Jeff Bezos and Warren Buffett once had this conversation.

"Warren, your investing strategy is so simple, why don't everyone just follow what you do?"

And Warren Buffett replied,

"Because nobody wants to get rich slow."

And in every sense that is so true.

I have seen so many people take unnecessary risks trying to "get-rich-quick" by aggressively buying options. And I really do mean aggressive - using their entire portfolio on call options.

With that said, using options can indeed build wealth really quickly - but you will soon lose everything if you are not careful.

So in the blog post, I want to share how even ordinary people can achieve their financial freedom using practical strategies.

Keep Yourself Protected

This is the first step before anything.

You need to be able to defend your wealth before you even start building your wealth.

Medical bills can often cause a huge dent in your pocket, and the last thing you want is to liquidate your assets to pay for these medical bills.

That's why insurance coverage is so important.

Never think that "But I am young and healthy - I don't need insurance."

It is precisely that you are healthy now, that you should buy insurance.

If you are unhealthy, no insurance company will want to insure you anymore - or perhaps, they will charge you an arm for your insurance premiums.

Also, make sure that you not only provide insurance coverage for yourself but also for your dependents.

Can you imagine that one day after you build your first $100,000 investment portfolio, and all of a sudden, you have to pay $80,000 in medical bills? That is going to set you back in your financial freedom journey for years.

So before you even start thinking about building your wealth - make sure you have plans in place to protect them in the first place.

Don't Leave Excessive Money In The Bank

Never ever save money for the sake of saving money.

You need to always have a plan on how you intend to use your money.

If you say that you want to keep aside 12 months of expenses so that you are able to provide for your dependents in the event you lost your job - that's absolutely fine. By all means, leave that sum of money in the bank.

But you must invest the remaining amount.

Don't leave it lying in the bank with a puny interest rate of less than 1%.

Where should you put your money instead?

Personally, most of my money are in the US stock market. And I have been consistently putting money every single month into it for the past years.

If you take a look at the different stock market index, you will realise that the S&P 500 have one of the most consistent returns over the long term.

For those who are staying out of the US, and thinking:

"But I am not from the US, I am not comfortable investing in foreign companies."

Well, you have to realise that you never change your life until you step out of your comfort zone; change begins at the end of your comfort zone.

At the end of this blog post, I will also leave a resource for you to open your US brokerage account.

Increase Your Income

If your income is low, you won’t have as much money left over to invest each month.

Raising your income while lowering your expenses is a common sense formula for building wealth.

Let me demonstrate why this is important.

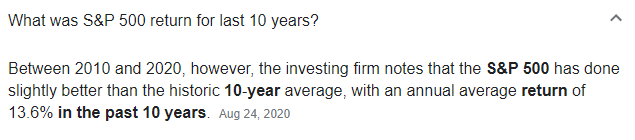

The average annual return from the US index, S&P 500, is around 13.6%.

But let's be conservative and assume it is a mere 10%.

Let's compare the difference when you consistently put aside $3600 every single year for your investments, and compounding at 10% return over 10 years. What would that amount be in 10 years?

Well, it would be $63,112.20.

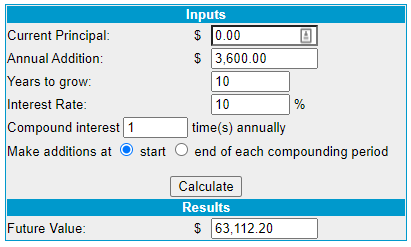

But here's the thing - what if you could put aside twice the amount, $7,200 every single year, (i.e. $600 per month).

Well, that would be $126,224.40 - just be investing an extra $300 every single month.

Some of you might be thinking, "Gin, where the heck am I going to get an extra $300 every month?"

Well, that's the whole idea - increase your income.

Never be stuck thinking that your 9-to-5 job is your only source of income.

There are plenty of other opportunities out there - but only if you are willing to work for it.

If you are not willing to work for it and prefer to spend your entire weekends watching NetFlix, there is nothing wrong with that. We all have our own goals and hunger to succeed.

But don't complain why you are not financially free earlier than others. You need to acknowledge that if you want to be financially free earlier, you cannot avoid hard work.

Don't Spend Money To Impress Others

In my early 20s, I have the opportunities to learn from many successful down-to-earth entrepreneurs and investors.

But if you ever met them out in the street, you will never think that they are actually multi-millionaires. Simply because, they live a humble life - and they are self-confident, and don't need a fancy car to boost their ego.

I'm not saying that buying that new toy you always wanted is wrong - there's nothing wrong if you want to reward yourself for the hard work you have done.

But buying it for the sake to impressing others is pretty silly - especially when you know you could have spend that money on quality assets instead.

"The goal is to win, not to look like you win.

Would you rather have a $100 bag with nothing in it...

... or a $1 bag with $99 in it?

There are better ways to display your wealth. Sometimes the richest men have the cheapest pleasures not because they can't afford it...

... but because they'd rather invest that money and double it in returns."

What's Next?

I have shared with you quite a few concepts on financial freedom, such as investing in the US stock market, putting money consistently every month, making sure that you have insurance coverage for yourself, etc.

But I understand that my readers can come from different backgrounds - some are more experienced investors, while some are just getting started; and my goal is to really help out the beginner investors to get a solid foundation in investing so that you can achieve financial freedom.

For those who have been following me know that I have created many free resources to help beginners in their financial freedom journey and I am always looking to improve these resources.

I have created a free course that you can get access to the following:

- How to know exactly how much capital you need to become financially free. (Its much lesser than you think)

- The 3 ways to get the your financial freedom capital (you choose the one that is most suitable for you)

- My very own financial freedom calculator I used that I know I will be financially free in my early 30s

There are also other courses such as opening your US brokerage account - so check them out by clicking the button below.

Access Your Courses

A resource hub dedicated to building your financial freedom.