Entry Rules Of Long Call

Options Investing Hub ⮞ Long Call Options ⮞ Entry Rules Of Long Call

6 RESOURCES

⮞ Introduction

⮞ Pros & Cons Of Long Call

⮞ What Stocks To Buy Using Call Options

⮞ Entry Rules Of Long Call

⮞ Strike Price & Expiry Date Selection

⮞ Exit Rules Of Long Call

Entry Rules Of Long Call Options

You probably have read the cons of using long call options - and how the main risk of using call options is greed.

However, there are also other stringent criteria that we have to follow when it comes to the long call option strategy.

- Fundamentally good company

- Stock is on an uptrend

- Oversold Stochastics

- Portfolio Sizing

1. Fundamentally Good Companies

To me, a fundamentally good company is one that have passed the 8-Point checklist.

These are companies that have an increasing earnings trend as well as passes other criteria to sustain the earnings trend.

And as we should now by now, share price is driven by earnings.

So if the earnings continues to increase, share price will eventually follow.

If you are new to the 8-Point checklist, do grab your very own copy right here.

Get Your 8-Point Checklist!

So that you know what stocks

to avoid investing in.

Remember that, this strategy is designed for overvalued stocks.

I don't usually use the long call strategy on undervalued stocks - I would just buy the stocks straight instead.

2. On an Uptrend

This is where technical analysis come into play.

