The 8 Financial Ratios

Stock Investing Hub ⮞ Stock Fundamentals ⮞ 8 Financial Numbers To Look Out For When Investing

5 RESOURCES

⮞ Introduction

⮞ Why Most Investors Lose Money

⮞ The Only Reason Share Price Increases

⮞ What Financial Numbers To Look Out For When Investing

⮞ What to Know Before Investing In A Stock

The 8 Financial Ratios

Some of you probably know what these 8 financial ratios are.

This is an advanced add-on to the 8-Point Checklist that I give away to my readers.

(If you haven't got it - get your copy here, and come back to this chapter.)

The free PDF download, will teach you where to find the financial ratios of every company and provides a summary of this chapter.

And this chapter serves to give a more detailed explanation of why the 8 financial ratios are so important.

So a little warning - this is going to be a very long section. But I promise it will be worth your time, as it will give you the fundamentals to be great investor.

Before that, you need to extract all the relevant numbers from morningstar.com

So its worth going through the free PDF to know how we can extract 10 years worth of data from morningstar.

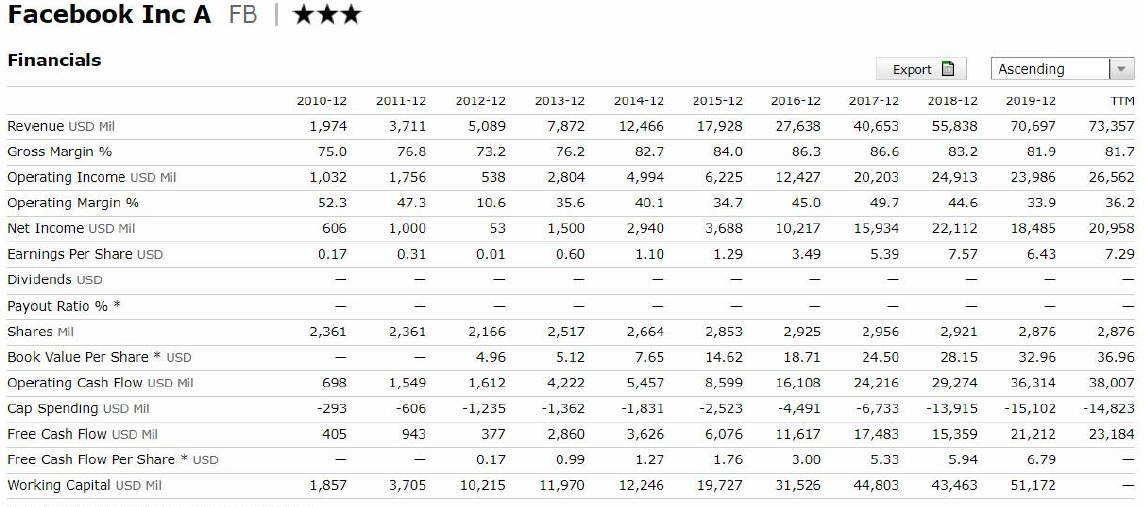

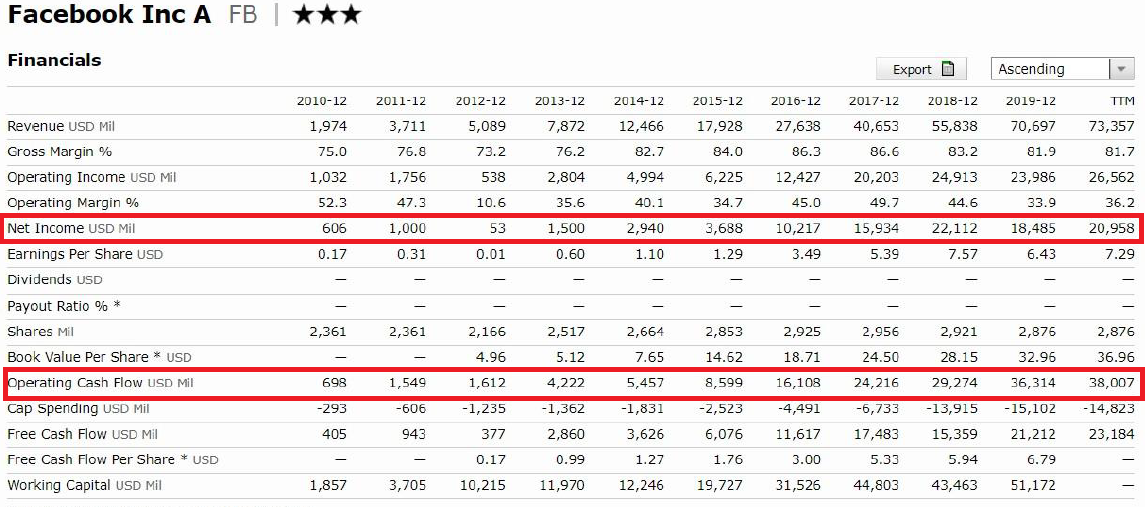

Example of 10 Years Of Financial Data for Facebook

Now that we have extracted the key ratios of the data, it is time to figure out the 8 Financial Ratios in our 8-Point Checklist.

