the strike price, and referring to this table.

So it is all good right?

You get to keep the $300 in option premium.

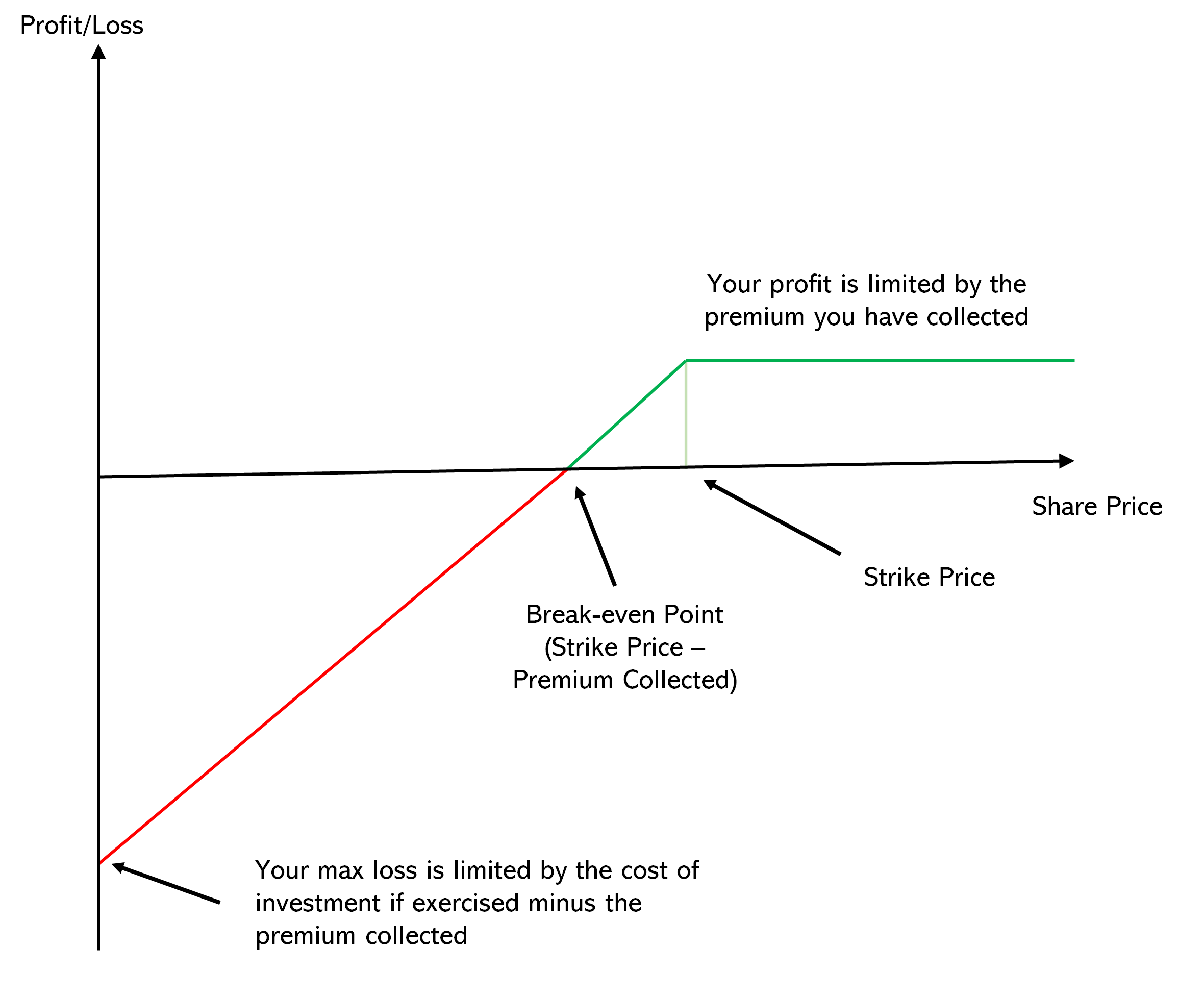

However, here's the downside of selling put option - your maximum profit is limited to $300.

Remember the risk profile graph for selling put options?

This means that even if the share price shot up to $200 - you would still only profit $300.

Imagine what would happen if you bought a call option when the share price was at $160 and it shot up to $200. It would easily been an ROI of more than 60% on your call options.

So here's the downside of selling put option, the amount of profit you make is limited.

Let's practice this with an example.

Example 2a:

Stock XYZ was at $250. Gin sold a put option at a strike price of $200 because he calculated the entry price of XYZ to be $200. In return, he collected $100 in option premium.

At the end of expiry, stock XYZ increased to $280. What was Gin's realised profits?

a) $200

b) $3000

c) $100

Ans: The answer is c. Remember that when you sell a put option, the profit is limited by the amount of premium you collected. So in this case, it would be $100.

Example 2b:

Stock DEF was at $120. Gin sold a put option at a strike price of $90 because he calculated the entry price of DEF to be $90. In return, he collected $60 in option premium.

At the end of expiry, stock DEF fell to $85. The option was exercised, and Gin now holds 100 shares of DEF at $90 each. What was Gin's realised profit/loss?

a) $440 loss

b) $500 loss

c) $60 gain

Ans: This is a tricky question. The answer is c. Gin has a realised gain of $60. However, as he is holding 100 shares at $90 and the current share price is $85, he has a paper loss of $500.