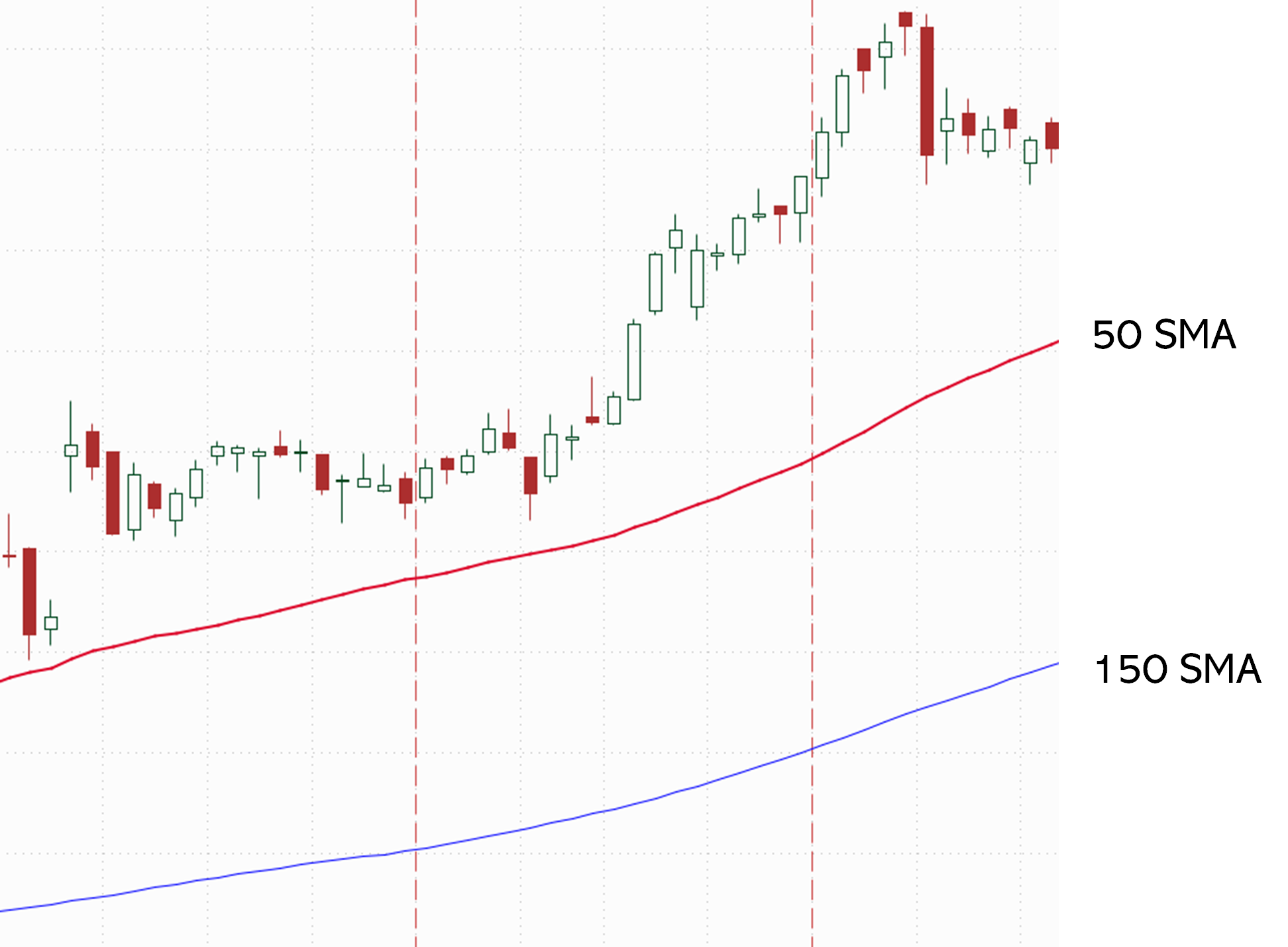

We want to use the 50 and 150 Simple Moving Average to determine the trend of the stock.

And we want to only buy our call option when the stock is on an uptrend.

So how do we determine the uptrend of the stock?

Well, an uptrend has to follow these rules:

- The 50 SMA is above 150 SMA and

- The 150 SMA has to be sloping up

So this is how it will look like.