1. Increasing Earnings Trend

What are earnings?

Earnings, or net income - these terms are often used interchangably. It is often used to describe the profitability of the business, and usally determines how much a company is worth, i.e. its intrinsic value.

To calculate the earnings, you need to know two other things:

So what is revenue and expenses?

Revenue is the sales proceed from a company.

So let's imagine I own a lemonade stand.

And I sold $300 worth of lemonade.

That means that my revenue is $300.

However, the lemons that was used to make the lemonades were not free - I had to buy them from my supplier.

So let's say that I spent $100 to buy those lemons.

That means my expenses are $100.

The profit, or earnings refers to the difference between the revenue and expenses.

This means that the amount of profit in this example is $200.

Why is it important?

In our previous chapter, we talked about share price being driven by earnings.

So if you want to buy a stock that will increase in price over time, you want a company that will increase its earnings over time.

This is why it is so important to look at the earnings trend of the company.

Where To Find This Financial Ratio

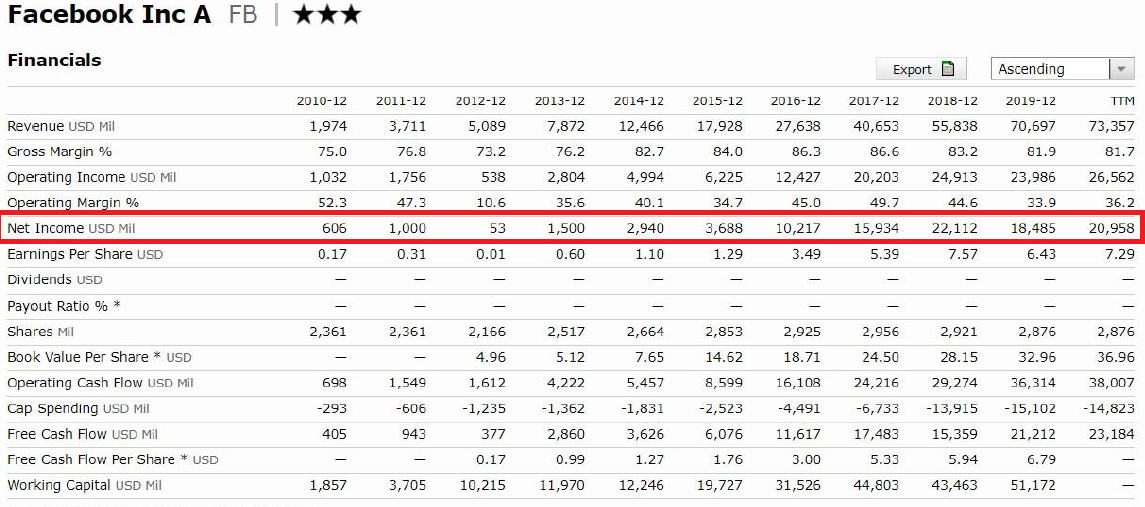

I would also recommend copying the numbers of net income in the form of a graph to be able to quickly identify the trend of the earnings.

