Pros And Cons Of Long Call

Options Investing Hub ⮞ Long Call Options ⮞ Pros And Cons Of Long Call

6 RESOURCES

⮞ Introduction

⮞ Pros & Cons Of Long Call

⮞ What Stocks To Buy Using Call Options

⮞ Entry Rules Of Long Call

⮞ Strike Price & Expiry Date Selection

⮞ Exit Rules Of Long Call

Pros and Cons Of Long Call

The chapter is on Pros and Cons of Long Call.

I have repeatedly mentioned the long call options are ideal for investors with smaller portfolio.

But I haven't quite explain why this is the case.

And in this chapter - you will find out why.

Pros Of Long Call

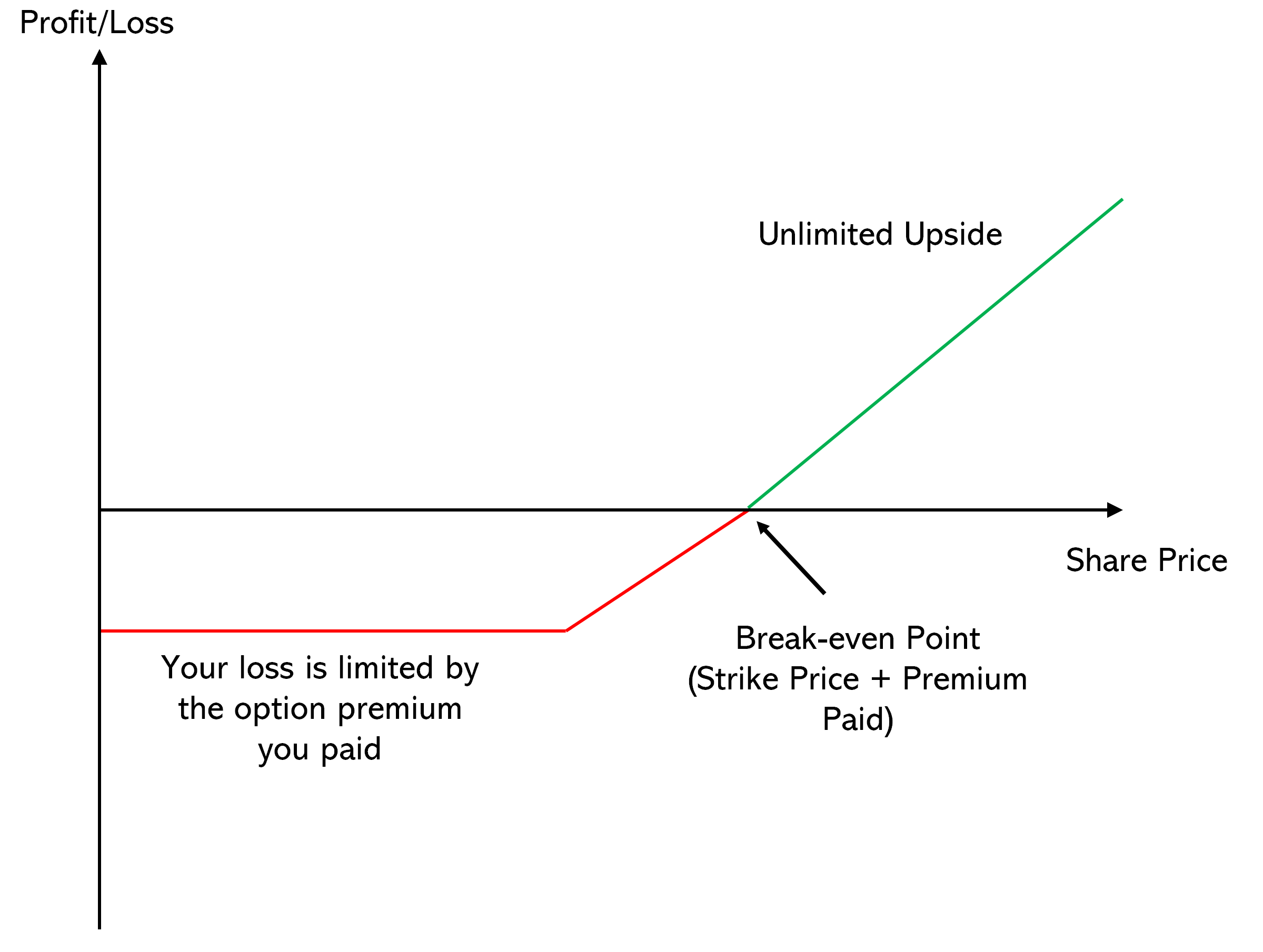

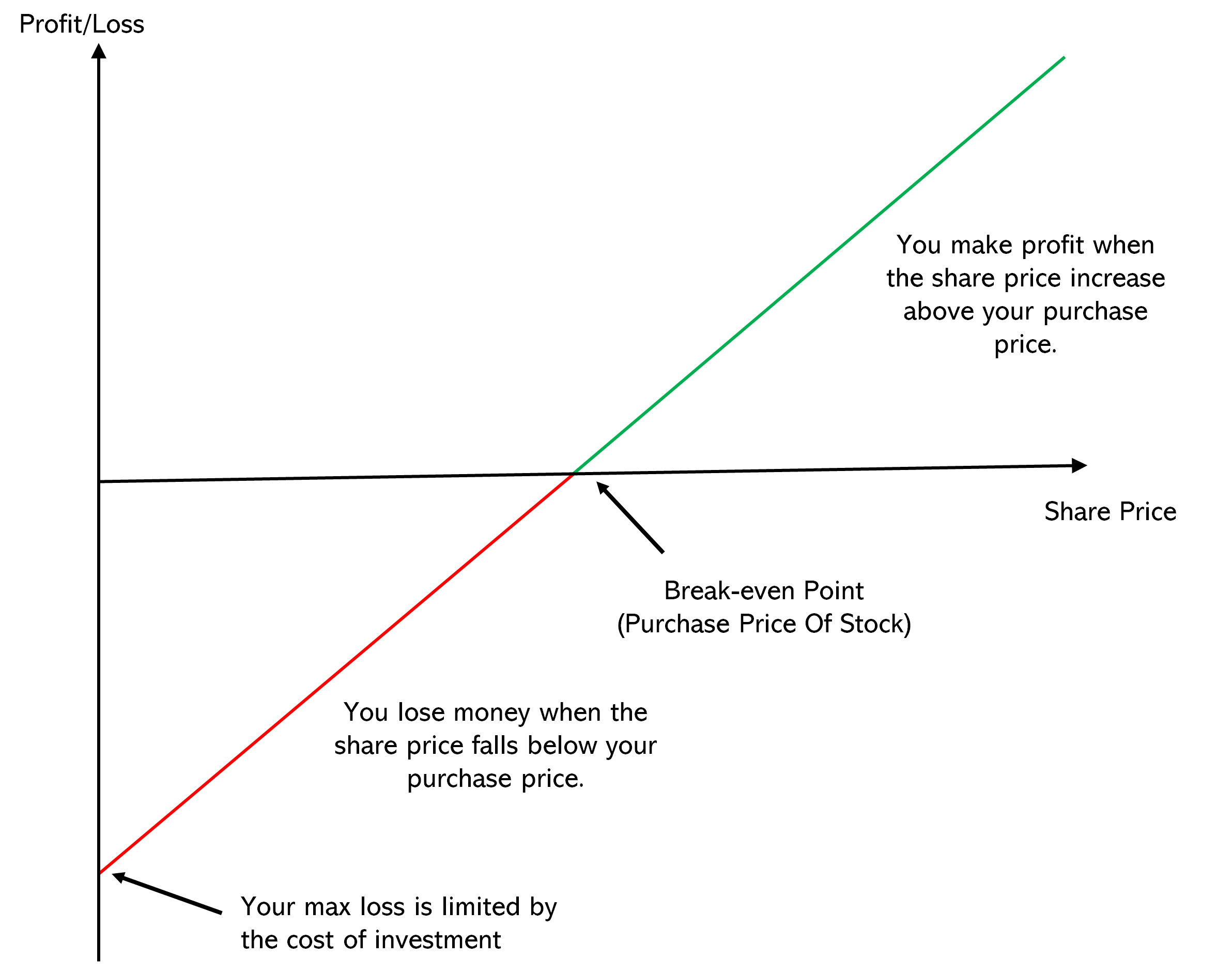

I want to show the two risk profile of long call and long stock - so that you appreciate why long call options are great for investors with smaller capital size.

Risk Profile Of Long Call Option

Risk Profile Of Stock

These two risk profile alone explains why long call options are great for small portfolio.

Imagine you have $26,940 - and you want to buy Facebook.

If Facebook share price is currently at $269.40 - you can afford to buy 100 shares.

However, you can also choose to buy a call option using just $6,970.

The main advantage of using a long call option over buying stock, is the return on investment will be far greater - simply because of the smaller capital outlay.

In fact, let's do a comparison based on the example above.

This is why using call options are ideal for investors with smaller capital size because they are able to invest with a much smaller capital outlay.

Cons Of Long Call

Now, it sounds like buying call options is all great and fantastic - so what's the catch?

The short answer to this question is human greed.

The good news is that greed can be controlled - but why is this a disadvantage?

Well, let's go back to the previous example - imagine you have $26,940 that you want to invest.

You can choose one of these two options:

- Use $26,940 to buy 100 shares @$269.40 each

- Buy 4 Call options @ $6970 each

We want to take a look at these two positions in terms of risk.