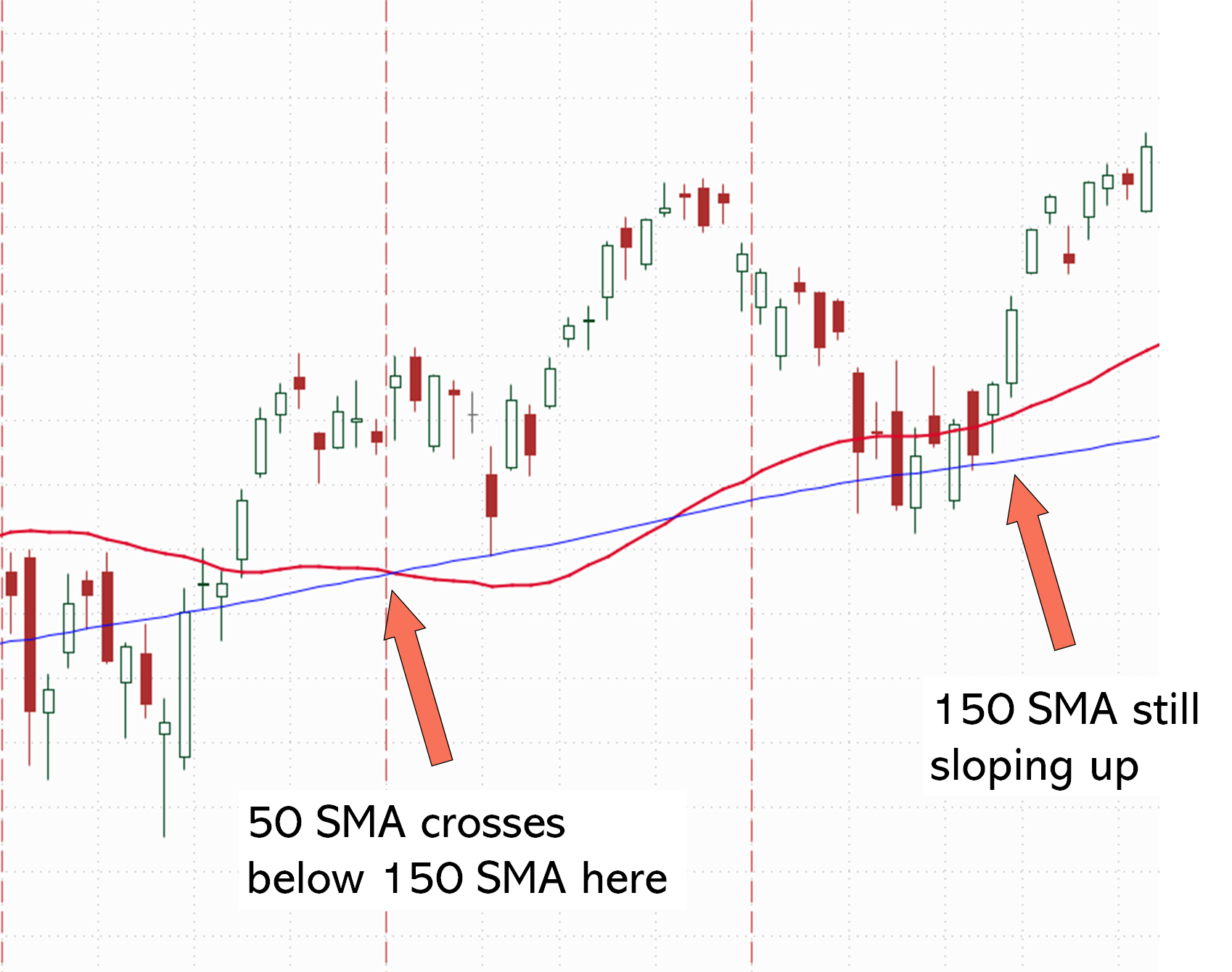

Sometimes the 50 SMA may fall below the 150 SMA. However, if the 150 SMA is still sloping up - then the stock is still considered an uptrend.

So here's the second rule for an uptrend:

- The 50 SMA crosses below the 150 SMA but

- The 150 SMA is still sloping up.

Now, you should be able to guess what a downtrend means - well it basically means:

- The 50 SMA is below the 150 SMA and

- The 150 SMA is sloping down

Its important to recognise this change in trend because we never want to buy call options on a downtrend.