So you can easily produce this graph in Excel - and you are able to quickly identify that Facebook has an increasing earnings trend.

2. Net Margin

What is Net Margin

Net Margin, also known as Net Profit Margin - refers to the net profit as a percentage of revenue.

Using the above example, the net profit is $200 and the revenue is $300.

So in this example - the net margin would be 66.7%.

Why is it important

The general rule of thumb in my checklist is to have a net margin more than 15%.

This is crucial because if a company has very low net margin, it is very difficult for the company to maintain its profits when expenses increases. Having a net margin also gives a good margin of safety for the business.

Why?

Because in events if the company is unable to make revenue, a company with a higher net margin has the ability to reduce its price to bring in more customers - and still remain profitable.

Where To Find This Financial Ratio

Pretty straightforward, isn't it?

Again, if you are not sure how to get to the "Key Ratios" Page as seen in the video - make sure to follow the instructions in our checklist.

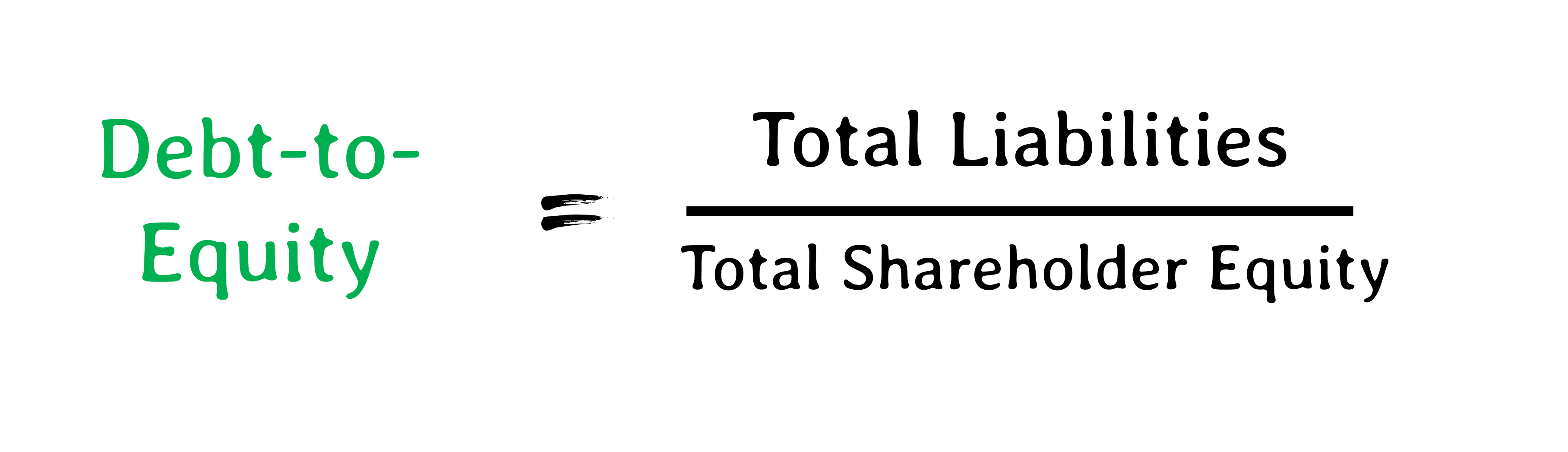

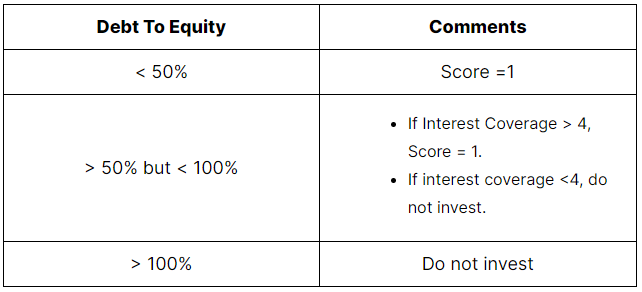

3. Debt To Equity

What is Debt To Equity

The debt-to-equity ratio is a financial ratio between the debt to shareholder's equity.

