3 Reasons To Sell A Stock

Stock Investing Hub ⮞ When To Sell A Stock ⮞ 3 Reasons To Sell A Stock

3 RESOURCES

⮞ Introduction

⮞ 3 Mistakes When Selling A Stock

⮞ 3 Reasons To Sell A Stock

3 Reasons To Sell A Stock

Now that we have covered what are the mistakes when it comes to selling a stock - we can now discuss about the right reasons to sell a stock.

A Better Opportunity

You have probably heard of the saying, "the grass is greener on the other side".

So what does a better opportunity means?

Well, remember that when we discussed about portfolio diversification, we will diversify based on our portfolio size.

Let's take a $10,000 portfolio for example - based on a 30% allocation, you would only invest in 3 companies.

However, what happens if you find a better investment opportunity?

It could be that it has a better score in the 8-point checklist, and that it is more undervalued as well.

Well, you have to decide to sell one of your stocks in order to free up capital to buy the new company.

(The alternative of course, is to fund more capital into your brokerage account.)

That's one example of when you might sell your stocks.

Besides the stock market, there may be times where you find a better potential with other investment vehicles such as properties - in such an event, you may also choose to sell your stocks to finance your property investment.

A Change In Fundamentals

As investors, whenever there is a drop in share price, we want to be anchored in fundamentals, and ask ourselves these questions:

- "Is the business still making money?"

- "Does the business still pass the 8-point checklist?"

If the business is facing headwinds and you see a changed in fundamentals of the 8-point checklist, this is where you might want to think about selling a stock.

For example, if you start to see a 3 years downtrend in the companies' earnings - or that the company has taken on more debt that it is able to cope.

These are red flags that you might want to consider whether or not to keep that company in your portfolio.

The Stock Becomes Overvalued

This is the most important part, and is the reason why valuating the business is so important.

By understanding the valuation of the business - you will be able to determine when a stock is not worth buying anymore.

"Buy at a price you wouldn't sell, and sell at a price you wouldn't buy"

So you want to sell the stocks when the stock price is overvalued.

But you may be thinking - how do you know whether the stock is overvalued?

Like, if it is only 3% above its intrinsic value - will it be considered overvalued?

Well, that's a great point.

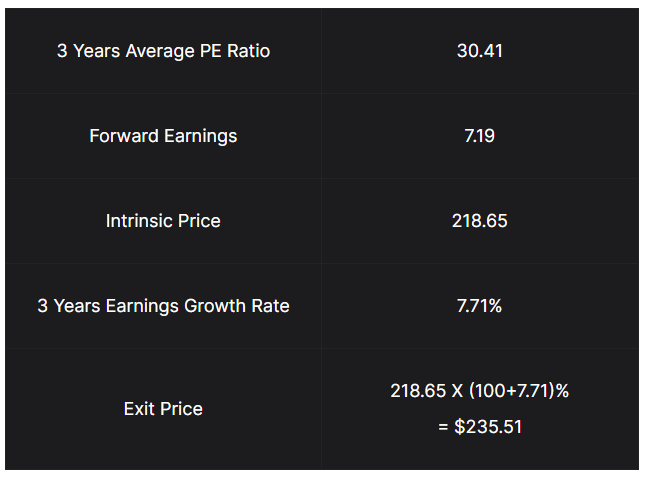

For me, I use the 3 years earnings growth rate of the company to determine my selling price.

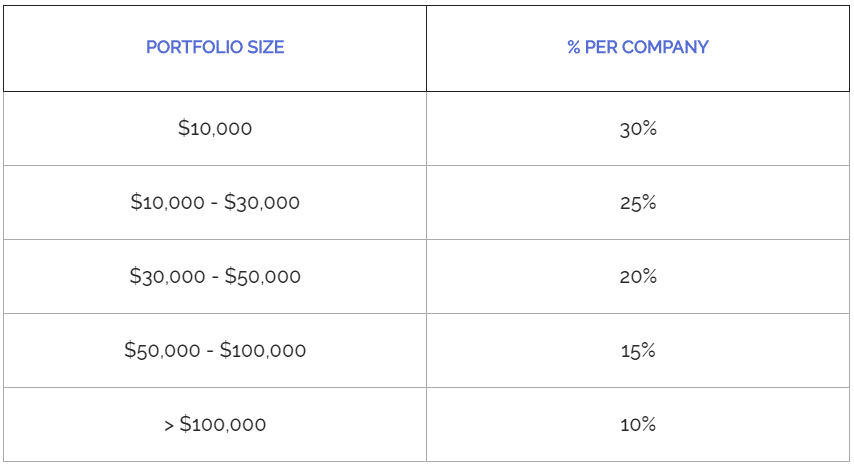

Remember this table from our previous example using Facebook?

Remember that Facebook has a checklist score of 7, which means the margin of safety is 10%.

This means the entry price is $196.78, and our exit price is $235.51.

However, because Facebook's intrinsic value will change if there is an increase in earnings, this means that our exit price will increase as well.

That's why it is so important to invest in a business that have an increasing earnings trend.

Now that we have gone through the following:

We have to now go through the "Tipping Point". which we outline how you can use a single "shopping list" to integrate everything that you have learned.