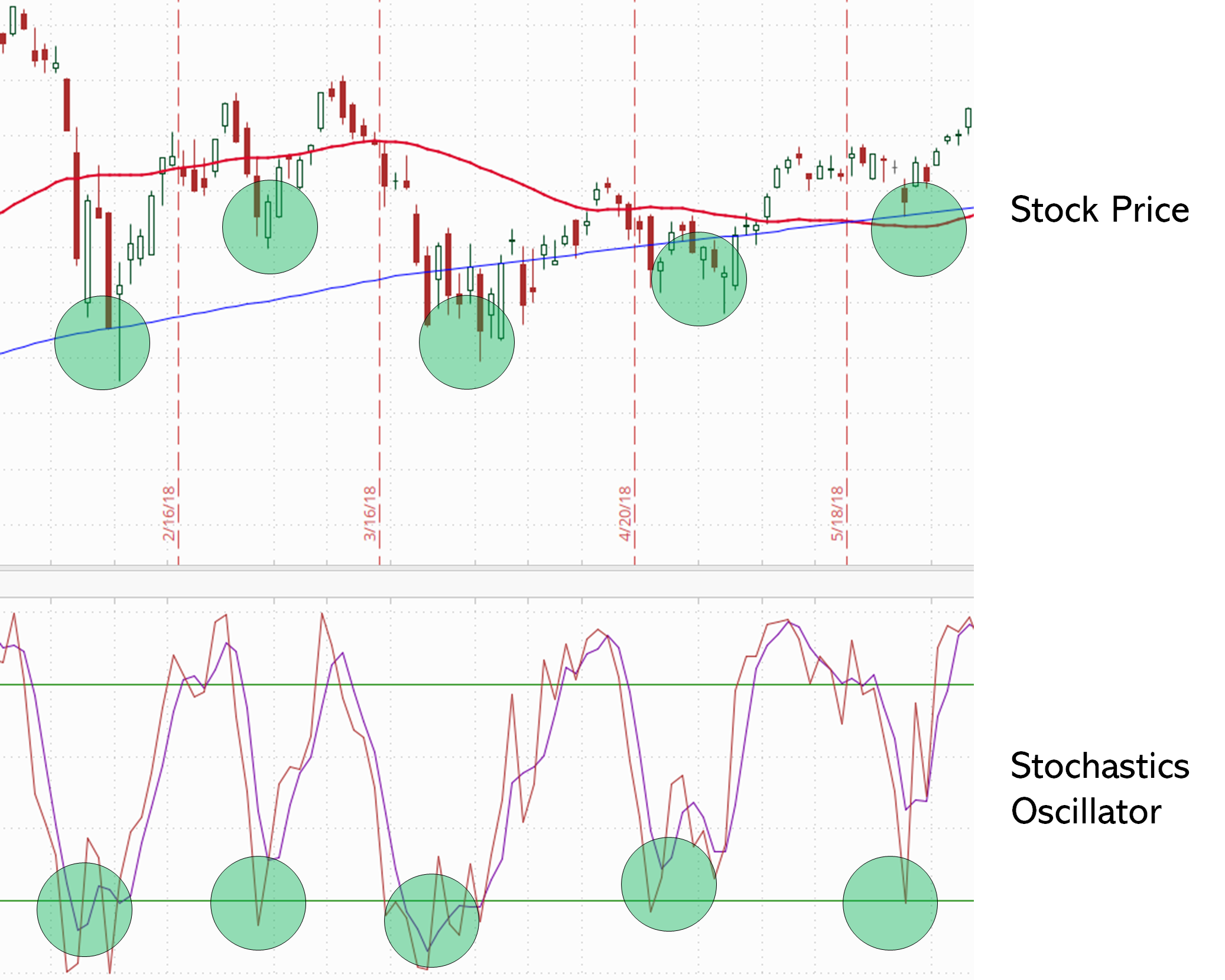

3. Oversold Stochastics

The stochastic oscillator is a technical indicator to determine the oversold or overbought levels of the stock.

You can see that the "dips" of the share price usually coincides with when the stochastics oscillator is overbought (i.e. below 20).

So when we buy at the overbought stochastics, it increases the chances of us buying the stock at its dips.

This stochastics becomes exceptionally powerful when used in combination with the moving average.

To use the long call strategy, I would buy the call option only when the stock has reached one of the moving average and the stochastics is overbought.

When these three conditions appear, it is a very strong probability trade to enter:

- Stock is on an uptrend

- The low of the candle is below the 50 SMA but closes above the 150 SMA

- Stochastics is oversold

The green areas are great entry points based on the three conditions

In the above image, you can see that these are potential entry points that fulfils all three conditions.

Now, remember that this only suggest that it is a good entry point - it does not mean the stock will definitely go up from there.

So we always want to be careful with portfolio sizing, which will be discussed next.

But, before that, let's go through a short video summary on what we have gone through so far.

4. Portfolio Sizing

Now let's talk about the ultimate way to control your risk - portfolio sizing.

Remember that the maximum risk is the amount of premium you paid.

If you have a $10,000 portfolio, and you buy a call option that cost you $500 - then your maximum risk on that call option is $500.

So how do I manage my portfolio using call options?