Why is it important

Debt is interesting - because it is a double-edge sword.

While many people were brought up with the idea that having debt is a bad thing, business often used debt to boost their business's revenue and operations.

The most important thing is to be able to use debt prudently.

As a general rule, the debt-to-equity is considered conservative when its less than 50%.

If it is more than 50% - it does not necessarily mean it is a poor business to invest in. We have to take a look at how well the company can manage the debt. We figure this out by looking at the interest coverage ratio.

However, if it is more than 100% - I typically will not to invest in the business, as I would consider the business being overleveraged.

Debt To Equity | Comments |

|---|---|

< 50% | No need to look at Interest Coverage Ratio |

> 50% but < 100% | Look at Interest Coverage Ratio |

> 100% | Do not invest |

Where To Find This Financial Ratio

If you see a "-" at the debt-to-equity, this means the the company does not hold any debt - so its a good thing.

For debt-to-equity, we usually only look at the most recent quarter, because that is the most recent debt-to-equity that the company hold.

After all, we are not concerned about how much debt they used to have, but the amount of debt they have currently.

You now know how to find out whether a company holds a lot of debt - next, we are going to find out more interest coverage ratio.

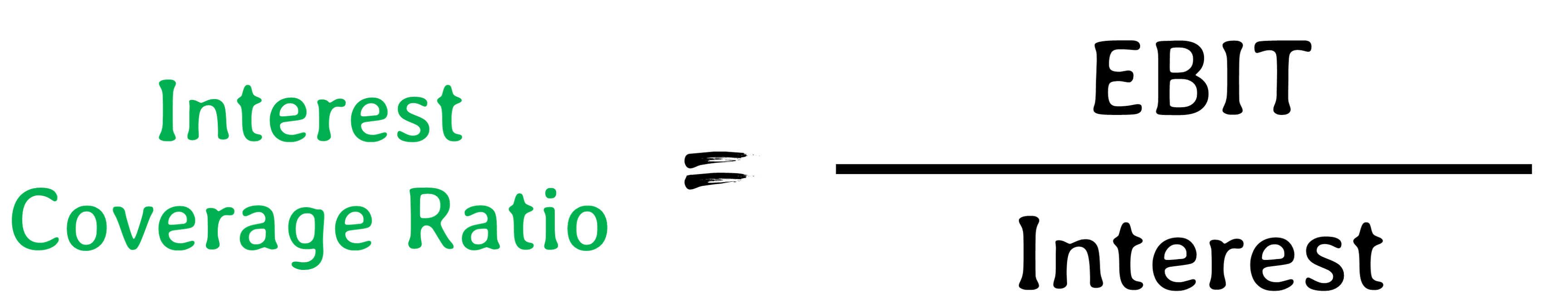

4. Interest Coverage

What is Interest Coverage

The interest coverage ratio is used to determine how well a company can pay off interest on their debts.

The debt of the company is paid off using the company's earnings.

Therefore, the ratio is caculated by dividing the company's earnings before interest and tax (EBIT) by the interest payments.

Fortunately, this interest coverage ratio is automatically calculated in morningstar - which I will share how to find it down below.

Why is it important

When business take on debt, they have to pay interest on the their loans.

The interest coverage shows how well the company can pay off the interest on their debts.

This means that having an interest coverage ratio of 4, the company is able to pay off 4 years worth of interest with one year of the company's earnings.

In short, the higher the interest coverage - the better the company is able to manage its debt.

As a general rule of thumb, if the debt-to-equity is more than 50%, I would want to have an interest coverage ratio of at least 4.

(Of course, if the debt-to-equity is more than 100%, then I wouldn't consider investing in the business.)

Where To Find This Financial Ratio

If the interest coverage is shown as "-", that's a good thing because it shows that the company either does not have any debt, or does not have to pay interest on their debt.

Similar to debt-to-equity, we usually only look at the interest coverage ratio of the most recent quarter.

