First of all, this blog post is a follow-up to two other blog posts - the "Funnel Method" and the "Thermostat Method".

The "Funnel Method" is what helped me find many profitable stock ideas - the next step then, was to value them using the "Thermostat method".

Now to the next step - building a shopping list.

Building A Shopping List

The shopping list.

What is it? And how can it help you in your investing journey?

Before I go on to explain in greater detail what is it - let me illustrate a problem among most investors.

They will do their research, find a quality stock, and then they do the valuation on the stock.

And it turned out to be overvalued...

What happens next?

They forget about it and move on, thinking to themselves,

"Everything seems to be overvalued..."

Here's the thing - share prices move up and down everyday.

This means that share prices could also fall to undervalued levels.

(Again, read the "Thermostat Method" if you are unsure how to valuate stocks)

How The Shopping List Works?

Building a shopping list is what allowed me to spend only 15 minutes a week in investing.

I used to be glued to the computer screen, the moment the stock market opens.

But now I realised - that's a complete waste of time - unless you are a day trader.

If you are currently always looking at the stock market - here's my advice.

Don't do it - you can't control the share price anyways. Focus that time on doing something productive instead.

Something, what I called, the shopping list.

I am going to dive in and show you how a shopping list looks like, and explain a little later.

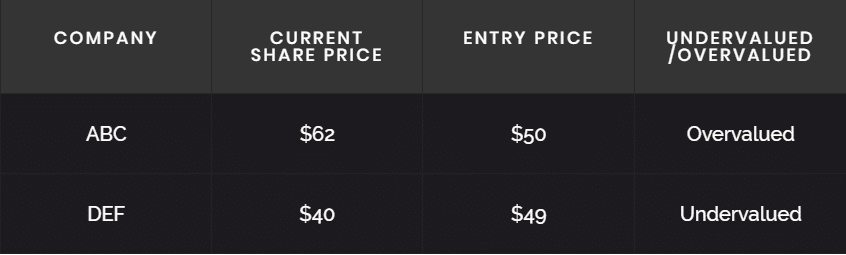

This is an example of a shopping list.

It tells us immediately whether a stock is undervalued or overvalued.

The Company "ABC" and "DEF" are found first using the "Funnel Method".

The Entry Price is found using the "Thermostat Method".

And using Google Sheets, you can easily figure out, at a glance, whether a stock is undervalued or overvalued.

So bascially, every few days, I will just take a quick look to see which stock is becoming undervalued soon - and I would buy them once they are undervalued.

And investing is supposed to be a passive activity - don't spend all your time looking at share prices, you can't control share prices anyways.

But what you can do is to find quality stocks, do the valuations and build your very own shopping list.

This is something that I taught to all my students:

The Funnel Method + Thermostat Method + Shopping List = Profitable Watchlist

And with the profitable watchlist, they were able to invest much more confidently without relying on "stock tips" anymore.