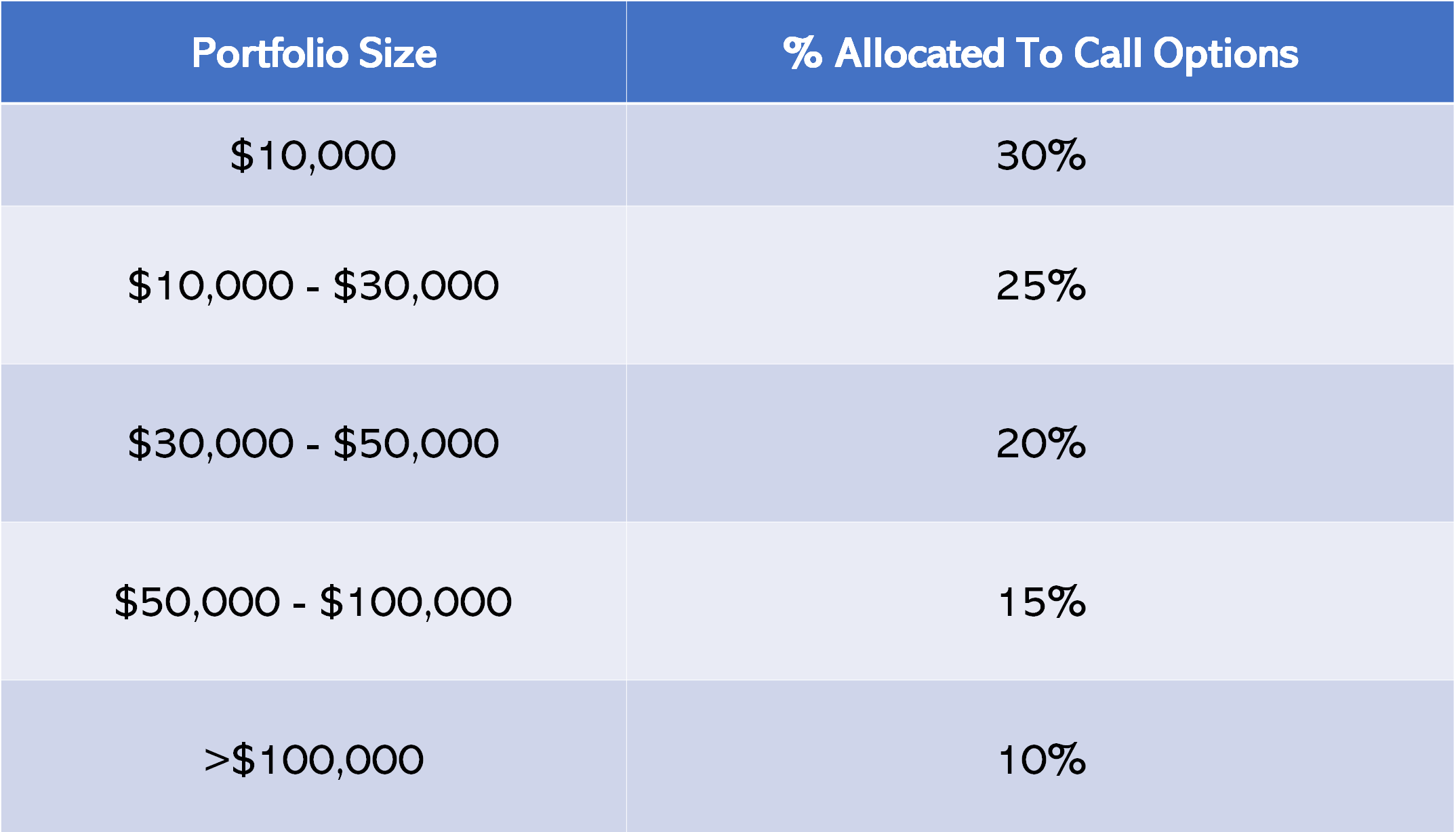

The answer depends on your portfolio size.

Do note that this is a general guideline.

I know that there are investors who are more aggressive and want to use 100% of their portfolio call options - I wouldn't recommend this as you need to have exceptionally good emotional stability and risk management.

Besides, call options are leveraged instruments and the whole idea is to take limited risk to get meaningful returns.

For example, for a $10,000 portfolio - you will only allocate $3,000 to call options. The remaining $7,000 can be used to buy undervalued stocks and hold for the long term until it reaches its exit price.

Try to diversify the $3,000 into 2 to 3 call option trades, so that your call options are diversified across a few positions.

This would mean $1000 to $1500 per call option.

Quiz Time

This is an important section, so I really want to make sure you understand the concepts discussed here. Take the quiz to test your understanding.

Now that you understand the entry rules of call options, let's dive into strike price and expiration date selection.

Note: One of the biggest reasons why the options hub was built as there were too many people who get burnt because of the lack of knowledge of how options works and its risks involved. This resource hub aims to equip beginner investors with the knowledge of options and how they can manage their risks when investing with options.