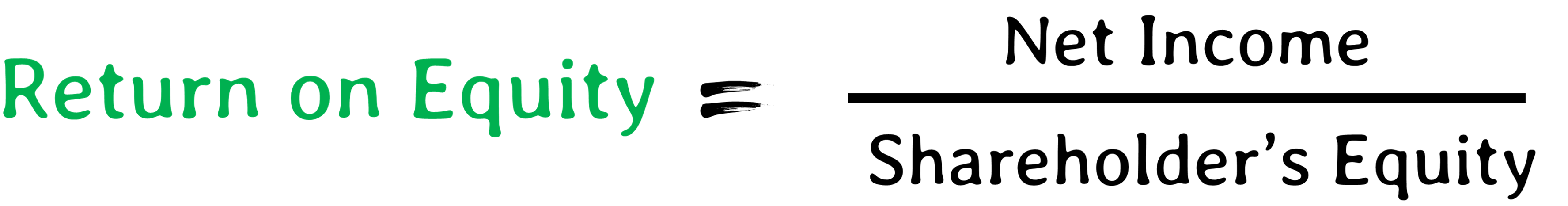

5. Return on Equity

What is Return on Equity

The return on equity refers to how efficient the business is in using shareholder's equity.

Shareholder's equity are typically refers to the companies asset minus its liabilities. Therefore, in a sense, the return of equity could be referred as how well the company generates profits using its assets.

The return on equity can be calculated by dividing the net income by shareholder's equity.

Why is it important

The R.O.E describes how efficient the business is with shareholder’s money.

It describes how much profit is made with a dollar of shareholder’s

money. The higher it is, the more efficient the business with shareholder’s equity.

As a rule of time, I typically invest in a company with a R.O.E of more than 15%.

Where To Find This Financial Ratio

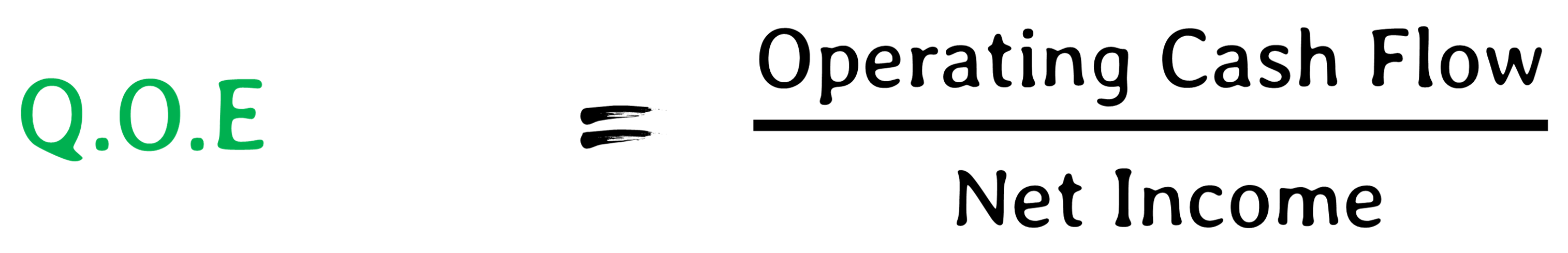

6. Quality of Earnings

What is QOE

The way I calculate quality of earnings is to understand how "good" the earnings are, by measuring how much of the company earnings is actually in the form of cash flow - meaning real cash coming into the business.

I used the following equation to calculate my QOE.

Why is it important

Many times, companies can try to manipulate their earnings such as to artificially inflate their earnings so as to look better to investors and analyst to invest in their company.

However, cash flow are hard to manipulate. Therefore, by using the cash flow - we know how "true" the net income actually is.

Because at times, companies can have "profits" but no cash flow into the business - and this is a major red flag, of possibly "creative" accounting practices.

As a rule of thumb, I generally want a Q.O.E ratio of more than 0.8.