Gin's Definition of Risk: Risk is the maximum amount an investor will lose on a position in the worst case scenario.

So in the above example, the maximum risk for the 100 stocks is $26,940 while the maximum risk for the call options is $27,880.

So you can see that the maximum risk of these two trades are very similar.

We might think that, "hey, it is a similar amount of risk! So why don't I just buy call options?"

Well, the answer to that is that we have not considered the probability of risk.

When you buy the $26,940 worth of Facebook stock - in order for you to lose the entire $26,940, Facebook has to fall to zero dollars.

If you think about it, that situation is very unlikely - especially if you only invested in stocks that passed the 8-Point checklist.

(The 8-Point Checklist is a personal checklist that I used before investing in a stock, read the 8 Financial Numbers To Look Out For When Investing)

However, when you buy call options - the risk of losing the entire $26,9400 is actually very possible.

Why?

Because at the time of expiry, if the share price is below the strike price of the call option - you will lose the entire option premium.

Here's a summary table:

So we now know that while the maximum risk is the essentially the same - the probability of the risk happening is a lot higher for call options than buying stocks.

But why do people fall into greed then?

Well, simply because of the common mistake of only looking at the upside.

Watch this video to understand why.

That's why, when we buy call options - it is very important to manage this risk, which we will talk about in the following sections.

And one of the ways to to manage this risk - is to be selective of the stock that you are going to buy using the long call strategy.

Note: One of the biggest reasons why the options hub was built as there were too many people who get burnt because of the lack of knowledge of how options works and its risks involved. This resource hub aims to equip beginner investors with the knowledge of options and how they can manage their risks when investing with options.