Since the question asked for realised profits, the answer would be $60, which is the premium he collected.

Most people struggle with having their put options exercised because they are not comfortable seeing their portfolio in the red.

For example, in Example 2b, you would have seen the portfolio in the red with a paper loss of $500.

However, we need to bear in mind that paper loss are not realised.

Remember that we are only selling put options on undervalued quality companies.

This means that the stock DEF could increase over time turning that paper loss into paper gains, and eventually realised gains when you sell the stock.

Note: Paper gains/losses are also known as unrealised gains/losses. These are profit and losses from opened positions.

Realised gains/losses, on the other hand, are profit and losses from completed transactions.

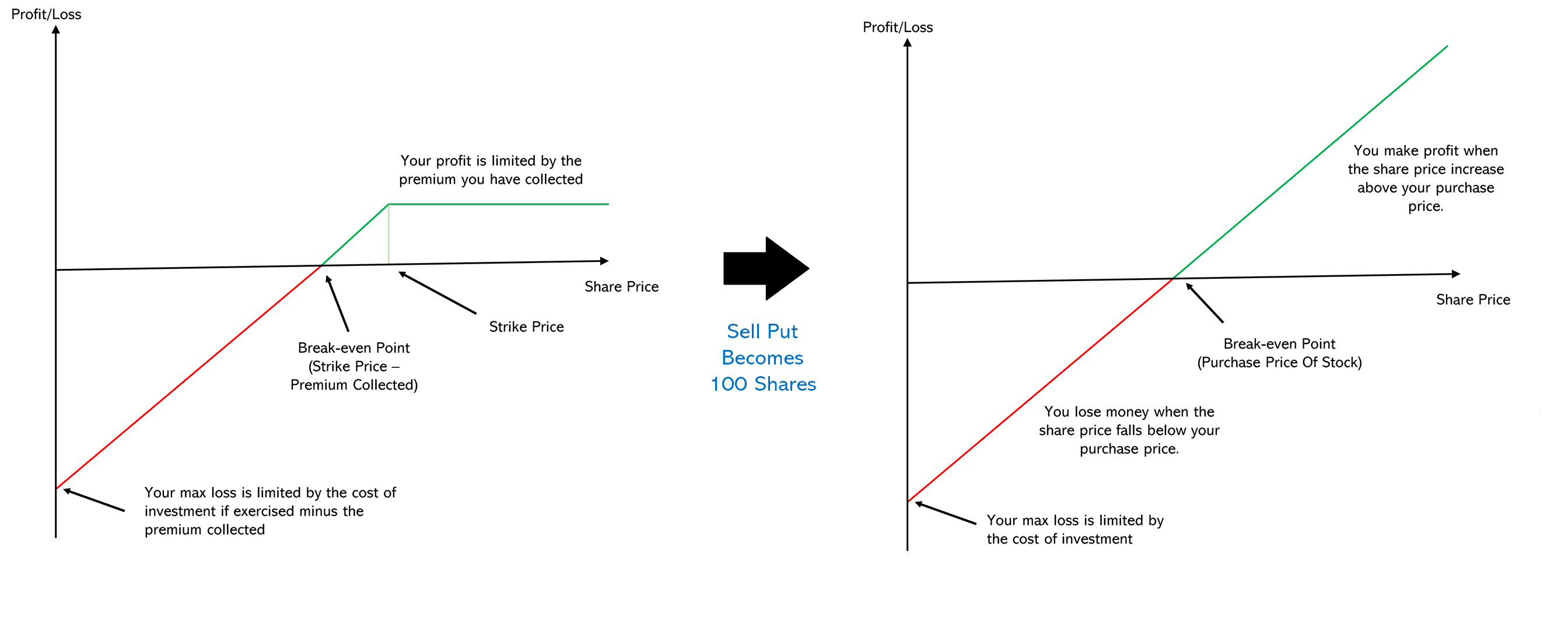

So, we have now made clear that when we sell put options, our profit is limited.

However, remember if the stock gets exercised, we get to own 100 shares - and our profit potential becomes unlimited.

Remember this risk profile transformation?

Click to enlarge image.

This is why I love it when my put options get exercised.

Sure, there is a temporary paper loss on the stock. However, if we invest in a quality company at a great price - it will still go up in the long run.

This brings me to the next limitations of selling put options.

Selling a put option requires you to hold a 100 shares.

This means that if you sell a put option at a strike price of $150, you need to have $15,000 in cash to buy the 100 shares, so that you don't risk getting a margin call.

This also means that the sell put strategy is more suitable for investors with a larger portfolio.

However, as I mentioned in the introduction - we all have our different journey.

So don't be discouraged if you cannot deploy the sell put strategy - it is always okay to buy call options or just buying the stocks instead, and grow the portfolio.

Quiz Time

In our next section, we are going to go through what are the stocks that we can sell put options on.

Note: One of the biggest reasons why the options hub was built as there were too many people who get burnt because of the lack of knowledge of how options works and its risks involved. This resource hub aims to equip beginner investors with the knowledge of options and how they can manage their risks when investing with options.