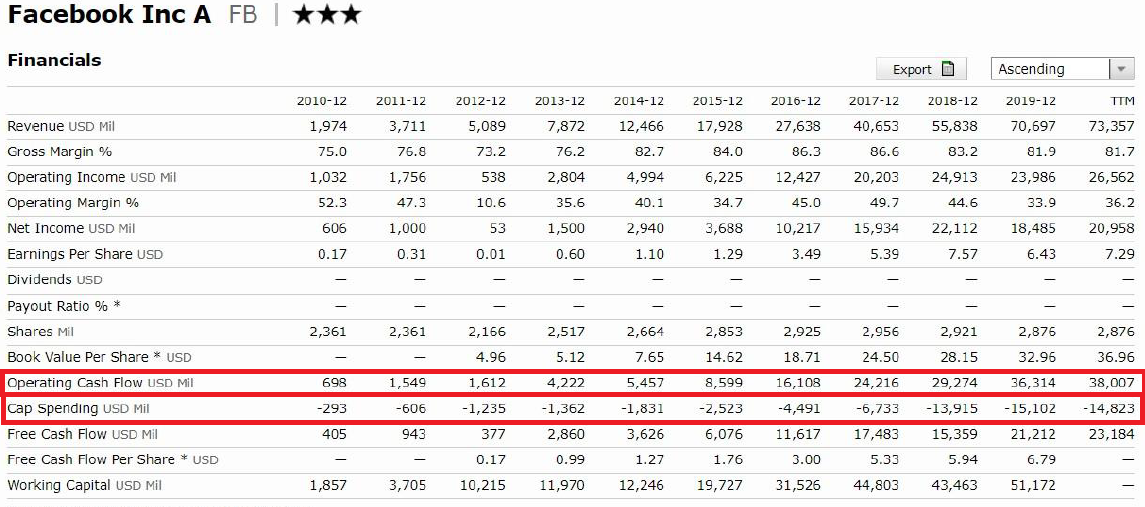

Where To Find This Financial Ratio

In order to find the QOE, you need two financial ratios:

and then subsequently use the above formula to calculate the quality of earnings.

7. CAPEX/OCF

What is CAPEX/OCF

CAPEX, it stands for Capital Expenditure and OCF stands for Operating Cash Flow.

The equation is straightforward in this case:

This bascially decribes what is the percentage of the cash flow that enters the business is used for capital expenditures - expenses that the business need to have in order to continue the operations of the business.

These expenses could be maintaining planes by airlines, or maintenance of ships by cruise industries.

Why is it important

The CAPEX/OCF is important to understand how much the business' cash flow is needed, just to continue the operations of the business.

And if the CAPEX is really high, it means that the company constantly need to spend cash just to maintain the business.

As a rule of time, I look out for a CAPEX/OCF of less than 0.5.

This means that for every $1 in cash flow entering the business, less than 50 cents is used to spent for capital expenditure.

A company with very high CAPEX/OCF is put in a very risk situation - because if they are unable to bring in the cash flow - during the COVID-19 crisis for example, they will not have enough to pay for their capital expenditure to maintain the operations of the business.

This is why airlines and cruises plummeted because these companies do not have the cash flow to even maintain their aircrafts and cruise ships - as they are no longer bringing in cash flow.

Where To Find This Financial Ratio

In order to find the CAPEX/OCF, you need two financial ratios:

Note that the "Cap Spending" is the same as Capital Expenditure - and is denoted in "negative".

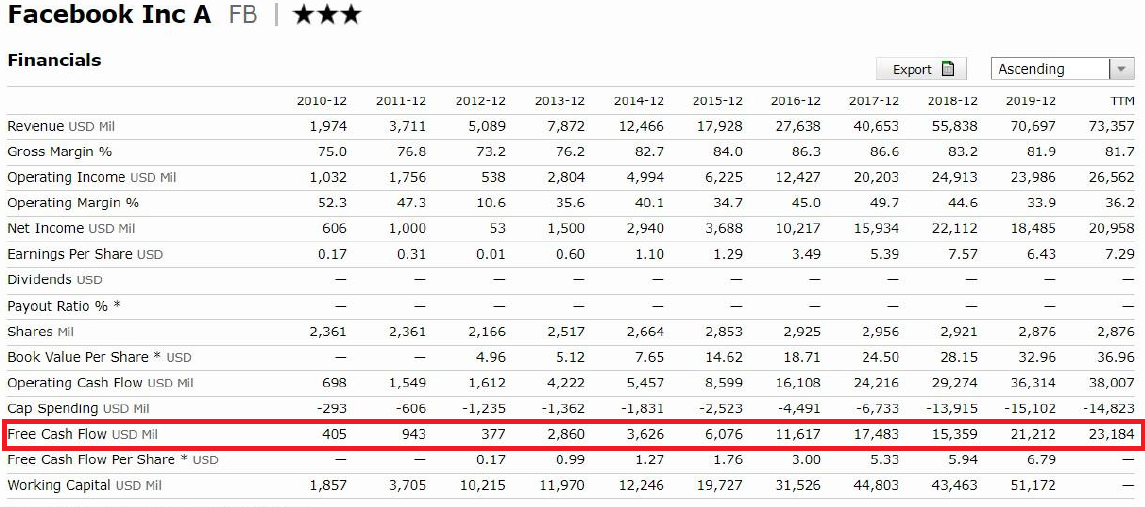

8. Free Cash Flow

What is Free Cash Flow

Free cash flow refers to the cash a company generates after accounting for the capiture expenditure.

Why is it important

There isn't really much to say about this - who doesn't like free cash flow?

Having free cash flow consistently for the past few years shows that a company is very cash-rich and ready to deploy their cash strategically when required.

Having more cash on the balance sheet of the company also increases the valuation of the company and gives the company a lot of opportunities for strategic acquisition and expansion.

Where To Find This Financial Ratio

In morningstar, the calculation for free cash flow is already done.

So there you go - these are the 8 financial ratios that you need to look out for when you invest.

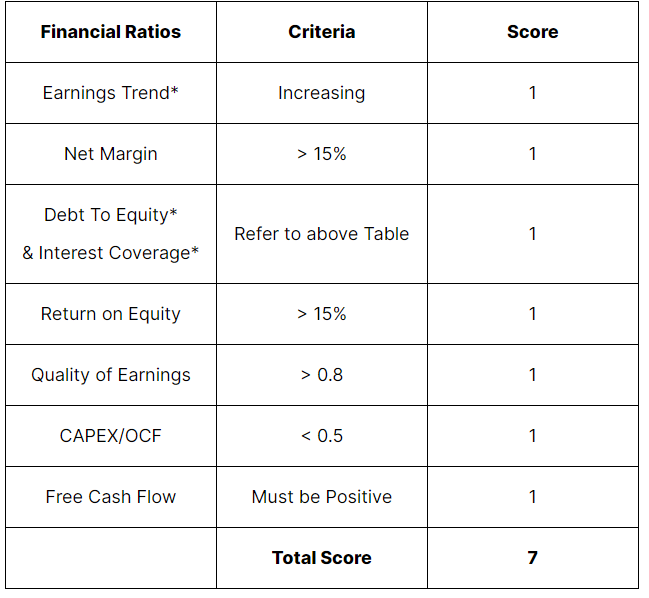

Does the company have to pass all 8 financial ratios to invest?

The short answer is no.

It really depends on how strict you are on your criteria.

If you want to invest only in companies that passed all 8 criteria - you are going to have very limited number of choices.

But if you loosen up your criteria too much, you are going to invest in some poor quality companies.

A sweet spot for me is to invest in companies that have a score of at least 5.

Calculate Checklist Score

How do you calculate the checklist score then?

Before I go on, it's important to note what I call the must-pass criteria.

What does this mean?

Well, it means that if any of the must pass criteria fails - it means that I will not invest in the business.

There are total of two must-pass criteria:

An increasing trend is straightforward, you can extract the past 10 years earnings and plot them in a graph.

If you don't see an uptrend in earnings over the years, then you shouldn't invest in the company.

For debt, we have to refer to the table below.

Note that debt to equity & interest coverage come hand-in-hand together.

So here's a summary.

*denotes must-pass criteria.

Right here, you notice that the maximum score from the checklist is 7.

This is important as we will not invest in a company with a checklist score of less than 5.

The checklist score will also be used in our valuation - to figure out how much to pay for a stock in our next chapter.